What Is Know Your Customer Kyc Authenticid

What Is Know Your Customer Kyc Authenticid Know your customer (kyc) is a set of standards and regulations used by financial institutions to make sure that they’re doing business with a legitimate, law abiding person or entity. when you open a bank account, apply for a credit card, or take out a loan, the financial institution you do business with will ask you to provide some personal. Electronic know your customer takes kyc a step further by digitizing the entire process through biometrics and other means, or a combination of electronic methods. as ekyc grows more prevalent, it behooves banks, financial service providers and other organizations that require airtight id verification to prevent fraud, understand the technology.

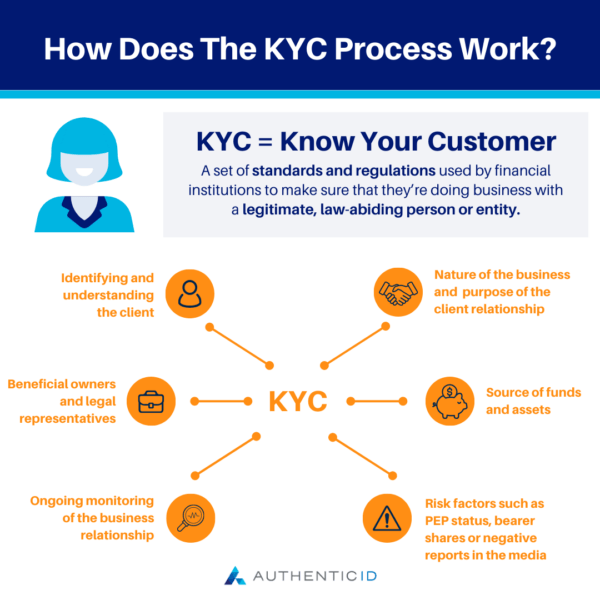

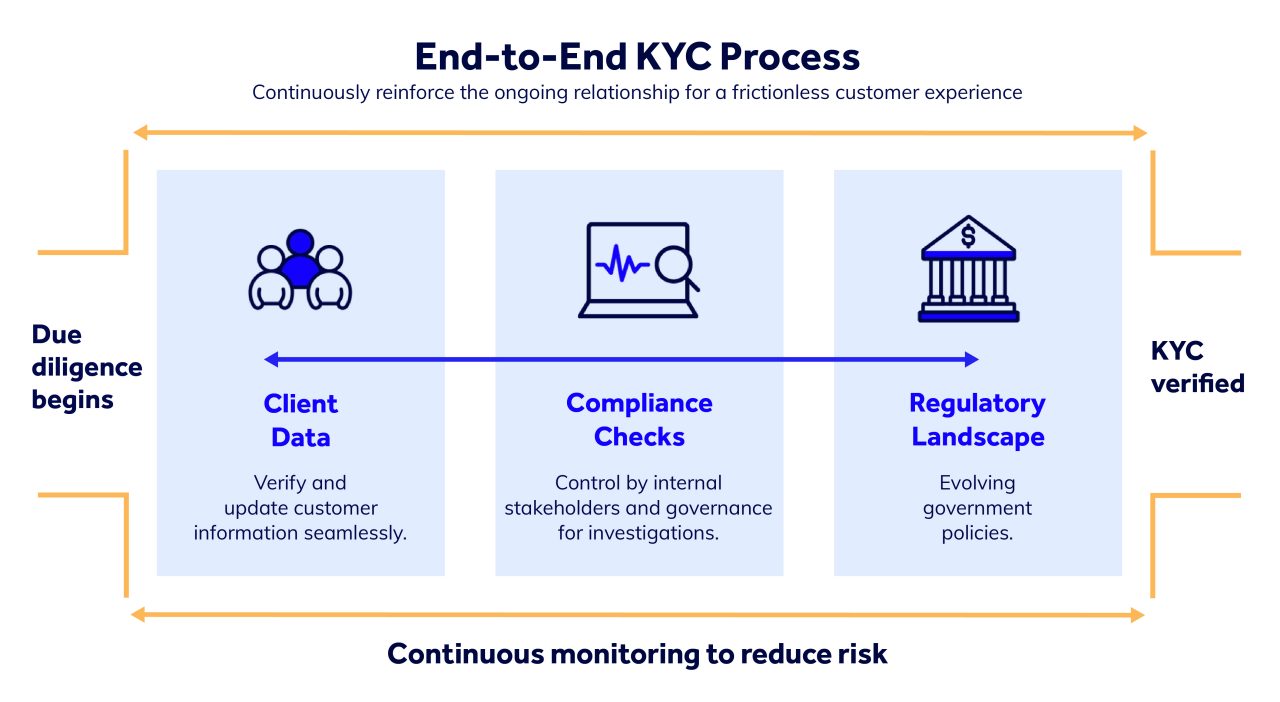

Kyc Process The Complete Guide Appian Ekyc (electronic know your customer) is the automated, digital process for customer identity verification, which serves as an alternative to the traditional, physical document based know your customer (kyc) process. know your customer (kyc) regulations targeting anti money laundering (aml) have been in place for decades now, and were only. Know your customer (kyc) authentication is a critical process for businesses and organizations across various industries. by verifying customer identities and assessing associated risks, companies can comply with regulations, prevent fraud, and foster trust among their stakeholders. as technology advances, kyc methods continue to evolve. Kyc, short for know your customer, is a critical process that businesses employ to verify the identity of their clients. far from being a mere procedural step, kyc is integral in safeguarding. Know your customer (kyc) is the process financial institutions follow to verify their customers' identities, assess risk profiles, and monitor transactions. kyc is crucial for preventing financial crime, such as money laundering and terrorist financing, and ensuring compliance with anti money laundering (aml) and counter terrorism financing.

What Is Kyc Understanding Know Your Customer How It Works Youverify Kyc, short for know your customer, is a critical process that businesses employ to verify the identity of their clients. far from being a mere procedural step, kyc is integral in safeguarding. Know your customer (kyc) is the process financial institutions follow to verify their customers' identities, assess risk profiles, and monitor transactions. kyc is crucial for preventing financial crime, such as money laundering and terrorist financing, and ensuring compliance with anti money laundering (aml) and counter terrorism financing. Know your customer or kyc is an essential process for financial institutions, helping them verify their customers’ identity and assess the risks associated with them. in this beginner’s guide, we’ll delve into the world of kyc, its components, its importance, and various kyc regulations and solutions. financial crime is a serious issue. At its heart, kyc involves verifying current and prospective customers’ identities so you understand who you’re interacting with. you can think of it as doing a mini background check before doing business with a customer. note: a customer can be an individual or a business, though kyc for businesses is often called corporate kyc or know.

Comments are closed.