Why Reit Investors Don T Need To Fear Inflation

Why Investors Don T Need To Fear Inflation Intelligent Reit Investor Here's why reit investors almost never need to fear inflation. the 1970s: as bad as inflation is likely to ever get in the us. the 1970s saw inflation peak at 13.5% in 1979. from 1978 to 1980 3. The zacks consensus estimate for this year’s ffo per share has been revised 5% upward in two months’ time to $1.88. it has a dividend yield of 5.04%. here are the price performances of the.

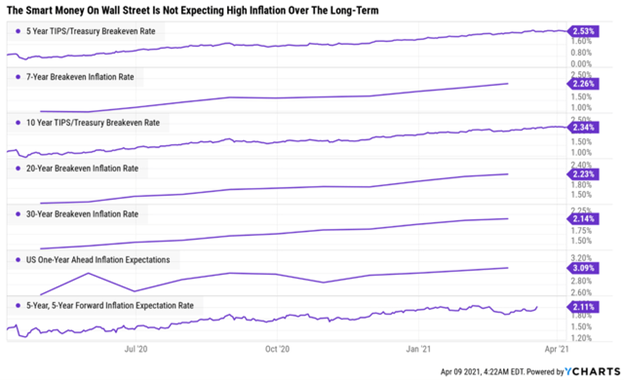

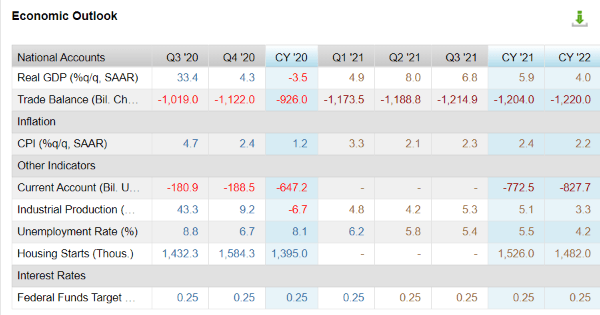

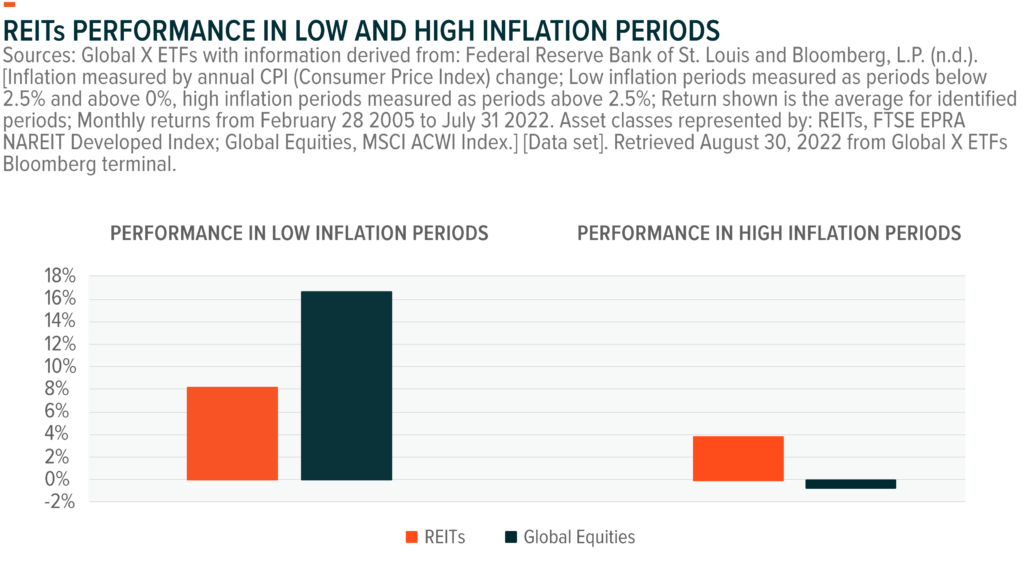

Why Reit Investors Don T Need To Fear Inflation Inflation and soaring interest rates that go with it have been a growing concern for investors in 2021. with $6 trillion worth of stimulus already passed and a potential $4 to $5 trillion more on the way, it's understandable why 2021 inflation predictions from reputable economists go as high as 4% to 8%. Matthew frankel: for the interest rates, the answer is yes. if the interest rates go up in the short term, reits will generally go down in price in a normal environment. now, that's only one. Reason #2: maturities are long. leverage is low and on top of that, maturities also are historically long. since most of the debt is fixed rate, this means that most reits won't feel any impact. In 2021, considered a high inflation year (7.0% or greater), reits outperformed the s&p 500 by 12.6 percentage points with an annual return of 41.3% compared to 28.7% for the s&p 500. reits tend to outperform in the high inflation periods, with strong income returns offsetting falling reit prices. on average, reits outperformed the s&p 500 by 5.

Why Investors Don T Need To Fear Inflation Intelligent Reit Investor Reason #2: maturities are long. leverage is low and on top of that, maturities also are historically long. since most of the debt is fixed rate, this means that most reits won't feel any impact. In 2021, considered a high inflation year (7.0% or greater), reits outperformed the s&p 500 by 12.6 percentage points with an annual return of 41.3% compared to 28.7% for the s&p 500. reits tend to outperform in the high inflation periods, with strong income returns offsetting falling reit prices. on average, reits outperformed the s&p 500 by 5. The s&p500 has repriced to the lower yield world and investors don't fear rising rates. reits, on the other hand, have failed to reprice to the lower yield world because investors already foresee. The reit structure is designed for investors to share in this potential growth as reits are required to pay out at least 90% of their earnings in the form of dividends. all of these inflation driven and secular trends support our view that reits are well positioned to benefit from the inflationary trends coursing through the u.s. and global.

Know The Risks When Investing In Reits Securities Investors The s&p500 has repriced to the lower yield world and investors don't fear rising rates. reits, on the other hand, have failed to reprice to the lower yield world because investors already foresee. The reit structure is designed for investors to share in this potential growth as reits are required to pay out at least 90% of their earnings in the form of dividends. all of these inflation driven and secular trends support our view that reits are well positioned to benefit from the inflationary trends coursing through the u.s. and global.

Why Reits Can Be A Good Investment During A Recession Upside Avenue

Comments are closed.