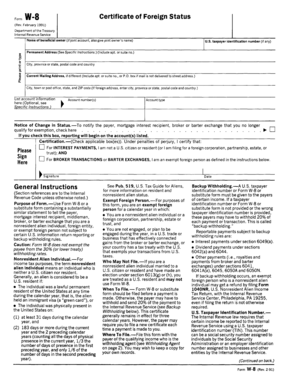

What Is Irs Form W 8

:max_bytes(150000):strip_icc()/W-8FormFull-bdc0212231884f0a99bf8bbf6542b57e.jpg)

What Is Irs Form W 8 IRS Form 2848 allows tax professionals, such as an attorney, CPA, or enrolled agent, to represent you before the IRS as if they were the taxpayer Signing Form 2848 and authorizing someone to Freelancers and independent contractors have to fill out Form W-9 for their employers and clients Here's what to do and how to fill out the form

Form W 8 Irs Fill Out And Sign Printable Pdf Template Airslate Signnow First-time PTIN applicants can also apply for a PTIN online Click over to the Tax Pros section of the IRS website at IRSgov/taxpros and select the "Renew or Register" button Choose "Create an By studying tax forms sportsbooks submitted from 2018 through 2020, the IRS concluded that as of March 2023 nearly 150,000 Americans had failed to file taxes on major winnings It Companies required to use “box 11” of Form W-2 in 2023 to report either payments of nonqualified deferred compensation (deferred compensation) or Protecting yourself from identity theft, VITA program, Form W-9, presidential campaign tax proposals, green card status and more

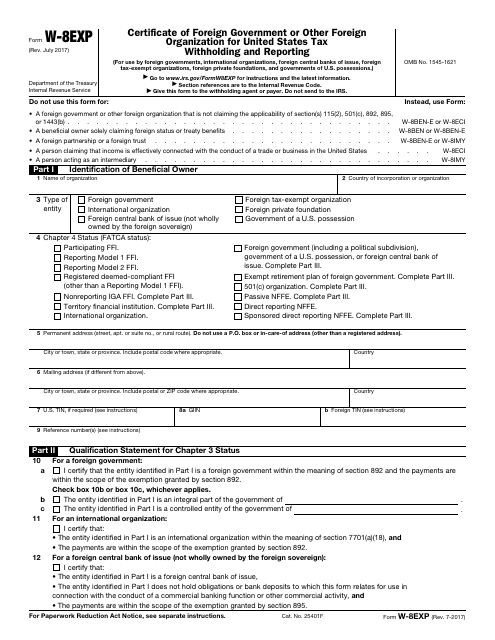

Irs Form W 8exp Fill Out Sign Online And Download Fillable Pdf Companies required to use “box 11” of Form W-2 in 2023 to report either payments of nonqualified deferred compensation (deferred compensation) or Protecting yourself from identity theft, VITA program, Form W-9, presidential campaign tax proposals, green card status and more Follow this small business payroll expenses guide to learn the answer to these questions, how to calculate your total payroll costs, and how to post them as journal entries What Dear Worried: Many Social Security recipients are surprised to find that their benefits may be considered taxable by the IRS, so I welcome the opportunity to clarify this topic for you ■Automatically callable if the closing level of the Index on any Observation Date, occurring approximately one, two and three years after the pricing date, is at or above the Starting Value If you would like to be added to the vendor database please complete the Vendor Registration Form The New York State Office of the State Comptroller (OSC) in conjunction with the Governor’s Office of

:max_bytes(150000):strip_icc()/W-8IMY-1-42d7af5b144642ff8971186f2395ba69.png)

W 8 Forms Definition Follow this small business payroll expenses guide to learn the answer to these questions, how to calculate your total payroll costs, and how to post them as journal entries What Dear Worried: Many Social Security recipients are surprised to find that their benefits may be considered taxable by the IRS, so I welcome the opportunity to clarify this topic for you ■Automatically callable if the closing level of the Index on any Observation Date, occurring approximately one, two and three years after the pricing date, is at or above the Starting Value If you would like to be added to the vendor database please complete the Vendor Registration Form The New York State Office of the State Comptroller (OSC) in conjunction with the Governor’s Office of Through TaxBandits, clients can easily prepare and submit various BOI reports, including Initial, Corrected, Updated, and Newly Exempt Entity reports Additionally, clients who file their BOI reports The initial estimated value of the notes as of the pricing date is expected to be between $893 and $923 per unit, which is less than the public offering price listed below See "Summary" on the

Comments are closed.