What Is The Difference Hmo Vs Ppo Resourceful In 2024

What Is The Difference Hmo Vs Ppo Resourceful In 2024 Cheaper health insurance rates: hmo plans are usually a lower cost alternative to ppos. the average hmo rate is $427 monthly for an affordable care act (aca) plan for someone who is 30 years old. When considering health plans, the pros and cons of hmos and ppos are key to understanding the contrasting approaches to healthcare coverage. pros and cons of hmo pro: offers lower premiums, making the plan more affordable. con: requires patients to select a primary care physician within a predefined network. pros and cons of ppo.

Hmo Vs Ppo How To Pick Your Health Insurance Plan One Medical In 2024, blue cross blue shield (bcbs) offers coverage in 39 states, with hmo and ppo plans available. bcbs accounts for 4.4 million, or 14%, of medicare advantage enrollment, according to the kff. Key takeaways: hmos and ppos have different rules about covering healthcare services delivered by out of network providers. hmos limit your choice of providers but often have a lower deductible and premiums. ppos offer you more flexibility than hmos in choosing doctors and hospitals. lpettet istock via getty images. Pos plans. a point of service (pos) plan is a health insurance plan that partners with a group of clinics, hospitals and doctors to provide care. with this type of plan, you’ll pay less out of pocket when you get care within the plan's network. pos plans often require coordination with a primary care provider (pcp) for treatment and referrals. There are a few key differences between hmo and ppo plans. primary care physicians. hmo plans generally require members to utilize a primary care physician (pcp), while ppo plans typically do not. cost. on average, hmo members can generally expect to pay lower premiums than members of ppo plans. referrals.

What Is The Difference Hmo Vs Ppo Resourceful In 2024 Pos plans. a point of service (pos) plan is a health insurance plan that partners with a group of clinics, hospitals and doctors to provide care. with this type of plan, you’ll pay less out of pocket when you get care within the plan's network. pos plans often require coordination with a primary care provider (pcp) for treatment and referrals. There are a few key differences between hmo and ppo plans. primary care physicians. hmo plans generally require members to utilize a primary care physician (pcp), while ppo plans typically do not. cost. on average, hmo members can generally expect to pay lower premiums than members of ppo plans. referrals. Lower cost. hmo plans typically have lower monthly premiums. you can also expect to pay less out of pocket. higher cost. ppos tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. out of pocket medical costs can also run higher with a ppo plan. Two of the most common types are hmo and ppo. an hmo plan typically has lower costs but limits you to a network of doctors and requires referrals for specialists. a ppo plan, on the other hand, offers more freedom but usually comes with higher premiums and out of pocket expenses. in this article, we’ll compare the pros and cons of both plans.

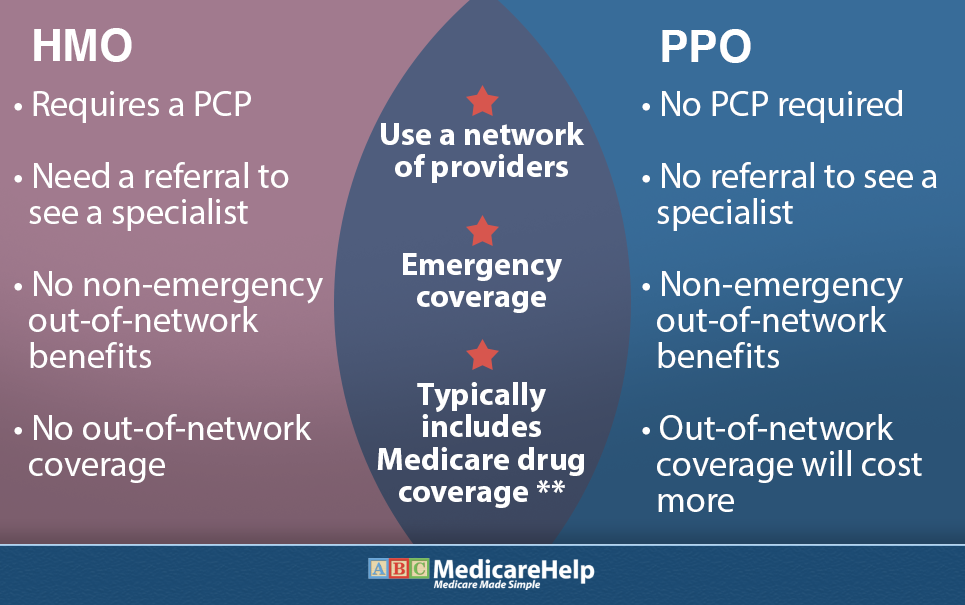

Ppo Vs Hmo Plans Abc Medicare Lower cost. hmo plans typically have lower monthly premiums. you can also expect to pay less out of pocket. higher cost. ppos tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. out of pocket medical costs can also run higher with a ppo plan. Two of the most common types are hmo and ppo. an hmo plan typically has lower costs but limits you to a network of doctors and requires referrals for specialists. a ppo plan, on the other hand, offers more freedom but usually comes with higher premiums and out of pocket expenses. in this article, we’ll compare the pros and cons of both plans.

Comments are closed.