Working For An Insufferable Boss And 4 Other Reasons To Retire Before 60 Retirementplanning

5 Reasons Why You Should Start Retirement Planning Early Tweak Your Biz 7. extra income can be hard to come by. working in retirement might not be as simple as you think. while 70 percent of workers plan to work for pay in retirement, according to the ebri study, just 27 percent of actual retirees reported working for pay. even part time jobs can be a challenge. If the 72(t) doesn’t fit your needs and you retire in the year you turn age 55 (or after), the “rule of 55” allows retirees to access their 401(k) without having to pay a 10% penalty, and.

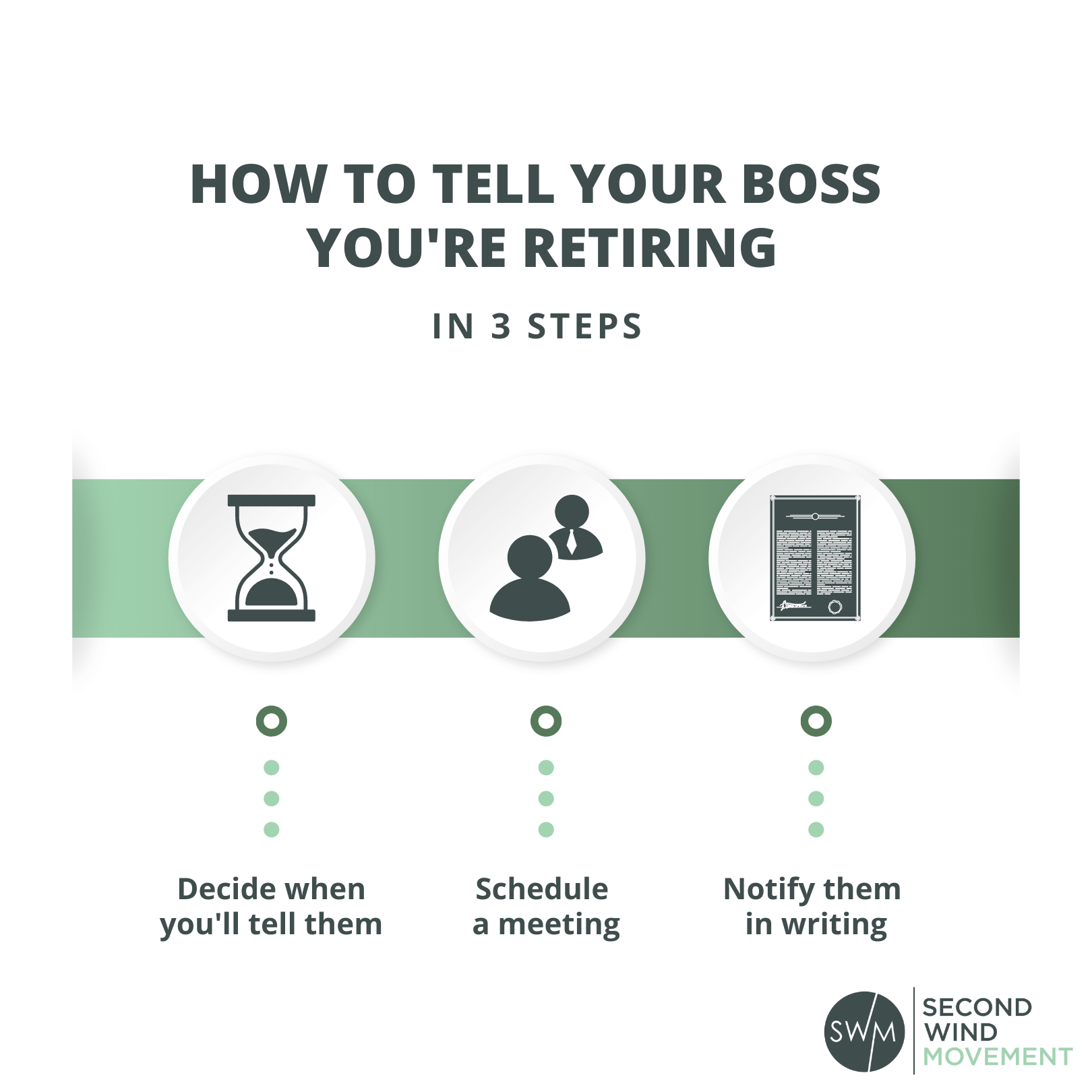

How To Gracefully Retire From A Job How To Tell Your Boss The most crucial is timing. you are first eligible to take social security at 62. but collecting prior to your full retirement age (between 66 and 67) will mean a reduced benefit. if, on the other. Retiring early means you'll have less working years, which has it's pros and cons. here are 10 reasons to retire early. Still, sometimes retirement is the better option, especially if any of these signs rings true. 1. you’re uninterested in the job. work should give you a sense of purpose in addition to a paycheck, but for many people who have been there and done that for decades, it’s lost its luster. if going into the office or logging on for the day. If you’re making $35,000, you should have $35,000 saved. by age 40, aim to have 3x or 5x saved. by age 50, aim to have 6x or 8x your salary saved. by age 60, if you plan to retire, you should have 10x or more (ideally 12x) of your annual salary saved. if you are earning $75,000 per year, plan to have at least $750,000 saved.

How To Retire Early Steps Strategies Savings The Motley Fool Still, sometimes retirement is the better option, especially if any of these signs rings true. 1. you’re uninterested in the job. work should give you a sense of purpose in addition to a paycheck, but for many people who have been there and done that for decades, it’s lost its luster. if going into the office or logging on for the day. If you’re making $35,000, you should have $35,000 saved. by age 40, aim to have 3x or 5x saved. by age 50, aim to have 6x or 8x your salary saved. by age 60, if you plan to retire, you should have 10x or more (ideally 12x) of your annual salary saved. if you are earning $75,000 per year, plan to have at least $750,000 saved. Next, total all of these sources of income to see how much you’ll have available each month. don’t forget to reduce it by any income taxes you’ll pay. 4. consider your tax situation in retirement. in regards to taxes, the fewer taxes you pay in retirement, the more or your savings you can keep. If you were born between 1943 and 1954 your full retirement age is 66. retirement topics — required minimum distributions (rmds) irs. " retirement topics—required minimum distributions (rmds)." deciding when to retire can be stressful to think about. this retirement guide is sure to help, covering financial strategies from ages 50 to 70.

Retirement Planning Retire Like A Boss By Krishnajoshi05 On Deviantart Next, total all of these sources of income to see how much you’ll have available each month. don’t forget to reduce it by any income taxes you’ll pay. 4. consider your tax situation in retirement. in regards to taxes, the fewer taxes you pay in retirement, the more or your savings you can keep. If you were born between 1943 and 1954 your full retirement age is 66. retirement topics — required minimum distributions (rmds) irs. " retirement topics—required minimum distributions (rmds)." deciding when to retire can be stressful to think about. this retirement guide is sure to help, covering financial strategies from ages 50 to 70.

Comments are closed.