What Is The W4 Form And How Do You Fill It Out Simple Guide

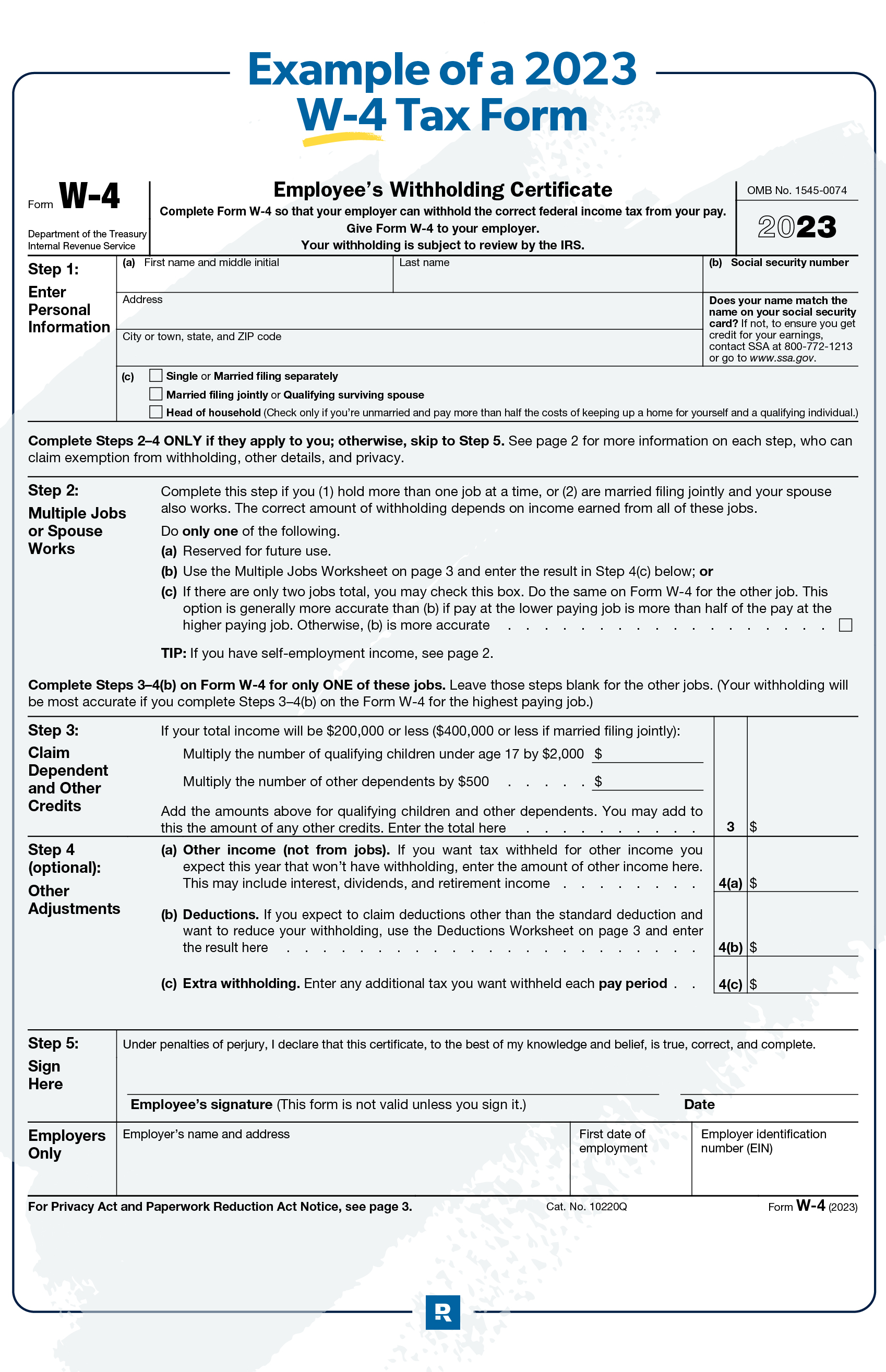

How To Fill Out A W 4 Form Ramsey How to fill out a w 4. step 1: enter your personal information. fill in your name, address, social security number and tax filing status. importantly, your tax filing status is the basis for which. Simple guide. it's important to fill out the w 4 correctly, since it tells your employer how much federal income tax to withhold from your paycheck.

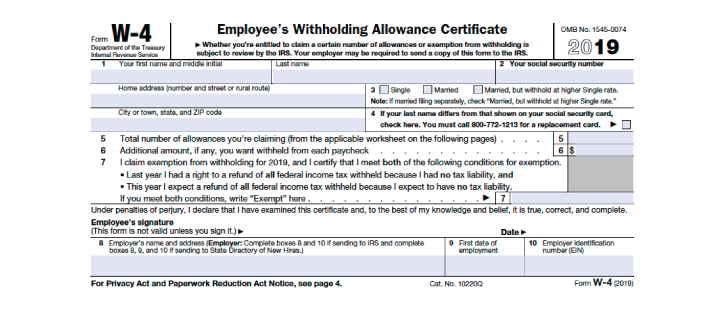

How To Do Stuff Simple Way To Fill Out A W4 The redesigned w 4 form no longer has allowances. we explain the five steps to filling it out and answer other faq about the form. Page last reviewed or updated: 22 may 2024. information about form w 4, employee's withholding certificate, including recent updates, related forms and instructions on how to file. form w 4 is completed by employees and given to their employer so their employer can withhold the correct federal income tax from the employee's pay. Step 2: account for all jobs you and your spouse have. unlike when you filled out w 4 forms in the past, you’ll have to fill out your w 4 with your combined income in mind, including self employment. otherwise, you may set up your withholding at too low a rate. to fill out this part correctly, you have three choices. Ensure you have the latest w 4 form from the irs website or your employer to report your income accurately. step 2: fill out separate forms for each job. complete a w 4 form for each employer if you have multiple jobs, as each employer needs to withhold taxes separately. step 3: review previous year's tax return.

Download And Print W 4 Form 2020 Step 2: account for all jobs you and your spouse have. unlike when you filled out w 4 forms in the past, you’ll have to fill out your w 4 with your combined income in mind, including self employment. otherwise, you may set up your withholding at too low a rate. to fill out this part correctly, you have three choices. Ensure you have the latest w 4 form from the irs website or your employer to report your income accurately. step 2: fill out separate forms for each job. complete a w 4 form for each employer if you have multiple jobs, as each employer needs to withhold taxes separately. step 3: review previous year's tax return. Step 5: sign and date form w 4. the form isn't valid until you sign it. remember, you only have to fill out the new w 4 form if you start a new job or if you want to make changes to the amount. Your w 4 is a four page irs form that basically tells your employer how much money to take out of your paychecks to cover taxes—and it was modified in 2020 to help people request the most.

W 4 Form Irs How To Fill It Out Definitive Guide 2018 Smartasset Step 5: sign and date form w 4. the form isn't valid until you sign it. remember, you only have to fill out the new w 4 form if you start a new job or if you want to make changes to the amount. Your w 4 is a four page irs form that basically tells your employer how much money to take out of your paychecks to cover taxes—and it was modified in 2020 to help people request the most.

Comments are closed.