What Is The Bankruptcy Process Bankruptcy Fixes Debt

What Is The Bankruptcy Process Bankruptcy Fixes Debt Bankruptcy is a legal process that lets individuals or businesses overburdened with debt eliminate debts and start fresh or, in some cases, work out deals with creditors to pay debts off. A chapter 13 bankruptcy is also called a wage earner's plan. it enables individuals with regular income to develop a plan to repay all or part of their debts. under this chapter, debtors propose a repayment plan to make installments to creditors over three to five years. if the debtor's current monthly income is less than the applicable state.

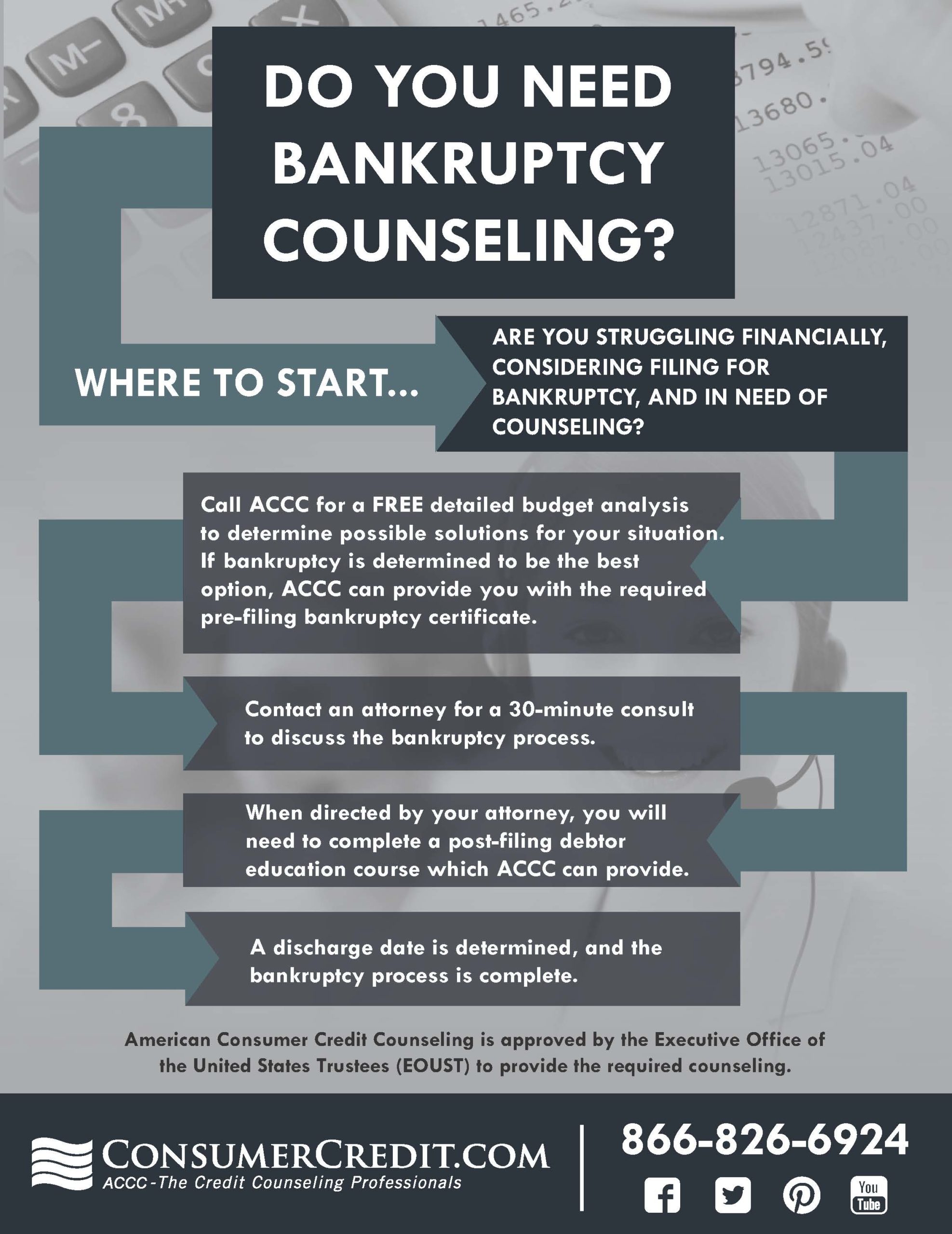

Understanding The Bankruptcy Process Consumercredit Bankruptcy is a legal process, so it begins when the debtor files a petition with the relevant bankruptcy court. this is often achieved through the help of a lawyer specialized in these types of. The bankruptcy rules contain a set of official forms for use in bankruptcy cases. the bankruptcy code and bankruptcy rules (and local rules) set forth the formal legal procedures for dealing with the debt problems of individuals and businesses. there is a bankruptcy court for each judicial district in the country. each state has one or more. Bankruptcy is a legal tool that gives people and businesses debt relief. it’s a way for folks in a tough financial situation to get a fresh start. chapter 7 and chapter 13 bankruptcy are the two most common types of bankruptcy that individuals and married couples file. A chapter 13 bankruptcy is a reorganization of all debts you might owe: houses, cars, credit cards, medical bills, personal loans, and etc. what is reorganing debt mean? a person filing a chapter 13 case can catch up on past due payments owed to mortgages and car payments without the worry of foreclosures or repossessions.

Bankruptcy Fixes Debt Get A Fresh Start On Your Finances Bankruptcy is a legal tool that gives people and businesses debt relief. it’s a way for folks in a tough financial situation to get a fresh start. chapter 7 and chapter 13 bankruptcy are the two most common types of bankruptcy that individuals and married couples file. A chapter 13 bankruptcy is a reorganization of all debts you might owe: houses, cars, credit cards, medical bills, personal loans, and etc. what is reorganing debt mean? a person filing a chapter 13 case can catch up on past due payments owed to mortgages and car payments without the worry of foreclosures or repossessions. Bankruptcy is a legal process for getting relief from debts that you cannot repay. if you file for personal bankruptcy, you generally have two options: chapter 7 or chapter 13. Bankruptcy is a legal process designed to provide debt relief to individuals, businesses, and other entities struggling with overwhelming debt. this process allows debtors to reorganize their financial affairs and obtain a fresh start, while also providing protection from creditors. while bankruptcy can be a complex and difficult process, it.

Starting The Bankruptcy Process Free Consult Call Now Bankruptcy is a legal process for getting relief from debts that you cannot repay. if you file for personal bankruptcy, you generally have two options: chapter 7 or chapter 13. Bankruptcy is a legal process designed to provide debt relief to individuals, businesses, and other entities struggling with overwhelming debt. this process allows debtors to reorganize their financial affairs and obtain a fresh start, while also providing protection from creditors. while bankruptcy can be a complex and difficult process, it.

Comments are closed.