You Re Probably Saving Enough For Retirement Wsj

You Re Probably Saving Enough For Retirement Wsj You’re probably saving enough for retirement. a new gao report presents an unduly grim picture, and media sensationalism only makes it look worse. one problem: voters aren't buying it. the. Nearly 1 in 4 of americans are not saving enough for retirement, according at a new study from bankrate . bankrate's chief financial analyst greg mcbride joins the news hub with tanya rivero.

Are You Saving Enough For Retirement Wsj How much money will you really spend in retirement? probably a lot more than you think. most of us vastly underestimate the percentage of income we’ll need. here’s how to make sure you get. Everyone, relax. there is no retirement savings “crisis,” and you’re probably saving enough for retirement. that’s the message in a recent op ed in the wall street journal, and a working paper from the american enterprise institute’s andrew biggs, a frequent critic of what he says are sensationalized reports in the consumer and financial press of widespread poverty in retirement. During this period, try to delay collecting social security benefits. the longer you wait, up to age 70, the greater your payout. “the goal is to delay as long as possible,” says d’agostini. “those who delay get a credit of 8 percent per year” between their full retirement age and age 70. By law, maximum annual contribution limits into a 401 (k) are $19,500 for those under age 50, plus an additional $6,500 “catch up” contribution for those 50 or older. typically, financial advisors recommend saving at least 12% to 15% of your annual income for retirement. based on those limits, however, you can be earning $163,000 each year.

Are You Saving Enough For Retirement The Washington Post During this period, try to delay collecting social security benefits. the longer you wait, up to age 70, the greater your payout. “the goal is to delay as long as possible,” says d’agostini. “those who delay get a credit of 8 percent per year” between their full retirement age and age 70. By law, maximum annual contribution limits into a 401 (k) are $19,500 for those under age 50, plus an additional $6,500 “catch up” contribution for those 50 or older. typically, financial advisors recommend saving at least 12% to 15% of your annual income for retirement. based on those limits, however, you can be earning $163,000 each year. Here’s the conventional wisdom on pensions: you’re a weak willed and shortsighted fool who isn’t saving enough, and as a result you will spend your retirement in poverty. That's a good guideline, so if you're 30 years old earning $70,000 a year and your ira or 401(k) is barely at the $25,000 mark, you have some work to do. one thing it pays to do in that situation.

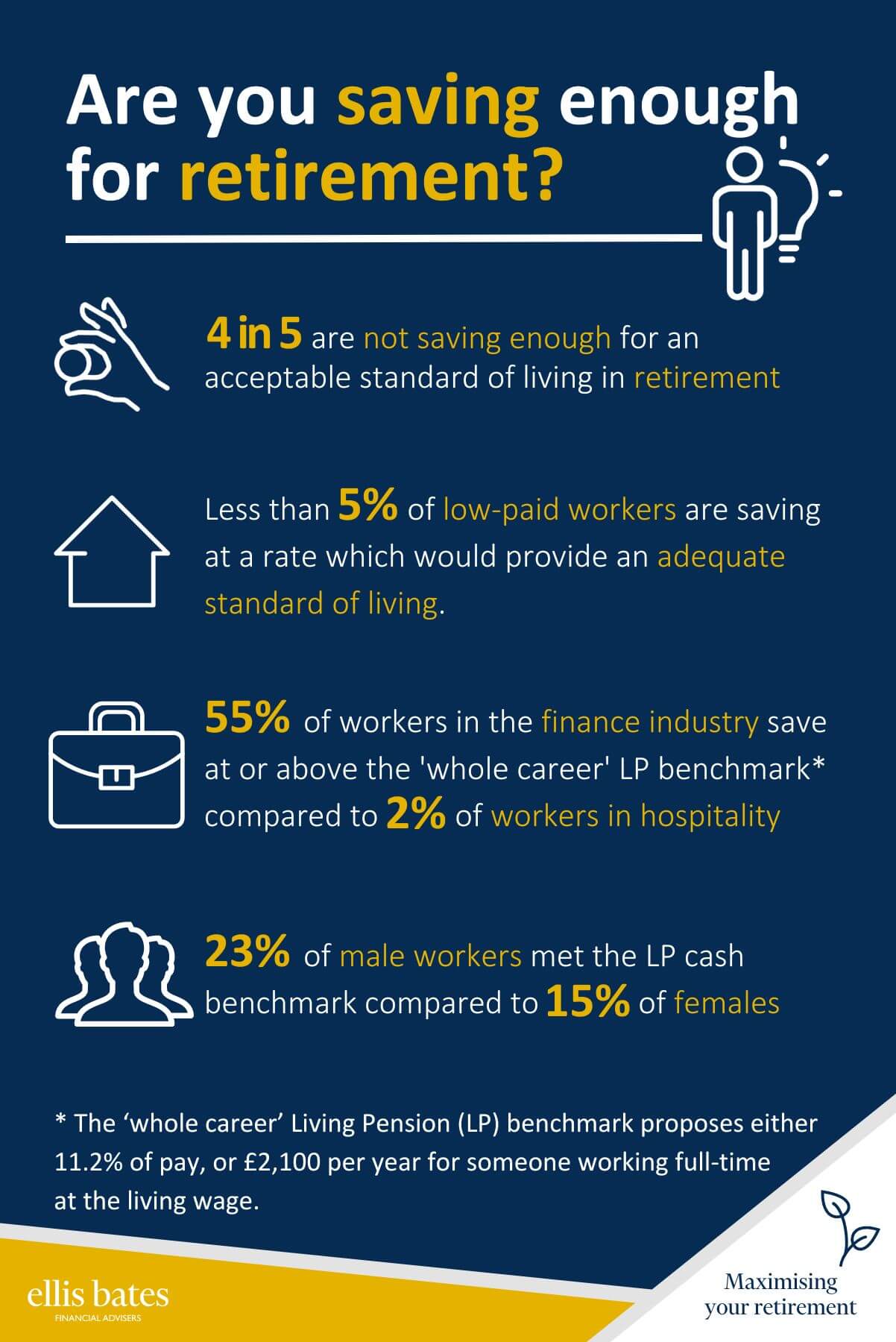

Are You Saving Enough For Retirement Ellis Bates Financial Advisers Here’s the conventional wisdom on pensions: you’re a weak willed and shortsighted fool who isn’t saving enough, and as a result you will spend your retirement in poverty. That's a good guideline, so if you're 30 years old earning $70,000 a year and your ira or 401(k) is barely at the $25,000 mark, you have some work to do. one thing it pays to do in that situation.

Comments are closed.