Why Raising The Capital Gains Tax Could Hurt Our Economy

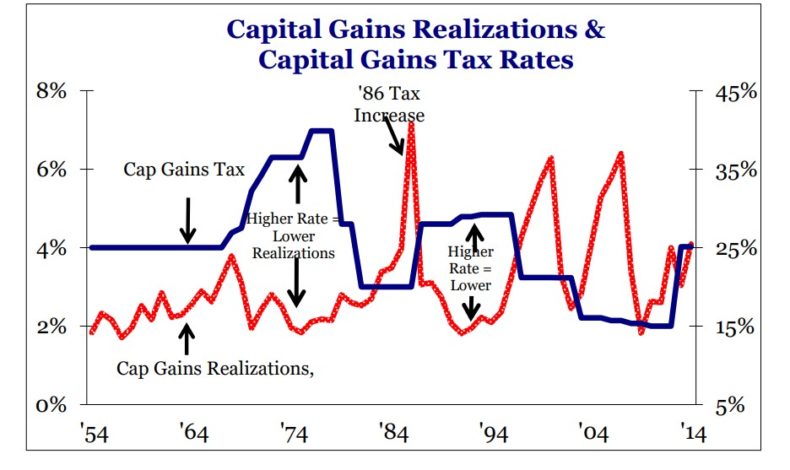

Raising Capital Gains Tax Would Be An Act Of Economic Self Harm Capx 1.6k. biden's capital gains tax proposal could crush the economy, experts say. president biden's latest proposal to hike the top capital gains tax rate to its highest level in more than a century. The dumbest tax increase, indeed. not only will higher capital gains rates hurt current workers, it will hurt current and future retirees. a higher rate, immediately upon enactment, reduces the value of all stocks. that means everyone saving for retirement, or anyone who has already retired, will see the value of their 401ks fall.

Capital Gains Taxes Explained Charles Schwab President biden’s jaw dropping proposal to raise the capital gains tax rate for certain investors has caused shockwaves across financial markets. the proposed taxes are detailed in the. Democrats have been talking about this for years, decades, even maybe a century, but that's why it is sort of unthinkable. the capital gains break is as old as methuselah in tax terms. it's been. The tax rate on long term capital gains — assets held more than a year — for high earners would match the rate for short term gains, which are taxed at ordinary rates based on a taxpayer's. Households worth more than $100 million would pay an annual minimum tax worth 25% of their combined income and unrealized capital gains. say you purchase stock for $10 a share. it doubles to $20.

Capital Gains And Why They Matter A Tax Expert Explains The tax rate on long term capital gains — assets held more than a year — for high earners would match the rate for short term gains, which are taxed at ordinary rates based on a taxpayer's. Households worth more than $100 million would pay an annual minimum tax worth 25% of their combined income and unrealized capital gains. say you purchase stock for $10 a share. it doubles to $20. Fortunately, no, although another harris proposal is to tax certain unrealized capital gains. it is true that the hike to 28% would be a significant hike from the present 20% rate for higher. But the truth is, raising the capital gains tax rate won’t hurt the economy or cut investments at all. in fact, biden’s plan to raise the capital gains rate that wealthy americans pay on.

Why Our Capital Gains Tax System Needs Fixing Mint Fortunately, no, although another harris proposal is to tax certain unrealized capital gains. it is true that the hike to 28% would be a significant hike from the present 20% rate for higher. But the truth is, raising the capital gains tax rate won’t hurt the economy or cut investments at all. in fact, biden’s plan to raise the capital gains rate that wealthy americans pay on.

Should We Raise Capital Gains Taxes The Capital Gains Tax Its

Opinion Here S The Truth Raising The Capital Gains Tax Won T Hurt The

Comments are closed.