What To Know Before Applying For A Va Home Loan In 2023 1st United

What To Know Before Applying For A Va Home Loan In 2023 1st United Between september 8, 1980, and august 1, 1990. you meet the minimum active duty service requirement if you served for: at least 24 continuous months, or. the full period (at least 181 days) for which you were called to active duty, or. at least 181 days if you were discharged for a hardship, or a reduction in force, or. The va loan process timeline typically takes 30 45 days from contract to closing. while va streamline refinancing can be faster, often closing in half the time, both va purchase and refinance timelines are comparable to conventional mortgages. if you're a first time homebuyer, the va loan process can feel daunting, but the first step is simple.

How To Apply For A Va Home Loan Onepronic S governing the va home loan program.you may also call 1 877 827 3702, to contact the nearest va regional loan center and speak with a va representative regarding your individual home loan. ituation for counseling and guidance. even veterans without a va home loan can call the va regional loan. Va loan eligibility. backed by the u.s. department of veterans affairs, va loans are a benefit for active duty and veteran service members and some surviving spouses. you're eligible to apply for. Va home loans are provided by private lenders, such as banks and mortgage companies. va guarantees a portion of the loan, enabling the lender to provide you with more favorable terms. read our guide for buying a home. before you buy, be sure to read the va home loan buyer's guide. You may qualify for a va loan by meeting one or more of the following requirements: you served 90 consecutive days of active service during wartime. you served 181 days of active service during peacetime. you have 6 years of service in the national guard or reserves, or served 90 days (at least 30 of them consecutively) under title 32 orders.

What To Know Before Getting A Va Loan For A Rental Property Va home loans are provided by private lenders, such as banks and mortgage companies. va guarantees a portion of the loan, enabling the lender to provide you with more favorable terms. read our guide for buying a home. before you buy, be sure to read the va home loan buyer's guide. You may qualify for a va loan by meeting one or more of the following requirements: you served 90 consecutive days of active service during wartime. you served 181 days of active service during peacetime. you have 6 years of service in the national guard or reserves, or served 90 days (at least 30 of them consecutively) under title 32 orders. You can think about loan prequalification as a “first interview” of sorts. prequalification helps lenders achieve three main goals: assess a borrower’s service and credit eligibility. estimate the loan amount a borrower may obtain. begin gathering documentation needed for preapproval and loan underwriting. Apply for your va loan. work with the lender to complete a loan application and gather the needed documents, such as pay stubs and bank statements. loan processing. the lender orders a va appraisal and begins to "process" all the credit and income information. (note: va's appraisal is not a home inspection or a guaranty of value.

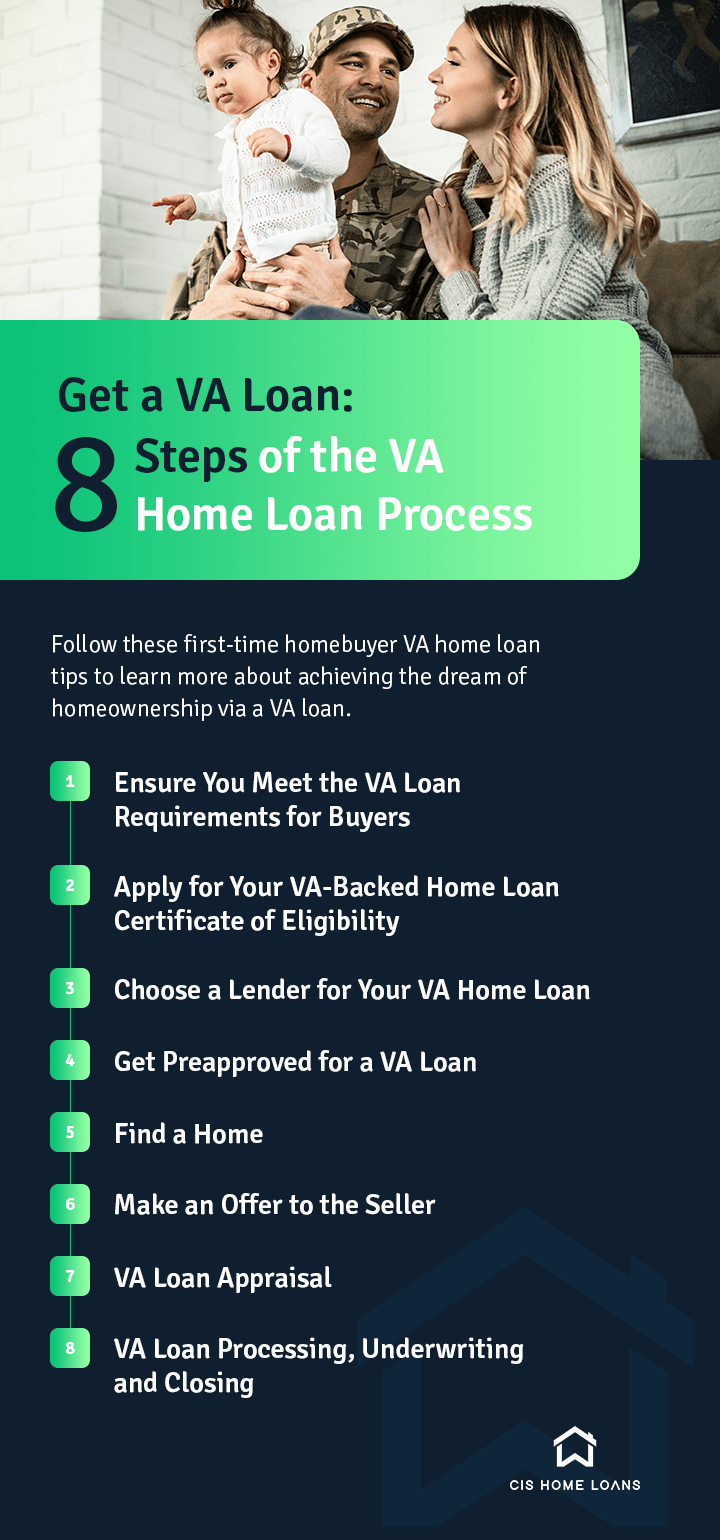

8 Steps Of The Va Home Loan Process Cis Home Loans You can think about loan prequalification as a “first interview” of sorts. prequalification helps lenders achieve three main goals: assess a borrower’s service and credit eligibility. estimate the loan amount a borrower may obtain. begin gathering documentation needed for preapproval and loan underwriting. Apply for your va loan. work with the lender to complete a loan application and gather the needed documents, such as pay stubs and bank statements. loan processing. the lender orders a va appraisal and begins to "process" all the credit and income information. (note: va's appraisal is not a home inspection or a guaranty of value.

Beginners Guide To Va Home Loans In 2023 Youtube

Comments are closed.