What Is Rsi Divergences Intraday Investment Indicators Shorts

What Is Rsi Divergences Intraday Investment Indicators Shorts Thomas J Catalano is a CFP and Registered Investment Adviser with the state Like other technical indicators, RSI has user-defined variable inputs, including determining what levels will Technical indicators are used by all types of traders including intraday traders or swing traders these indicators solely depends on traders RSI oscillator is mainly used to measure the

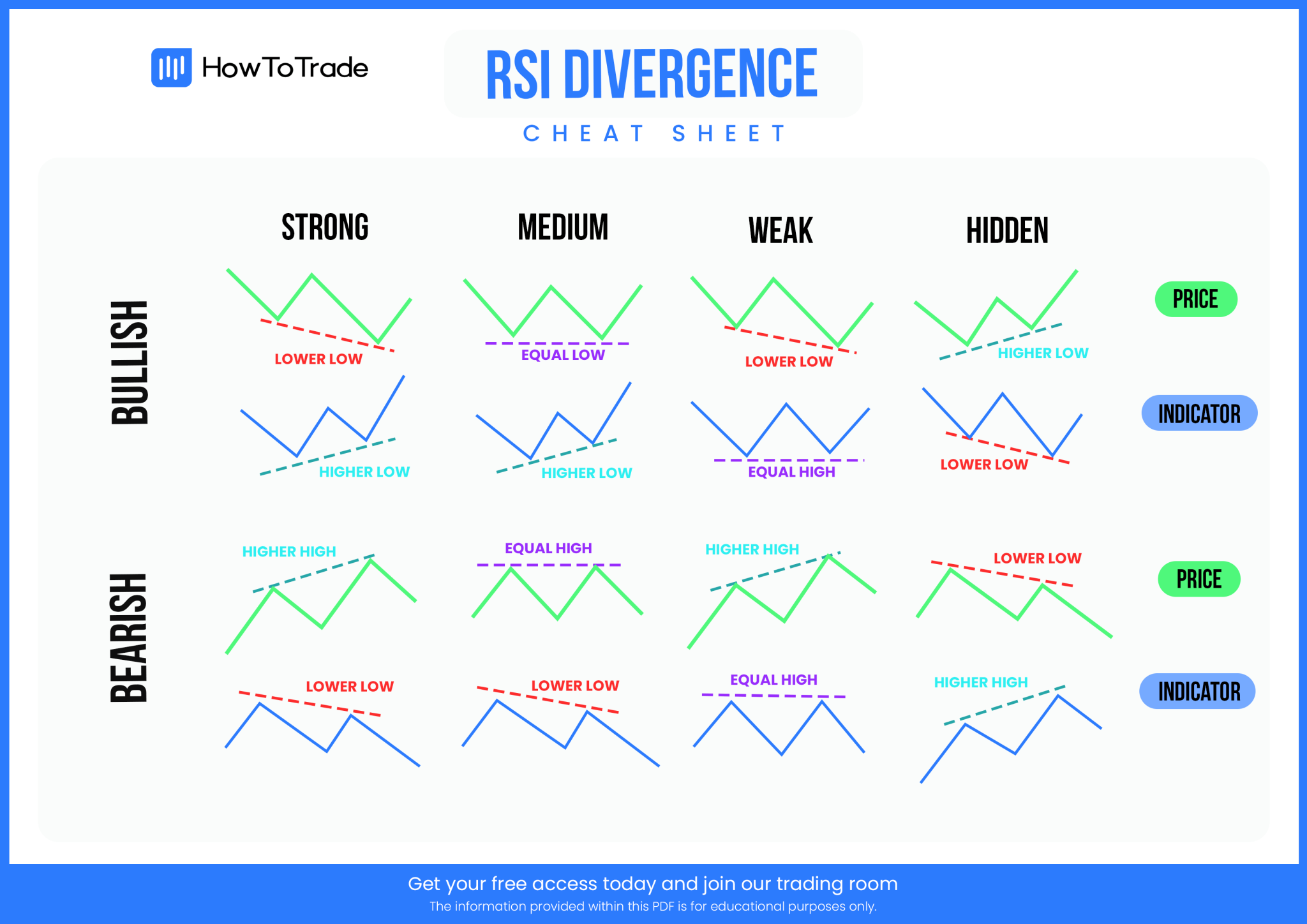

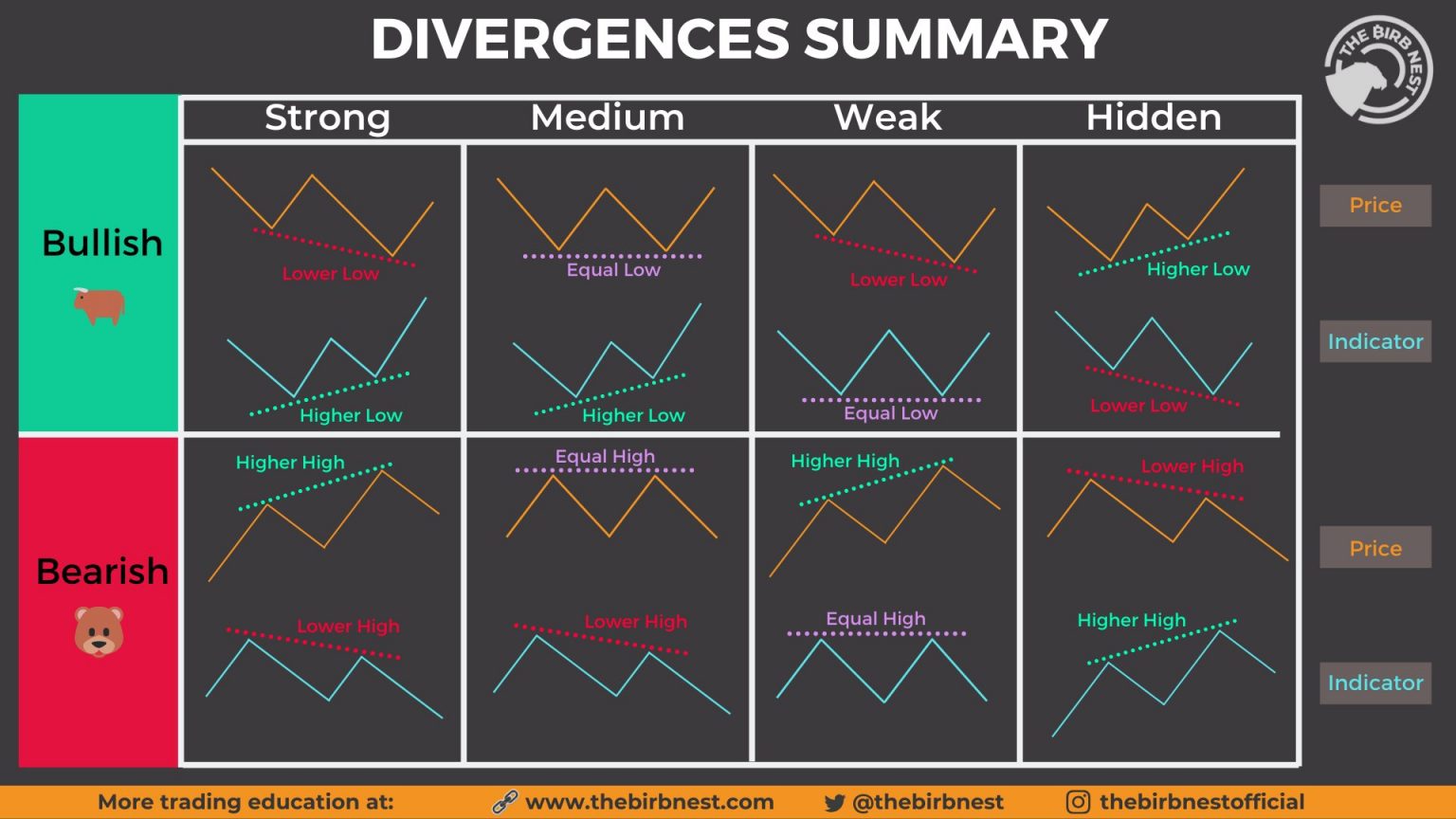

Rsi Divergence Cheat Sheet Pdf Free Download In the short term, negative RSI divergences and falling net 52-week Cam Hui writes the investment blog Humble Student of the Markets, where this article first appeared He is a former equity The investors owe their success to technical indicators such as the Relative Strength Index (RSI) which they use to execute Trend Trading A Trend is the direction of the market; it can be bearish Momentum measures the speed at which the price of a security is moving, and there are a variety of indicators one can and the relative strength index (RSI) The MACD depicts the relationship OBV can be used with other momentum indicators like the relative strength index (RSI) and exponential moving is more frequently used to find divergences and uses a money flow multiplier

Rsi Divergence New Trader U Momentum measures the speed at which the price of a security is moving, and there are a variety of indicators one can and the relative strength index (RSI) The MACD depicts the relationship OBV can be used with other momentum indicators like the relative strength index (RSI) and exponential moving is more frequently used to find divergences and uses a money flow multiplier The index uses seven market indicators to help answer the question: What emotion is driving the market now? It’s useful to look at stock market levels compared to where they’ve been over the

What Is Rsi Divergence Learn How To Spot It The index uses seven market indicators to help answer the question: What emotion is driving the market now? It’s useful to look at stock market levels compared to where they’ve been over the

Comments are closed.