What Is The Medicare Donut Hole 2minutemedicare

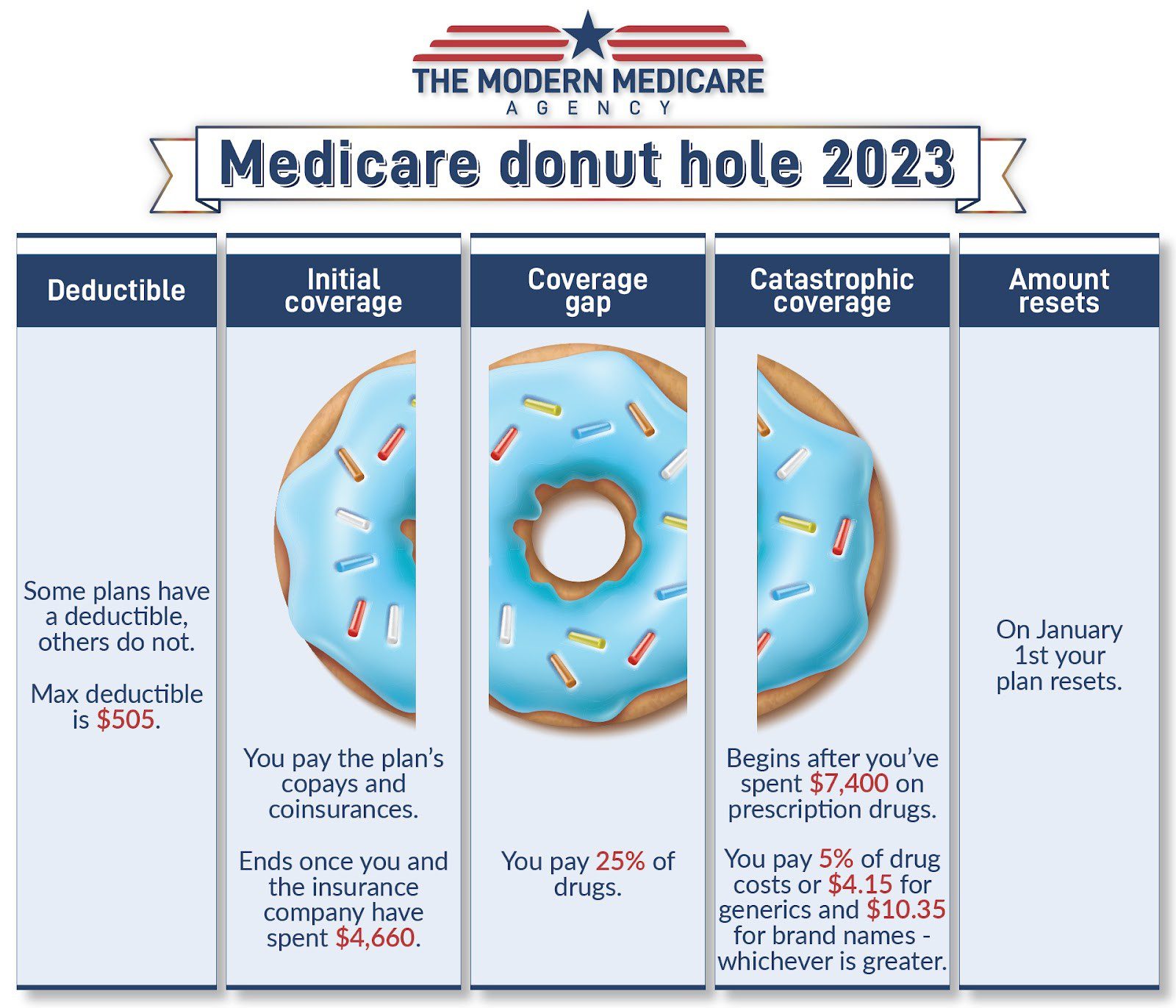

Medicare Donut Hole How It Works And How To Get Out The “donut hole” is the third (of four) payment stages within medicare part d. most part d plans and advantage plans will have this coverage gap. when the total overall drug costs—including what you and your plan have spent for your medications you enter the “donut hole.” you are then responsible for 25% of the cost of your drugs. Through 2024, most medicare drug plans have a coverage gap (also called the "donut hole"). this means there's a temporary limit on what the drug plan will cover for drugs. because of the prescription drug law, the coverage gap ends on december 31, 2024.

What Is The Medicare Donut Hole 2minutemedicare However, at some point, you may face a coverage gap called the “donut hole,” which is a temporary limit on what your part d plan will pay for your drugs for a specified period of time. read on. In the donut hole, a person pays for 25% of their medication costs out of pocket and receives discounts from drug manufacturers to cover the remaining costs. the insurance company will add up what. The medicare part d donut hole, or coverage gap, is one of four stages you may encounter during the year while a member of a part d prescription drug plan. specifically, the donut hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached the initial coverage limit. 2024 is the last year for the medicare donut hole. starting in 2025, the inflation reduction act’s new $2,000 out of pocket spending cap for medicare part d takes effect.

Medicare Part D Donut Hole How To Prepare For It The medicare part d donut hole, or coverage gap, is one of four stages you may encounter during the year while a member of a part d prescription drug plan. specifically, the donut hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached the initial coverage limit. 2024 is the last year for the medicare donut hole. starting in 2025, the inflation reduction act’s new $2,000 out of pocket spending cap for medicare part d takes effect. 2024 will be the last year medicare part d enrollees have to go through the donut hole coverage phase. due to the inflation reduction act, starting in 2025, all medicare part d plans will have a $2,000 maximum out of pocket limit. thus, taking away the need for the donut hole phase. once you meet the $2,000 limit is 2025, you will not be. In the “donut hole,” or coverage gap, you pay no more than 25% of your prescription costs plus 25% of the pharmacy dispensing fee, which is usually $1 to $3. the other 75% is paid by your health plan for generic drugs. for brand name medications, 5% is paid by your part d plan, and 70% is covered by a manufacturer discount.

What Is A Donut Hole In Medicare The Modern Medicare Agency 2024 will be the last year medicare part d enrollees have to go through the donut hole coverage phase. due to the inflation reduction act, starting in 2025, all medicare part d plans will have a $2,000 maximum out of pocket limit. thus, taking away the need for the donut hole phase. once you meet the $2,000 limit is 2025, you will not be. In the “donut hole,” or coverage gap, you pay no more than 25% of your prescription costs plus 25% of the pharmacy dispensing fee, which is usually $1 to $3. the other 75% is paid by your health plan for generic drugs. for brand name medications, 5% is paid by your part d plan, and 70% is covered by a manufacturer discount.

Comments are closed.