Which Is Best Comparing The Financial Advisor Service Models Aum Vs Flat Fee Practice Management

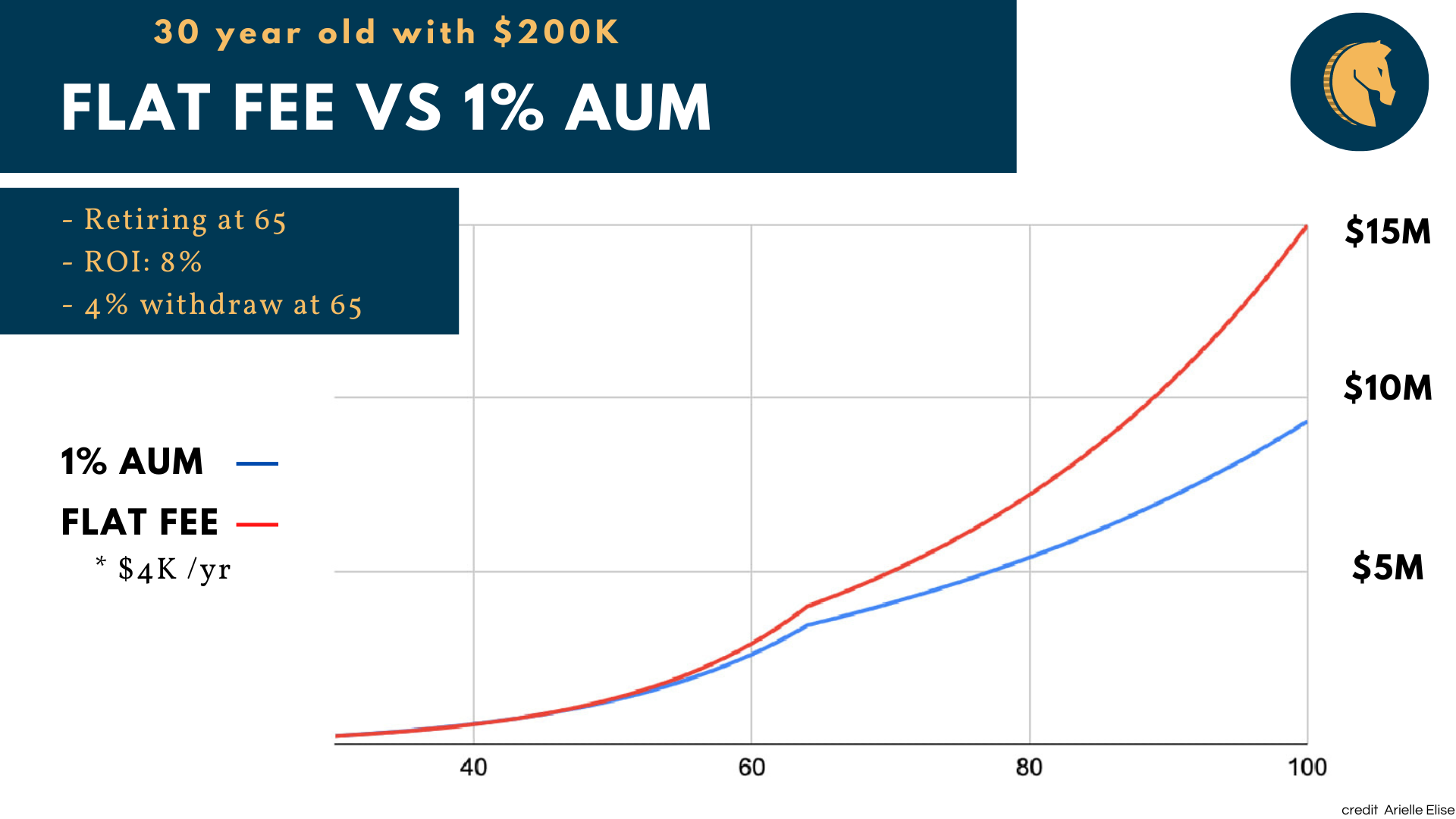

Which Is Best Comparing The Financial Advisor Service Models Aum Vs Flat fee financial advisors earn a flat fee for services. other advisors charge a percent of assets under management (aum). here’s a breakdown of the costs. For example: if you have $1,000,000 invested, you’ll pay $10,000 annually to an advisor charging 1% of assets under management, but you may only pay $2,000 per year to a flat fee advisor.

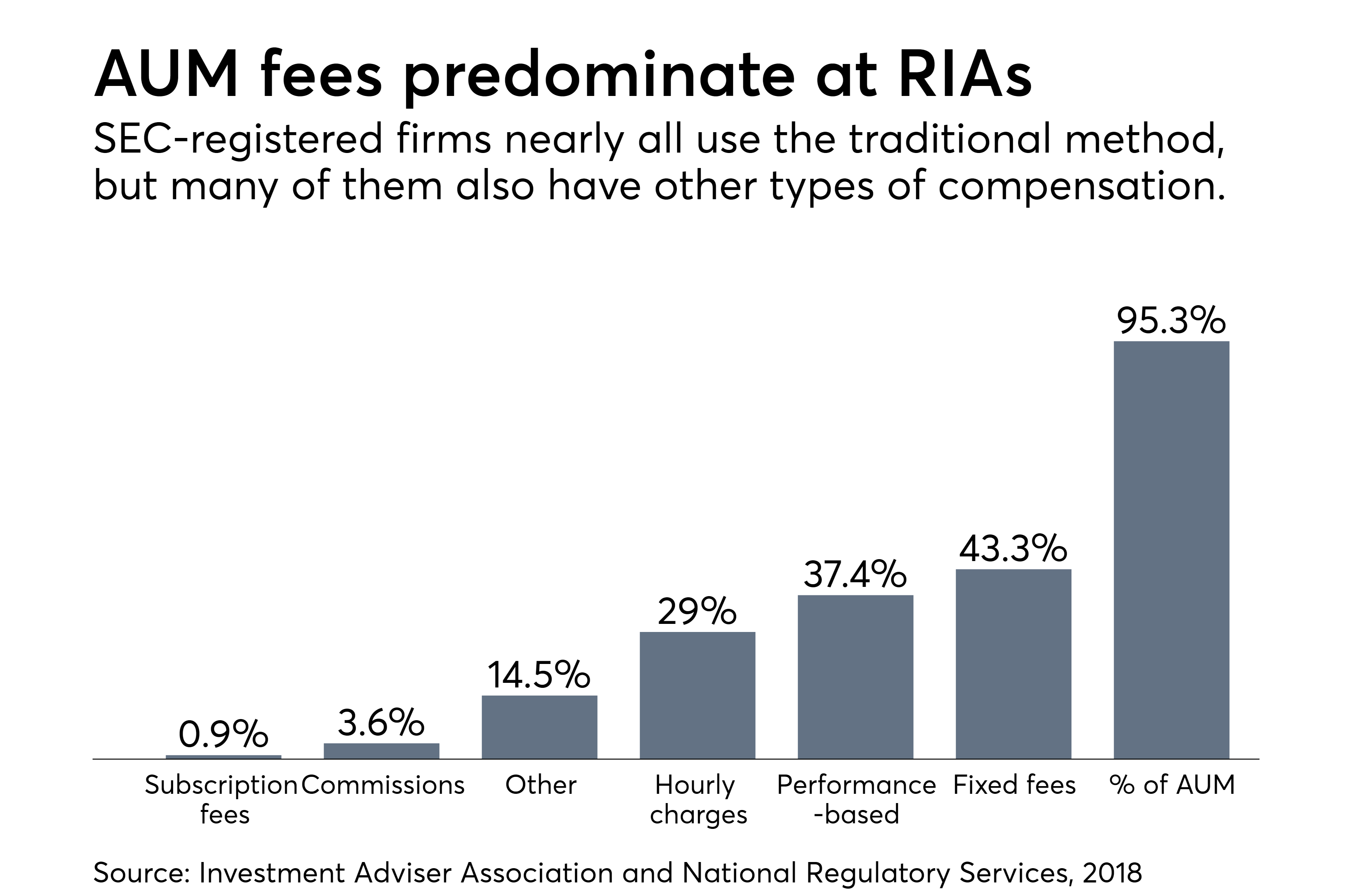

Financial Advisor Compensation Flat Fee Aum Model Financial Planning Let's dive into the three main ways financial advisors are compensated: aum (assets under management), commission, and flat fee models. by the end of this post, you'll have a clear understanding of each model and be better equipped to choose the right advisor for your needs. the three main fee models. aum (assets under management). Seeing the debate on social media between advisors is getting old but i liked ron bullis' opinion on serving clients. let me know your opinion in the comment. Fees paid with advice only flat fee advisor. $26,279. $58,314. $97,363. $144,965. first, you'll notice that with starting assets of $100,000, the fees paid to a flat fee advice only financial advisor could actually be higher than the fees paid to an aum advisor during the first 10 years. actually, it's really during the first 15 years. They focus most of the discussion on the most common method advisors use, asset under management (aum) fees and compare that to a newer method advisors are using, the comprehensive flat fee model. steve and aiden end the episode with an example of the potential long term difference in cost using an advisor who charges an aum fees vs an advisor.

Flat Fee Financial Advisors Rally Financial Fees paid with advice only flat fee advisor. $26,279. $58,314. $97,363. $144,965. first, you'll notice that with starting assets of $100,000, the fees paid to a flat fee advice only financial advisor could actually be higher than the fees paid to an aum advisor during the first 10 years. actually, it's really during the first 15 years. They focus most of the discussion on the most common method advisors use, asset under management (aum) fees and compare that to a newer method advisors are using, the comprehensive flat fee model. steve and aiden end the episode with an example of the potential long term difference in cost using an advisor who charges an aum fees vs an advisor. At the lower end of the spectrum, the typical financial advisory fee is 1% all the way up to $1m (although notably, a substantial number of advisors charge more than 1%, particularly for clients with portfolios of less than $250k, where the median fee is almost 1.25%). however, the median fee drops to 0.85% for those with portfolios over $1m. But that aum fee tends to be lower when a portfolio is worth over $1 million in assets. that client will likely pay 0.75% to 0.9%, which totals in the range of $7,000 to $9,000 a year. keep in.

Comments are closed.