Yapily Data Reveals Open Banking S Growth Into The Mainstream With

Yapily Data Reveals Open Banking S Growth Into The Mainstream With Explore yapily's review of 2023's open banking advancements and dive into predictions for 2024. discover how data sharing and tech integration are reshaping finance. this past year saw data sharing, driven by eu regulation, become the norm and open banking gained real traction in ways that cannot be ignored. At the end of 2021, cumulatively over 26.6 million open banking payments had been made, an increase of more than 500% in 12 months. to put this into perspective, nearly 625,000 additional open banking transactions were made in january 2022 from december 2021. by comparison, just 320,000 open banking payments were made in the whole of 2018.

Open Banking Success Yapily New data released by yapily, the uk’s leading open banking network, has revealed how open banking connectivity has become a top priority for banks in the uk as we head into 2021. the data reveals that despite disruption to banking operations caused by the covid 19 pandemic, banks had matured in their open banking development once the industry had entered q3, with response times closing on. Yapily’s open banking data solutions. let’s take a closer look at how yapily’s open banking data solution can bring widespread benefits to your business, in just a few clicks: validated direct debits: by leveraging yapily’s capabilities, businesses can confidently validate direct debits, ensuring transactional accuracy and reducing the. New data released by yapily, the uk’s leading open banking network, has revealed how open banking connectivity has become a top priority for banks in the uk as we head into 2021. the data reveals that despite disruption to banking operations caused by the covid 19 pandemic, banks had matured in their open banking development once the industry. The league table – based on data compiled in 2021 by yapily through its eu wide open banking api infrastructure and monitoring tools – reveals that while parts of the eu are making positive.

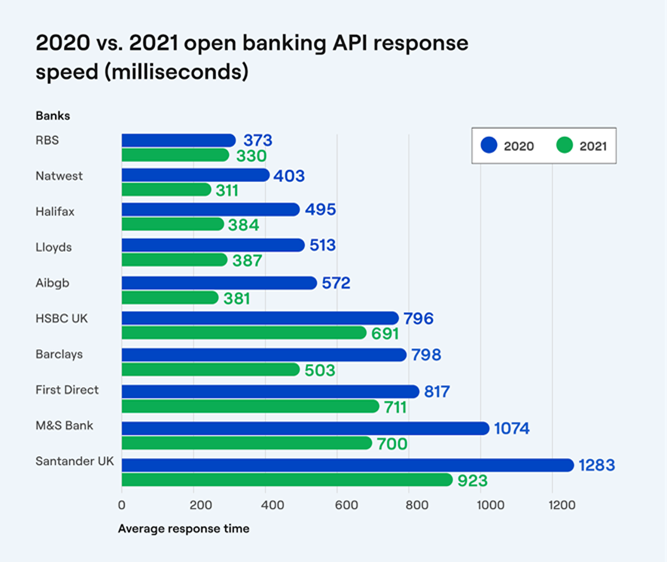

New Data From Yapily Further Proof Open Banking Adoption Is Rising New data released by yapily, the uk’s leading open banking network, has revealed how open banking connectivity has become a top priority for banks in the uk as we head into 2021. the data reveals that despite disruption to banking operations caused by the covid 19 pandemic, banks had matured in their open banking development once the industry. The league table – based on data compiled in 2021 by yapily through its eu wide open banking api infrastructure and monitoring tools – reveals that while parts of the eu are making positive. This article delves into recent pivotal developments in the uk and eu, highlighting their impact on the open banking ecosystem. jroc’s decisive steps for open banking’s future. recently, the uk’s joint regulatory oversight committee (jroc) made significant progress in the open banking domain. Today, new data released by yapily — the leading open banking infrastructure provider — reveals that uk banks have continued to invest in open banking technology as user adoption grows. the data, which analyses the average open banking api response times across 10 of the uk’s top traditional banks, reveals that 100% have improved their response speed between 2020 and 2021, in some cases.

Open Banking Remains Top Priority For Uk Banks Yapily Data Reveals This article delves into recent pivotal developments in the uk and eu, highlighting their impact on the open banking ecosystem. jroc’s decisive steps for open banking’s future. recently, the uk’s joint regulatory oversight committee (jroc) made significant progress in the open banking domain. Today, new data released by yapily — the leading open banking infrastructure provider — reveals that uk banks have continued to invest in open banking technology as user adoption grows. the data, which analyses the average open banking api response times across 10 of the uk’s top traditional banks, reveals that 100% have improved their response speed between 2020 and 2021, in some cases.

Comments are closed.