What S Difference Between Traditional Ira And Roth Ira

Traditional Vs Roth Ira Yolo Federal Credit Union Key takeaways. the key difference between roth and traditional individual retirement accounts (iras) lies in the timing of their tax advantages. with traditional iras, you deduct contributions now. The difference between roth and traditional iras. the main difference between a roth ira and a traditional ira is how and when you get a tax break. contributions to traditional iras are tax.

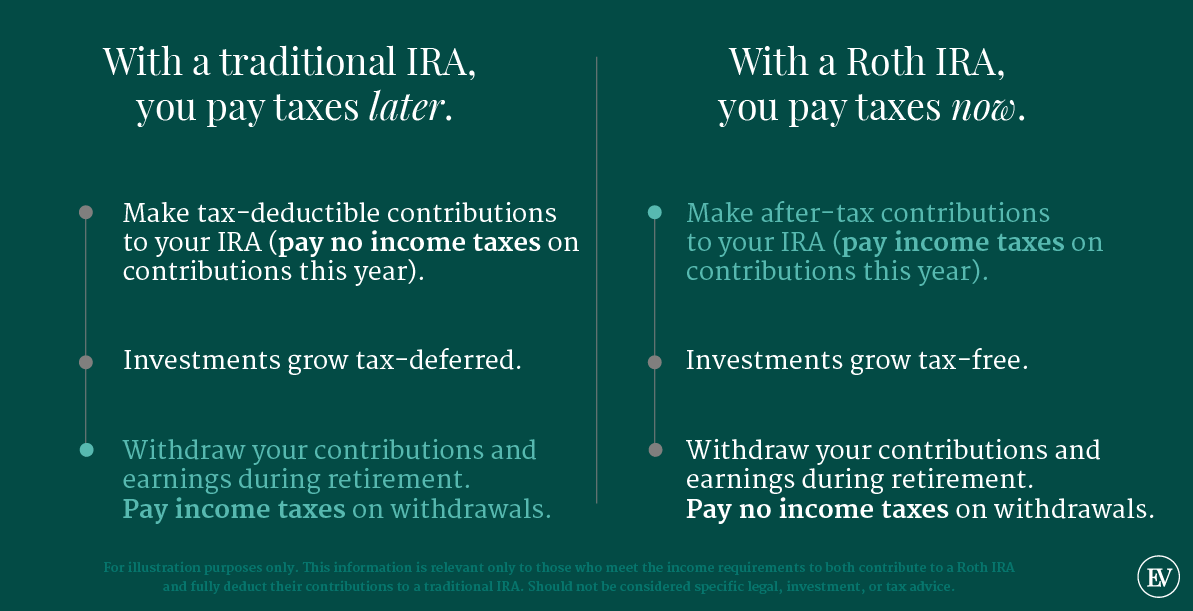

Roth Vs Traditional Ira What You Need To Know Ellevest Let's compare roth and traditional ira features side by side to help you find your best fit. keep in mind: not only do the roth and traditional iras offer different tax benefits, they also have different irs rules around eligibility based on your income. open and contribute to the one that suits you. Traditional iras generally allow anyone with earned income to contribute, but tax deductibility is phased out at higher income levels if the contributor or their spouse has access to a workplace retirement plan. in contrast, roth iras have income caps beyond which individuals cannot contribute at all. determining eligibility is crucial before. The difference between a traditional ira and a roth ira comes down to taxes. with a roth ira, you contribute funds on which you’ve already paid income taxes, commonly referred to as post tax. The 2024 contribution limit for a traditional ira is $7,000 with an extra $1,000 catch up contribution for those 50 and over. the other option is a roth ira. the roth ira was established as an account into which after tax dollars are invested. while the roth gives no tax deduction on the front end, the growth—and eventual distribution—is.

Traditional Iras Vs Roth Iras Comparison 1st National Bank The difference between a traditional ira and a roth ira comes down to taxes. with a roth ira, you contribute funds on which you’ve already paid income taxes, commonly referred to as post tax. The 2024 contribution limit for a traditional ira is $7,000 with an extra $1,000 catch up contribution for those 50 and over. the other option is a roth ira. the roth ira was established as an account into which after tax dollars are invested. while the roth gives no tax deduction on the front end, the growth—and eventual distribution—is. As mentioned above, traditional and roth iras differ mainly in their specific treatment of taxes during the contribution and withdrawal phases. traditional iras allow individuals to contribute pre tax dollars into a retirement account, which reduces their taxable income in the current year. with roth iras, individuals contribute post tax money. The key distinctions between roth iras and traditional iras involve two main considerations: taxes and timing. traditional iras offer the potential for tax deductibility in the present, while roth.

Here Are The Key Differences Between A Roth Ira And A Traditional Ira As mentioned above, traditional and roth iras differ mainly in their specific treatment of taxes during the contribution and withdrawal phases. traditional iras allow individuals to contribute pre tax dollars into a retirement account, which reduces their taxable income in the current year. with roth iras, individuals contribute post tax money. The key distinctions between roth iras and traditional iras involve two main considerations: taxes and timing. traditional iras offer the potential for tax deductibility in the present, while roth.

Comments are closed.