What Will It Take For Merchants To Use Open Banking

Open Banking Aisps And Pisps Explained Fintech Inshorts Latest This creates challenges for merchants who want to use open banking payments but are worried that some customers will unintentionally misuse tans to avoid paying. as a result, merchants and their. Moreover, from a payments perspective, open banking is increasingly seen as a cost effective method by businesses, merchants, and corporates, with open banking payments growing by 10% month on.

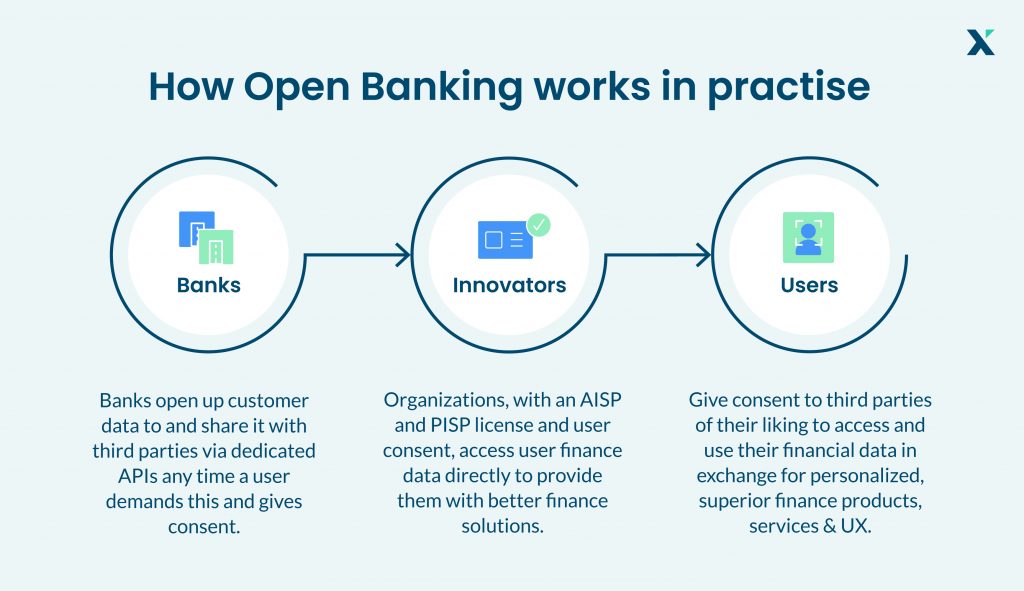

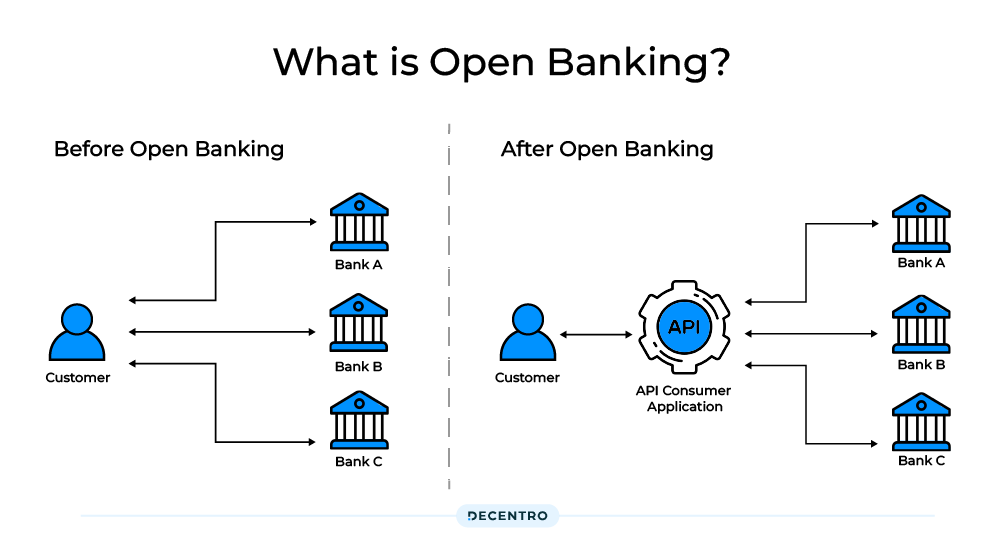

Everything You Need To Know About Open Banking The relatively large uptake in the uk over 5 million people actively using open banking services has been made possible by the hard work of banks in the uk and the open banking implementation entity. there, standards, guidelines and an implementation path was provided not only to banks but also the wider players including fintechs. A2a payments involve the checkout friction of entering bank credentials and challenges in dispute processes. consumers lose card networks’ protection against fraud—a highly valued feature provided by card providers. they also miss out on credit cards’ financing of purchases with a 30 day float. Omy. despite progress, open banking is a concept whose time is yet to come.open banking was originally conceived as an antidote to a perceived lack of competition and innovation in the banking market (obie in th. uk and psd2 for eu are two of the most recognizable initiatives globally). with banks required (regulation driven) or invited (market. Open banking, quite simply, means that banks will share customers’ financial information electronically and securely with trusted third parties when the account owner gives consent. this will allow consumers to use their banking apps to make authenticated payments directly to merchants in real time. the intent of this regulation is to.

Merchants And Open Banking Is This Going To Happen Omy. despite progress, open banking is a concept whose time is yet to come.open banking was originally conceived as an antidote to a perceived lack of competition and innovation in the banking market (obie in th. uk and psd2 for eu are two of the most recognizable initiatives globally). with banks required (regulation driven) or invited (market. Open banking, quite simply, means that banks will share customers’ financial information electronically and securely with trusted third parties when the account owner gives consent. this will allow consumers to use their banking apps to make authenticated payments directly to merchants in real time. the intent of this regulation is to. Account to account payment has many benefits for merchants, not least cost, where the fees are considerably lower than accepting payments using traditional card rails. there are three primary ways a2a payments occur: bank transfers: payers initiate transactions through their online banking apps—often called push payments. Research from pymnts shows that 46% of consumers became ‘digital shifters’ following the onset of the pandemic in spring of 2020, using online or mobile banking more than they did before the pandemic. 1. as a result, the global online banking market is expected to hit $20.5 billion by 2026, up from $9.1 billion in 2019. 2.

Open Banking What Is It And How Does It Work Decentro Account to account payment has many benefits for merchants, not least cost, where the fees are considerably lower than accepting payments using traditional card rails. there are three primary ways a2a payments occur: bank transfers: payers initiate transactions through their online banking apps—often called push payments. Research from pymnts shows that 46% of consumers became ‘digital shifters’ following the onset of the pandemic in spring of 2020, using online or mobile banking more than they did before the pandemic. 1. as a result, the global online banking market is expected to hit $20.5 billion by 2026, up from $9.1 billion in 2019. 2.

What Will Happen To Open Banking Next Know The Initiatives

Comments are closed.