Your Ultimate Checklist Of Tax Deductions For 2023

Your Ultimate Checklist Of Tax Deductions For 2023 These are the standard deduction amounts for tax year 2023: married couples filing jointly: $27,700, an $1,800 increase from 2022. single taxpayers: $13,850, a $900 increase from 2022. married. The deduction is based on how much you use your phone or internet for business use versus personal use. for example, if you use your cellphone 50% of the time for business, then you’ll deduct 50% of your phone bill. if your monthly phone bill is $100, then the deductible portion is $50.

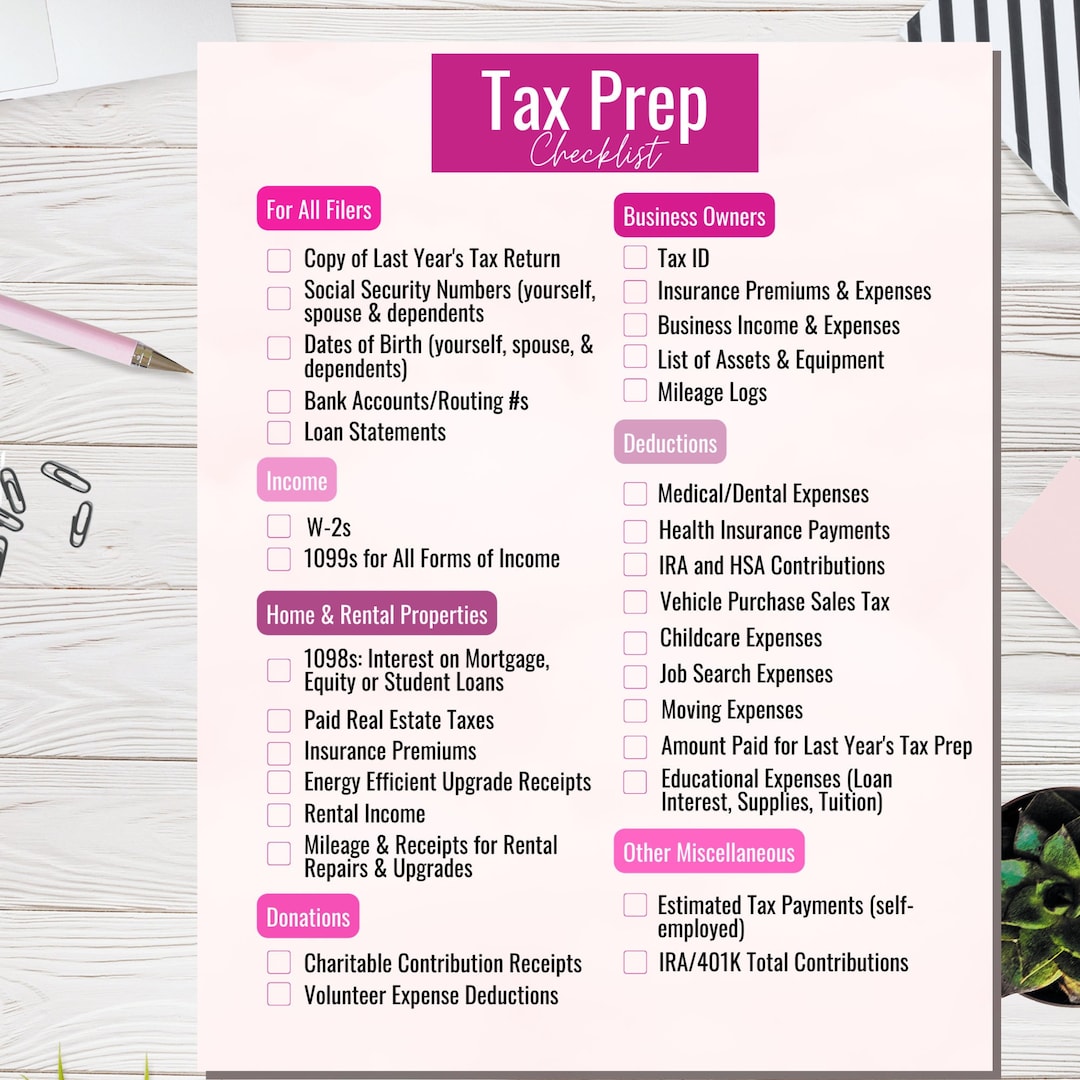

Tax Prep Checklist Tracker Printable Tax Prep 2023 Tax Checklist Tax Deductions for work related expenses. work related expenses are a great way to save on your taxes, and you may be able to claim some of these as deductions in 2023. travel expenses: you can deduct the cost of traveling for business or pleasure if you pay for it with your own money. you can also deduct mileage expenses from your car (up to $0. 11. half of the self employment tax. the self employment tax was 15.3% for 2022 and anyone who paid that full tax can then deduct half of it on their 2022 taxes. normally, employees pay a tax of 7.65% on their income (fica taxes) and their employers also pay that amount for a combined tax of 15.3%. The standard deduction and personal exemptions. the standard deduction for 2023 is $13,850 for individuals and $27,700 for married people filing jointly, up from $12,950 and $25,900, respectively, in 2022. for those age 65 and older or blind, there’s an additional standard deduction amount in 2023 of $1,500 for married taxpayers and $1,850. The 2023 tax deduction cheat sheet. according to the tax foundation, small businesses pay or remit more than 93% of all u.s. taxes. at the same time, small employers can count on a long list potential deductions to reduce the financial burden. to get you started on your tax preparation for your 2022 taxes and beyond, here is the mega list of.

The Ultimate 2023 Tax Deductions Checklist For Insurance Agents The standard deduction and personal exemptions. the standard deduction for 2023 is $13,850 for individuals and $27,700 for married people filing jointly, up from $12,950 and $25,900, respectively, in 2022. for those age 65 and older or blind, there’s an additional standard deduction amount in 2023 of $1,500 for married taxpayers and $1,850. The 2023 tax deduction cheat sheet. according to the tax foundation, small businesses pay or remit more than 93% of all u.s. taxes. at the same time, small employers can count on a long list potential deductions to reduce the financial burden. to get you started on your tax preparation for your 2022 taxes and beyond, here is the mega list of. The tax breaks below apply to the 2024 tax year (taxes due april 15, 2025). 1. child tax credit. the child tax credit (ctc) is a tax break for families with children below the age of 17. for 2024. For 2023, the standard mileage rate for the cost of operating your car, van, pickup, or panel truck for each mile of business use during 2023 increased to 65.5 cents a mile. redesigned form 1040 ss. for 2023, schedule (s) c and se (form 1040) are available to be filed with form 1040 ss, if applicable. for additional information, see the.

The Ultimate Tax Deductions Checklist How To Save Money On Your Taxes The tax breaks below apply to the 2024 tax year (taxes due april 15, 2025). 1. child tax credit. the child tax credit (ctc) is a tax break for families with children below the age of 17. for 2024. For 2023, the standard mileage rate for the cost of operating your car, van, pickup, or panel truck for each mile of business use during 2023 increased to 65.5 cents a mile. redesigned form 1040 ss. for 2023, schedule (s) c and se (form 1040) are available to be filed with form 1040 ss, if applicable. for additional information, see the.

Comments are closed.