What Is The Medicare Donut Hole Healthmarkets Explains

What Is The Medicare Donut Hole Healthmarkets Explains Healthmarkets insurance agency is a licensed and certified representative of medicare advantage hmo, ppo and ppfs organizations and stand alone prescription drug plans. each of the organizations we represent has a medicare contract. enrollment in any plan depends on contract renewal. the plans we represent do not discriminate on the basis of. What is the medicare donut hole? can you get out of it? why is it important? healthmarkets explains the medicare donut hole and how it impacts you. 1 817 813 4562.

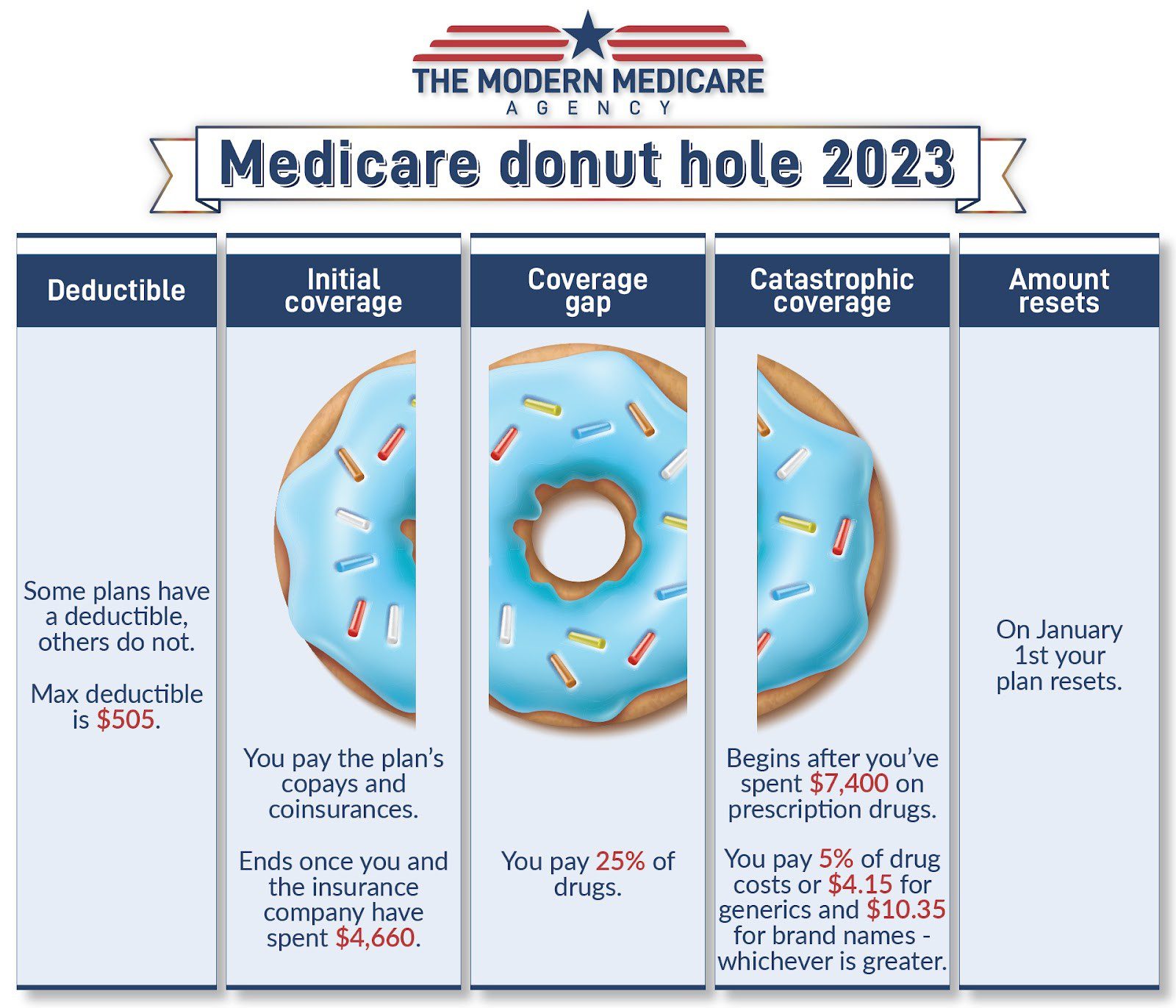

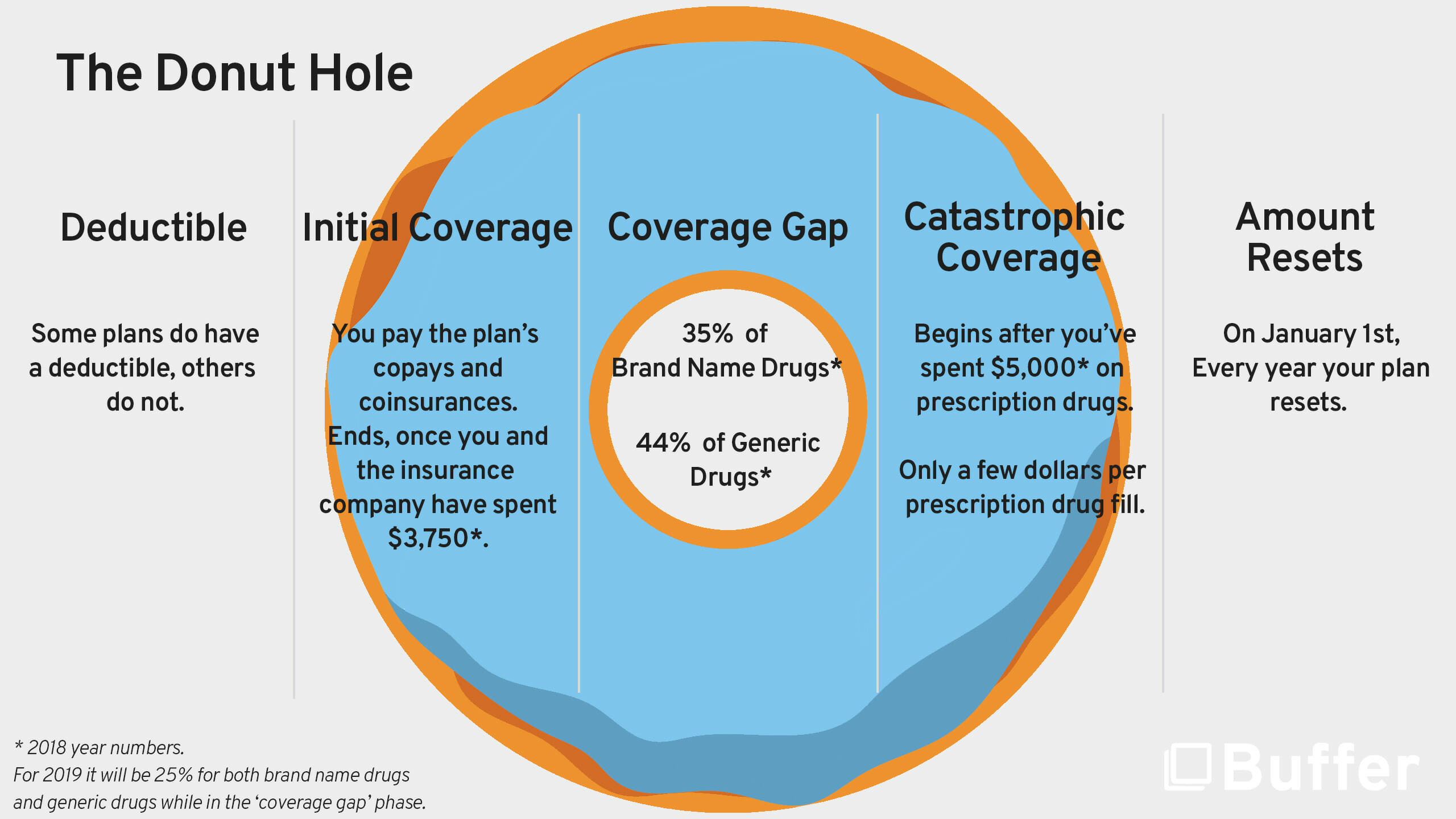

Medicare Donut Hole How It Works And How To Get Out This is until you’ve reached the coverage limit ($4,430 in 2022). 1. once the coverage limit has been reached, you will hit the medicare donut hole. during this time, you will be responsible for no more than 25% of your covered prescription drug costs until you hit the yearly out of pocket maximum limit ($7,050 in 2022). 2. However, at some point, you may face a coverage gap called the “donut hole,” which is a temporary limit on what your part d plan will pay for your drugs for a specified period of time. read on. In 2024, once you reach the coverage gap, you'll pay no more than 25% of the cost for your plan's covered brand name prescription drugs. you'll pay this discounted rate if you buy your prescriptions at a pharmacy or order them through the mail. some plans may offer you even lower costs in the coverage gap. The medicare part d donut hole, or coverage gap, is one of four stages you may encounter during the year while a member of a part d prescription drug plan. specifically, the donut hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached the initial coverage limit.

What Is A Donut Hole In Medicare The Modern Medicare Agency In 2024, once you reach the coverage gap, you'll pay no more than 25% of the cost for your plan's covered brand name prescription drugs. you'll pay this discounted rate if you buy your prescriptions at a pharmacy or order them through the mail. some plans may offer you even lower costs in the coverage gap. The medicare part d donut hole, or coverage gap, is one of four stages you may encounter during the year while a member of a part d prescription drug plan. specifically, the donut hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached the initial coverage limit. In the donut hole, a person pays for 25% of their medication costs out of pocket and receives discounts from drug manufacturers to cover the remaining costs. the insurance company will add up what. 2024 is the last year for the medicare donut hole. starting in 2025, the inflation reduction act’s new $2,000 out of pocket spending cap for medicare part d takes effect.

The Donut Hole Medicare Part D Buffer Benefits In the donut hole, a person pays for 25% of their medication costs out of pocket and receives discounts from drug manufacturers to cover the remaining costs. the insurance company will add up what. 2024 is the last year for the medicare donut hole. starting in 2025, the inflation reduction act’s new $2,000 out of pocket spending cap for medicare part d takes effect.

What Is The Medicare Donut Hole Healthmarkets Explains

Comments are closed.