What My Retirement Plan Looks Like

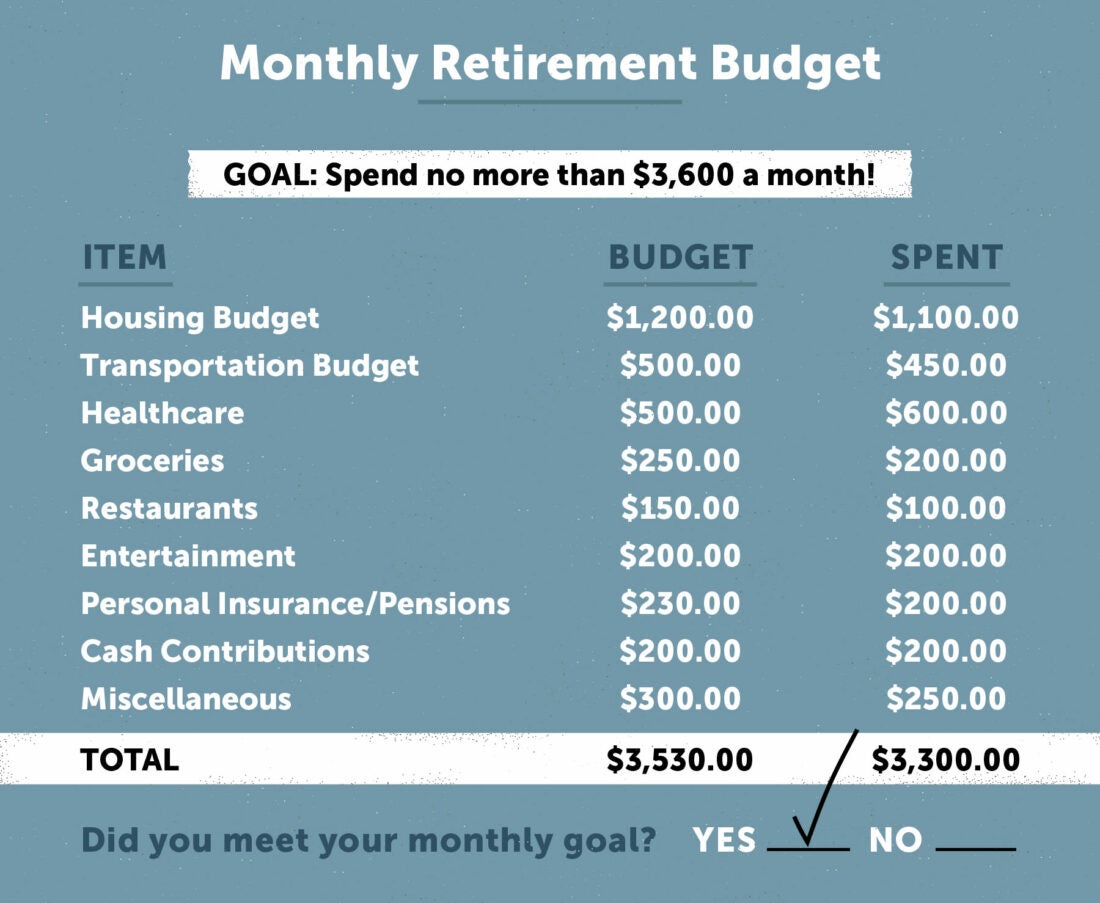

Retirement Planning Guide For Seniors Lexington Law Simply divide your income number by 4.5%, or 0.045. if you need your savings to generate $70,000 in annual retirement income, for example, you'd aim to amass at least $1,555,556 in your retirement. The typical advice is to replace 70% to 90% of your annual pre retirement income through savings and social security. with this strategy, a retiree who earns around $63,000 per year before.

What Does Your Retirement Plan Look Like Putting $100 into a retirement account every month starting at age 20 is more effective than putting $100,000 into a retirement account at age 65. even assuming a relatively low 5% rate of return. Retirement can look different to everyone, but figuring out what it looks like to you is essential to be able to plan for your ideal retirement lifestyle, and a plan that will help you fund those. Scenario 1: scaling back. many people see themselves living more simply and spending less in retirement. in some cases, a smaller nest egg can work. but living comfortably on less money takes planning. and your expenses might not drop as much as you think. according to data from the bureau of labor statistics, housing is likely the largest. Others rely on retirement plans provided through a workplace that may include 403 (b)s, 401 (k)s, and iras. some do both. no matter how you save, it’s important to understand your investment options. “your plan for retirement should be designed to meet your needs and wants in the long term,” says heather winston, a financial professional.

6 Best Retirement Plans To Build Your Old Age 2023 Review Scenario 1: scaling back. many people see themselves living more simply and spending less in retirement. in some cases, a smaller nest egg can work. but living comfortably on less money takes planning. and your expenses might not drop as much as you think. according to data from the bureau of labor statistics, housing is likely the largest. Others rely on retirement plans provided through a workplace that may include 403 (b)s, 401 (k)s, and iras. some do both. no matter how you save, it’s important to understand your investment options. “your plan for retirement should be designed to meet your needs and wants in the long term,” says heather winston, a financial professional. In the u.s., the traditional ira (individual retirement account) and roth ira are also popular forms of retirement savings. just like 401(k)s and other employer matching programs, there are specific tax shields in place that make them both appealing. the big difference between traditional iras and roth iras is when taxation is applied. Selecting the best retirement plan is a crucial step towards ensuring financial security and peace of mind in your later years. understanding the various options, including traditional and roth iras, 401 (k) plans, pensions, sep iras, and simple iras, is essential. each plan offers unique benefits, tax advantages, and contribution limits.

10 Retirement Plan Templates In Pdf Doc In the u.s., the traditional ira (individual retirement account) and roth ira are also popular forms of retirement savings. just like 401(k)s and other employer matching programs, there are specific tax shields in place that make them both appealing. the big difference between traditional iras and roth iras is when taxation is applied. Selecting the best retirement plan is a crucial step towards ensuring financial security and peace of mind in your later years. understanding the various options, including traditional and roth iras, 401 (k) plans, pensions, sep iras, and simple iras, is essential. each plan offers unique benefits, tax advantages, and contribution limits.

Comments are closed.