Will Rising Global Debt Boost Gold Presented By Cme Group

Cme Group To Change Gold Futures Contracts Increases Margin Despite slowing inflation and a revivified dollar, the updraft in gold shows no signs of slowing. so what’s driving the precious metal to all time highs? her. At a glance. the demand for gold continues to rise as uncertainty around interest rates and geopolitical stability have more traders turning to safe haven assets. april average daily volume for micro gold and micro silver futures increased 119% and 162% month over month. these days it seems nothing can stop gold, not even the federal reserve.

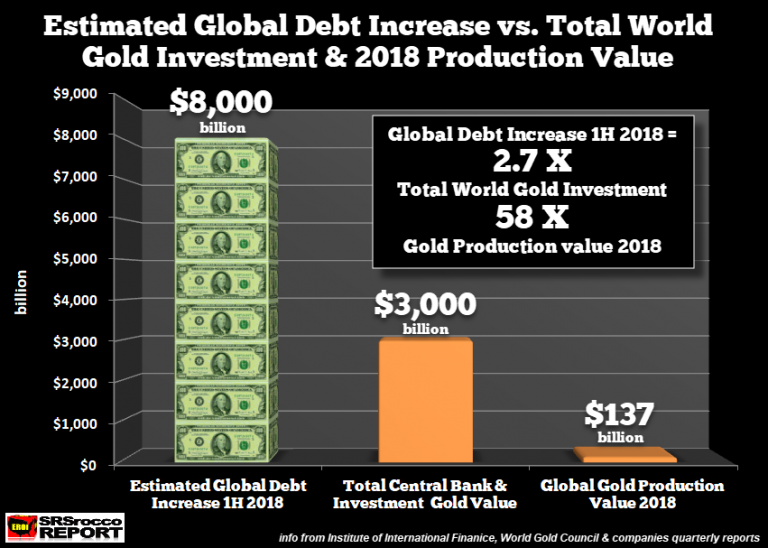

Global Debt Increase 2018 Vs Gold Investment Must See Charts Gold etf investments are treated as a collectible subject to large capital gains tax, vs blended 60 long term 40 short term capital gains treatment for gc futures. etfs can charge 50% margin, plus any broker financing fees. exchange traded futures’ standardized terms make buying and selling positions easier. The post pandemic period has been positive for gold, with the precious metal rising 50% since 2019 on an updraft of rocketing inflation and geopolitical unce. In the cbo’s view, interest on the national debt, which is expected to come in at 1.38% of gdp in 2021, will balloon to 8.6% of gdp (per year) by 2050 (figure 5). inherent in this assumption is the cbo’s view that the average interest rate (or bond yield) on the national debt will eventually rise to over 4% (figure 6). Gold prices soared in the 1970s era of inflation, but the root causes of inflation are different today. in six of the last eight recessions, gold outperformed the s&p 500 by 37% on average. getty.

Cme Group To Change Gold Futures Contracts Increases Margin In the cbo’s view, interest on the national debt, which is expected to come in at 1.38% of gdp in 2021, will balloon to 8.6% of gdp (per year) by 2050 (figure 5). inherent in this assumption is the cbo’s view that the average interest rate (or bond yield) on the national debt will eventually rise to over 4% (figure 6). Gold prices soared in the 1970s era of inflation, but the root causes of inflation are different today. in six of the last eight recessions, gold outperformed the s&p 500 by 37% on average. getty. The risks ahead for gold in a high rate environment. joseph stefans, mks pamp group head of trading, shares his views on gold. gold will continue to show strength in the face of u.s. rate hikes, rising expectations for a soft landing and heightened geopolitical risks, according to joseph stefans, head of trading at precious metals house mks pamp. In the u.s., public debt to gdp is set to reach a record 134% by 2027. the sharp rise in interest rates is increasing net debt servicing costs, which stood at $475 billion last year. over the next 10 years, net interest costs on u.s. debt are projected to total $10.6 trillion. china’s debt has also risen rapidly, and is projected to eclipse.

Cme Group Increases Gold Contract Margin Requirements 9 6 The Deep Dive The risks ahead for gold in a high rate environment. joseph stefans, mks pamp group head of trading, shares his views on gold. gold will continue to show strength in the face of u.s. rate hikes, rising expectations for a soft landing and heightened geopolitical risks, according to joseph stefans, head of trading at precious metals house mks pamp. In the u.s., public debt to gdp is set to reach a record 134% by 2027. the sharp rise in interest rates is increasing net debt servicing costs, which stood at $475 billion last year. over the next 10 years, net interest costs on u.s. debt are projected to total $10.6 trillion. china’s debt has also risen rapidly, and is projected to eclipse.

Comments are closed.