What Is W8 W8ben Or W8 Tax Form Guide Americans Overseas

Form W 8ben Explained Purpose And Uses Individuals or entities outside the u.s. fill out a w 8ben form to claim exemption from u.s. tax withholding for income earned in the u.s. w 8ben forms are essentially the equivalent of w 9 forms, which are required for non employees who are u.s. taxpayers. there are five w 8 forms, each designed for specific recipients or withholding agents. Provide form w 8ben to the withholding agent or payer before income is paid or credited to you. failure to provide a form w 8ben when requested may lead to withholding at the foreign person withholding rate of 30% or the backup withholding rate under section 3406. establishing status for chapter 4 purposes.

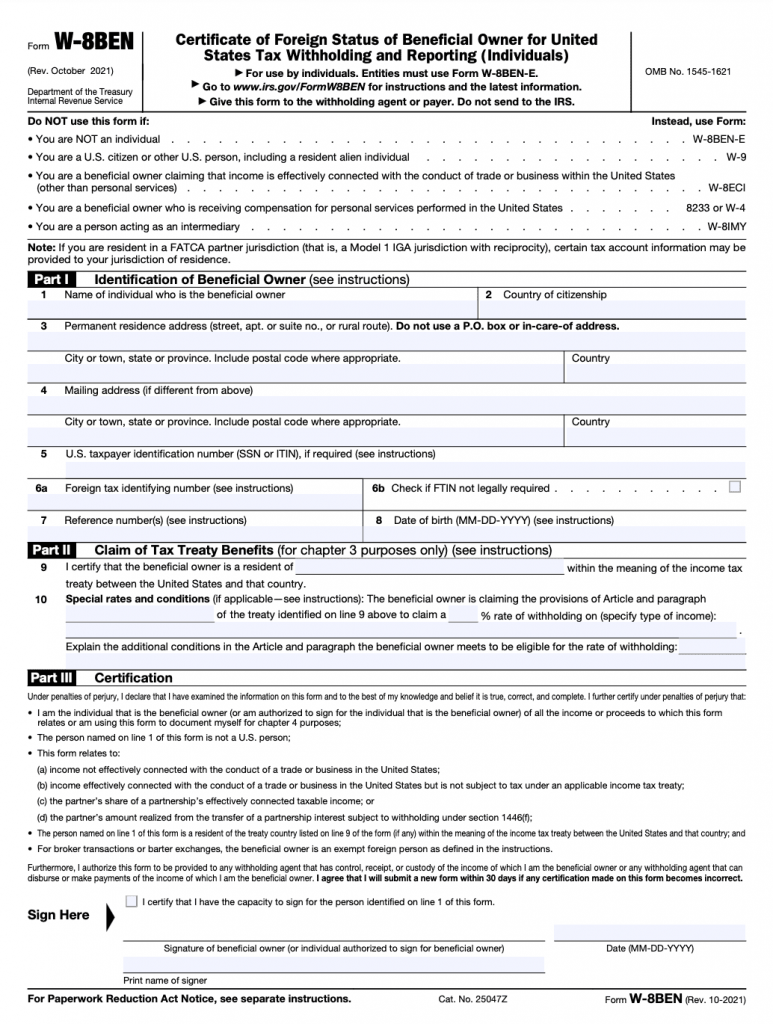

What Is W8 W8ben Or W8 Tax Form Guide Americans Overseas W 8 forms are used by foreign persons or business entities to claim exempt status from certain withholdings. there are five w 8 forms: w 8ben, w 8ben e, w 8eci, w 8exp, and w 8imy. form w 8imy is. Give form w 8 ben to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding. submit form w 8 ben when requested by the withholding agent or payer whether or not you are claiming a reduced rate of, or exemption from, withholding. The w 8ben form is a tax from the united states internal revenue service (irs) that is used to determine the foreign status of non residents for the purpose of taxation. the official name for the form is “certificate of foreign status of beneficial worker for united states tax withholding and reporting (individuals)”. Filing a w 8 form involves several steps. because the irs uses these forms to determine the correct amount of tax withholding and as proof of treaty benefits, it’s important to fill them out accurately. here is a guide on how to file w 8 forms: identify the correct form: as we’ve discussed, there are several types of w 8 forms. each type of.

How To Fill Out A W8 Ben Form Jamesbachini The w 8ben form is a tax from the united states internal revenue service (irs) that is used to determine the foreign status of non residents for the purpose of taxation. the official name for the form is “certificate of foreign status of beneficial worker for united states tax withholding and reporting (individuals)”. Filing a w 8 form involves several steps. because the irs uses these forms to determine the correct amount of tax withholding and as proof of treaty benefits, it’s important to fill them out accurately. here is a guide on how to file w 8 forms: identify the correct form: as we’ve discussed, there are several types of w 8 forms. each type of. Form w 8 ben is essentially an international worker’s version of the w 9 form. its official name is the “certificate of foreign status of beneficial worker for united states tax withholding and reporting (individuals).”. access form w 8ben at irs.gov. the irs includes several w 8 forms in the series. Form w 8ben should be filled in by non us persons who live outside the us and who receive income from the us to avoid paying an automatic 30% withholding tax on this us income. this is normally because they should be paying less than 30%, or no us tax at all. non us persons include anyone who isn’t an american citizen or green card holder who.

What Is W8 Ben Form A Detailed Guide To Fill It Correctly Asanify Form w 8 ben is essentially an international worker’s version of the w 9 form. its official name is the “certificate of foreign status of beneficial worker for united states tax withholding and reporting (individuals).”. access form w 8ben at irs.gov. the irs includes several w 8 forms in the series. Form w 8ben should be filled in by non us persons who live outside the us and who receive income from the us to avoid paying an automatic 30% withholding tax on this us income. this is normally because they should be paying less than 30%, or no us tax at all. non us persons include anyone who isn’t an american citizen or green card holder who.

What Is A W8 Ben Form Printable Forms Free Online

Form W 8ben Explained Purpose And Uses

Comments are closed.