Why Do Lenders Need Digital Lending Platform

Digital Lending 101 Sysarc Infomatix Digital and analytics. risk. digitization of the lending process brings a number of powerful benefits for banks, including better decisions, improved customer experience, and significant cost savings. it is also a complex and challenging project. in this video, mckinsey partner gerald chappell explores how digital lending can improve. This guide outlines how digital lending can help your financial institution meet the rising expectations of customers and empower your teams to be more productive and efficient in the process. you’ll learn: what digital lending is and why it’s essential. how digital lending solutions can elevate customer satisfaction.

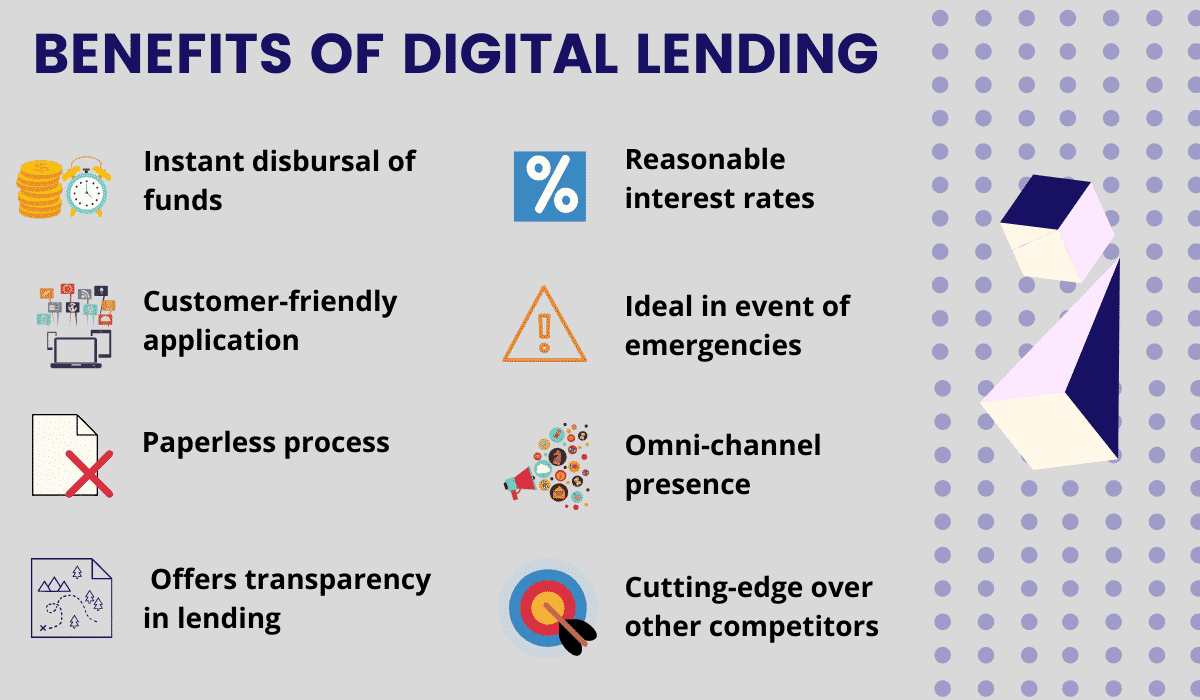

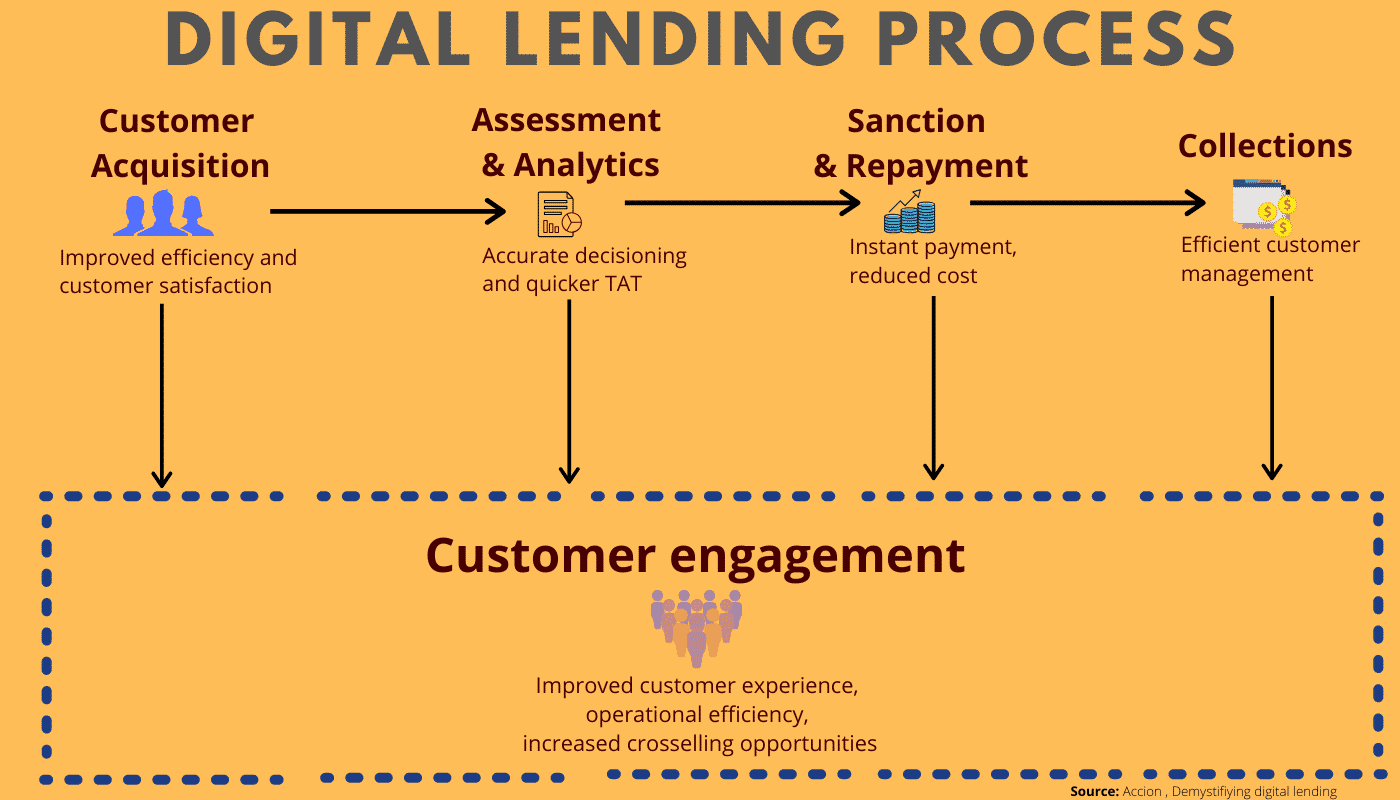

Why Do Lenders Need Digital Lending Platform A digital lending platform with sophisticated embedded analytics may assist lenders in tracking client behaviors and comprehending market trends to gain a deeper understanding of the loan process. long term, this approach aids lenders in anticipating and allocating appropriate underwriting resources to meet seasonal demands. We can and should do better. digital lending: the players and the process digital lending can broadly be defined as the process of offering loans that are applied for, disbursed, and managed through digital channels. in this process, lenders use digitised data to make credit decisions and build intelligent customer engagement. 12 minutes read. digital lending or fintech lending refers to obtaining loans online through digital platforms. it is technology to simplify borrowing money. instead of visiting a bank, you can apply for loans online. the process is streamlined, bypasses traditional intermediaries like banks, and often eliminates excessive paperwork. Fintech lending is the use of financial technology, including apis, to help lenders make faster, more informed lending decisions. this can include using alternative sources of data to weigh lending risk and connecting digital platforms to improve data sharing speed.

5 Ways You Can Benefit From An Ai Powered Digital Lending Platform 12 minutes read. digital lending or fintech lending refers to obtaining loans online through digital platforms. it is technology to simplify borrowing money. instead of visiting a bank, you can apply for loans online. the process is streamlined, bypasses traditional intermediaries like banks, and often eliminates excessive paperwork. Fintech lending is the use of financial technology, including apis, to help lenders make faster, more informed lending decisions. this can include using alternative sources of data to weigh lending risk and connecting digital platforms to improve data sharing speed. What is digital lending? digital lending is a type of loan acquisition method that allows individuals to apply for and receive loans through online platforms without having to visit a physical bank or financial institution. this method enables borrowers to complete the entire loan application process, receive the loan, and make repayments. Trend #3: the cloud is becoming the platform of choice. the cloud can be considered one of the most significant digital lending trends because of its ability to help financial firms deliver services, manage documents, store information, and process data online. it’s no wonder that more than 90% of banks now have at least a moderate level of.

Digital Lending 101 Sysarc Infomatix What is digital lending? digital lending is a type of loan acquisition method that allows individuals to apply for and receive loans through online platforms without having to visit a physical bank or financial institution. this method enables borrowers to complete the entire loan application process, receive the loan, and make repayments. Trend #3: the cloud is becoming the platform of choice. the cloud can be considered one of the most significant digital lending trends because of its ability to help financial firms deliver services, manage documents, store information, and process data online. it’s no wonder that more than 90% of banks now have at least a moderate level of.

Is Digital Lending The Game Changer In The Financial Block Sysarc

5 Reasons Why Lenders Should Use A Digital Finance Platform Zuron

Comments are closed.