What Is The Tila Respa Integrated Disclosure Rule

Nmls Exam Tila Respa Integrated Disclosure Rule Trid Youtube Resources to help industry participants understand, implement, and comply with the tila respa integrated disclosure (trid) rules. featured topic on august 5, 2021, the bureau issued an interpretive rule to provide guidance on certain trid timing requirements in light of the recent designation of juneteenth as a federal holiday. The questions and answers below pertain to compliance with the tila respa integrated disclosure rule (trid or trid rule). this is a compliance aid issued by the consumer financial protection bureau. the bureau published a policy statement on compliance aids, available here, that explains the bureau’s approach to compliance aids.

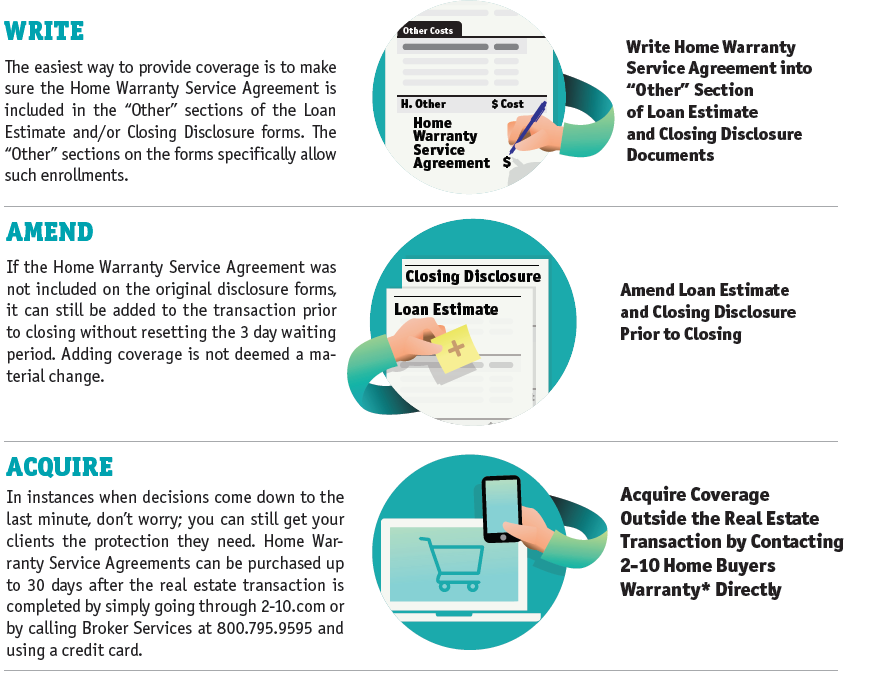

The Tila Respa Integrated Disclosure Rule Trid Nmls Mortgage Der tila and respa sections 4 and 5. section 1032(f) of the dodd frank act mandated that the bureau propose for public comment rules and model disclosures that integrate the tila a. respa disclosures by july 21, 2012. the bureau satisfied this statutory mandate and issued pro. Trid is an acronym that stands for tila respa integrated disclosures. it combines two federal laws, the truth in lending act (tila) and the real estate settlement procedures act (respa). both protect borrowers by requiring lenders to disclose key information about mortgage loans within mandatory timelines. let’s explore how trid delivers more. Quick takeaways. the trid (tila respa integrated disclosure) rule took effect in 2015 for the purpose of harmonizing the real estate settlement procedures act (respa) and truth in lending act (tila) disclosures and regulations. the rule has been amended twice since the initial issue, most recently in 2018. Disclosure to reset tolerances. the tila respa final rule, the amendments, and corrections are collectively referred to as the tila respa rule in this guide. the tila respa rule provides a detailed explanation of how the forms should be filled out and used. the first new form (loan estimate) is designed to provide.

What Is The Tila Respa Integrated Disclosure Rule Youtube Quick takeaways. the trid (tila respa integrated disclosure) rule took effect in 2015 for the purpose of harmonizing the real estate settlement procedures act (respa) and truth in lending act (tila) disclosures and regulations. the rule has been amended twice since the initial issue, most recently in 2018. Disclosure to reset tolerances. the tila respa final rule, the amendments, and corrections are collectively referred to as the tila respa rule in this guide. the tila respa rule provides a detailed explanation of how the forms should be filled out and used. the first new form (loan estimate) is designed to provide. Tila and respa were created in 1968 and 1974 respectively, and enforcing them now falls to the consumer financial protection bureau (cfpb), an agency created in july 2011. as of october 3, 2015, the cfpb combined all mortgage rate and fee disclosures mandated under tila and respa into two simple forms to make it easier for consumers to. In the news. the consumer financial protection bureau (cfpb) issued a factsheet addressing the disclosure of title insurance fees under the tila respa integrated disclosures rule (trid) on the loan estimate and closing disclosure. implementation of the consumer financial protection bureau’s integrated mortgage disclosures is aug. 1, 2015.

Understanding The New 2015 Tila Respa Integrated Disclosure Rule 2 10 Tila and respa were created in 1968 and 1974 respectively, and enforcing them now falls to the consumer financial protection bureau (cfpb), an agency created in july 2011. as of october 3, 2015, the cfpb combined all mortgage rate and fee disclosures mandated under tila and respa into two simple forms to make it easier for consumers to. In the news. the consumer financial protection bureau (cfpb) issued a factsheet addressing the disclosure of title insurance fees under the tila respa integrated disclosures rule (trid) on the loan estimate and closing disclosure. implementation of the consumer financial protection bureau’s integrated mortgage disclosures is aug. 1, 2015.

Overview Of The Tila Respa Integrated Disclosure Rule Ema Blog

The Tila Respa Integrated Disclosures

Comments are closed.