Whats The Difference Between A Nonprofit And A 501c3 Qa 1 Specialist Nicole

What S The Difference Between A Nonprofit And A 501 C 3 Q A 1 Ceo christian lefer answers “what’s the difference between a nonprofit and a 501(c)3? get the details in the video. instantnonprofit (formerly yippiekiyay). The main difference between 501 (c) (3) and a nonprofit corporation is tax exemption. a great misconception is that all nonprofit corporations have the 501 (c) (3) status. while being a nonprofit corporation makes it easy to gain this tax exemption, it is important to understand that not all nonprofit corporations are qualified for it.

Nonprofit Vs 501c3 Here S The Difference Youtube The first comparison comes in getting the respective nonprofit status from the irs. for 501 (c) (3), the tax exempt status comes by filing form 1023 or form 1023 ez with the irs. the cost of the same would be either $600 or $275. for 501 (c) (6), nonprofits need to file form 1024 to get their respective tax exempt status. While a nonprofit corporation is a state level designation, the 501 (c) (3) status is a federal, nationwide designation awarded by the irs. if a group has 501 (c) (3) status, then it is exempt from federal income tax, which often also means you don’t need to pay state income taxes either. donations to these groups are also tax deductible. Section 501 (c) (3) is the portion of the us internal revenue code that allows for federal tax exemption of nonprofit organizations that meet the code’s requirements. these nonprofits may be considered public charities, private foundations, or private operating foundations, which we’ll explain in more detail later. Differences between 501 (c) and 501 (c) (3) a 501 (c) organization and a 501 (c)3 organization are similar in designation, however they differ slightly in their tax benefits. both types of organization are exempt from federal income tax, however a 501 (c)3 may allow its donors to write off donations whereas a 501 (c) does not.

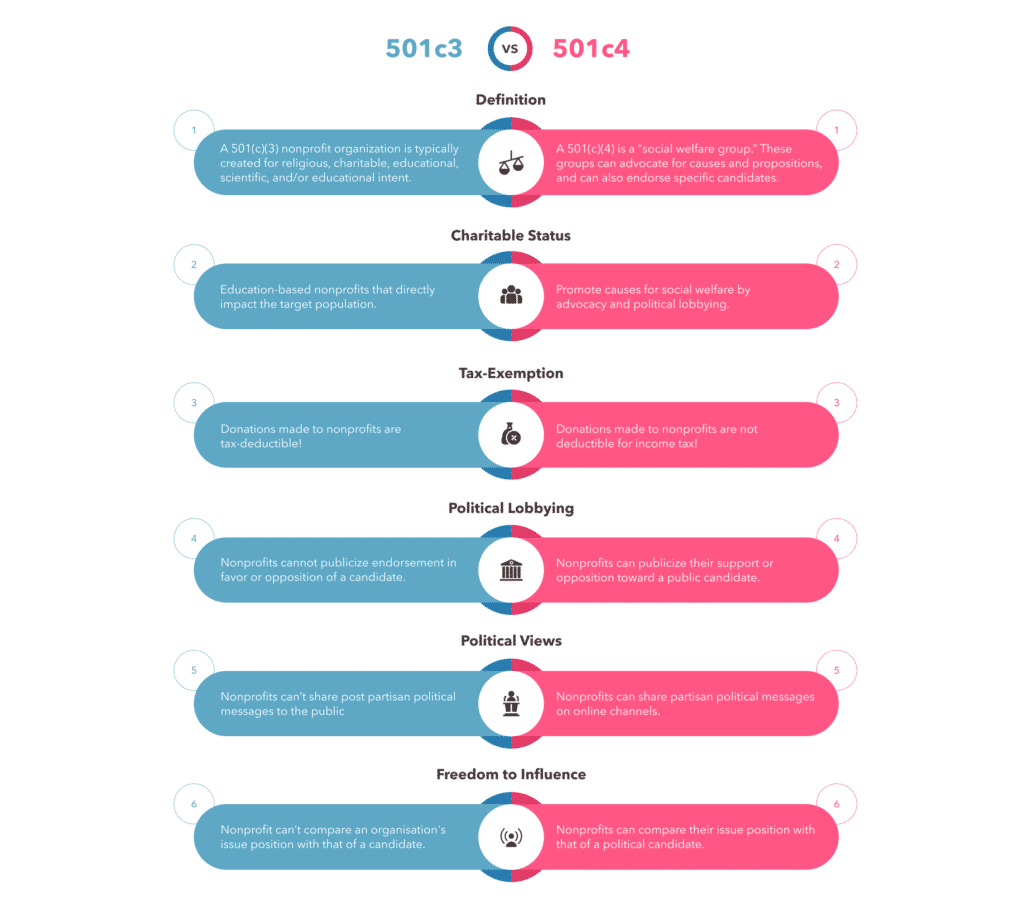

501 C 3 Vs 501 C 4 Key Differences And Insights For Nonprofits Section 501 (c) (3) is the portion of the us internal revenue code that allows for federal tax exemption of nonprofit organizations that meet the code’s requirements. these nonprofits may be considered public charities, private foundations, or private operating foundations, which we’ll explain in more detail later. Differences between 501 (c) and 501 (c) (3) a 501 (c) organization and a 501 (c)3 organization are similar in designation, however they differ slightly in their tax benefits. both types of organization are exempt from federal income tax, however a 501 (c)3 may allow its donors to write off donations whereas a 501 (c) does not. Many people confuse nonprofits on a state level with nonprofits on the 501(c)(3) irs level. it is must be noted that while many areas of these two types of organizations overlap, they are not entirely the same and the terms cannot be used interchangeably. so, what is the difference between nonprofits on a state level and 501c3 organizations?. That's not true of other 501 (c) groups. a 501 (c)4 nonprofit, for instance, is a social welfare group. although social welfare might sound interchangeable with charity, legally the two classes.

Comments are closed.