What To Know If You Ve Been Denied A Checking Account Sofi

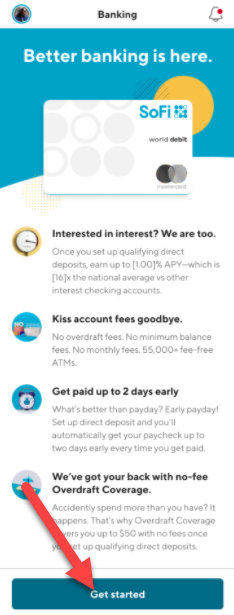

What To Know If You Ve Been Denied A Checking Account Sofi If you have been denied a bank account and can’t quickly resolve the issue, here are a couple of workarounds to consider: second chance checking account . some banking institutions offer a second chance account to those denied a traditional checking account. a second chance account typically provides limited services. Better banking is here with sofi, nerdwallet’s 2024 winner for best checking account overall.* enjoy up to 4.20% apy on sofi checking and savings. faq can i open a bank account if i’m blacklisted? you may have a few options if you’ve been blocked from opening an account. you could try to fix your old problems, and ask the bank to reconsider.

Denied Sofi Banking Accounts Despite Good Credit High Income No Options if you’ve been denied a bank account due to chexsystems. if you’ve been denied a checking account because of a negative chexsystems report, it helps to know what to do next. you have a few options: • clean up your chexsystems file. request a copy of your chexsystems report to understand why you were denied. Denied a sofi banking account. what do i do now? banking. i was denied for the past 3 weeks for a banking account with sofi. i already have an invest account my credit score is a 760 i have a chexsystems score of 680. i have never been denied a checking account with anyone else before. i even verified my name and address matched my experian report. Without knowing more, if you've had questionable banking history, they can decline you but they need to tell you why, so i'd hope you'd see a mailed reason. lack of credit history can be a factor too. if you don't have a good credit track record, you can be turned away. source: am was bank worker who opened accounts. Just got declined when applying for a sofi checking and savings account. the reasons they provided via email are: our inability to verify certain information that is required under the patriot act. data made available to us through public or private sources, which in this case does not include data obtained from any consumer credit reporting.

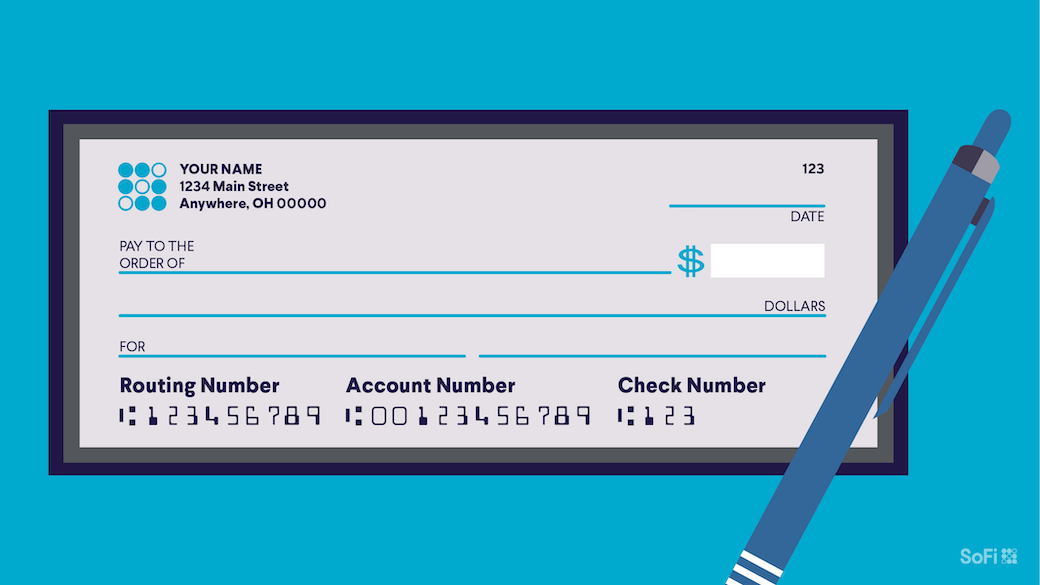

Routing Number Vs Account Number The Difference Explained Sofi Without knowing more, if you've had questionable banking history, they can decline you but they need to tell you why, so i'd hope you'd see a mailed reason. lack of credit history can be a factor too. if you don't have a good credit track record, you can be turned away. source: am was bank worker who opened accounts. Just got declined when applying for a sofi checking and savings account. the reasons they provided via email are: our inability to verify certain information that is required under the patriot act. data made available to us through public or private sources, which in this case does not include data obtained from any consumer credit reporting. Common reasons banks may deny you a checking account include: negative information on your chexsystems report. for example, you might have a record of: involuntary account closure. excessive overdrafts or nonsufficient funds incidents. unpaid fees or negative account balances, whether from an active or closed account. How to check a chexsystems report you can request a copy of a free chexsystems report at least once every 12 months. the request process can be initiated on the chexsystems website. alternatively, you can ask for a copy via mail or over the phone. you may also get a free chexsystems report if you've been denied opening a bank account. this.

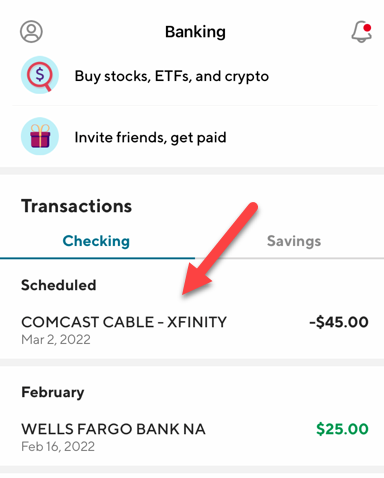

How Do I Cancel Or Edit A Bill Pay In My Sofi Checking And Savings Common reasons banks may deny you a checking account include: negative information on your chexsystems report. for example, you might have a record of: involuntary account closure. excessive overdrafts or nonsufficient funds incidents. unpaid fees or negative account balances, whether from an active or closed account. How to check a chexsystems report you can request a copy of a free chexsystems report at least once every 12 months. the request process can be initiated on the chexsystems website. alternatively, you can ask for a copy via mail or over the phone. you may also get a free chexsystems report if you've been denied opening a bank account. this.

How Do I Open Sofi Checking And Savings Accounts Sofi

Comments are closed.