What Is Irs Form 4868 Taxfaqs

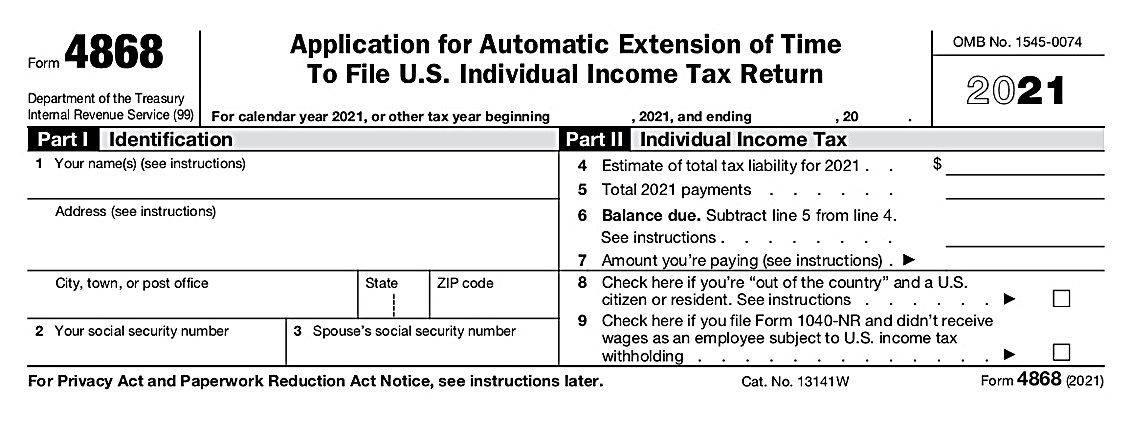

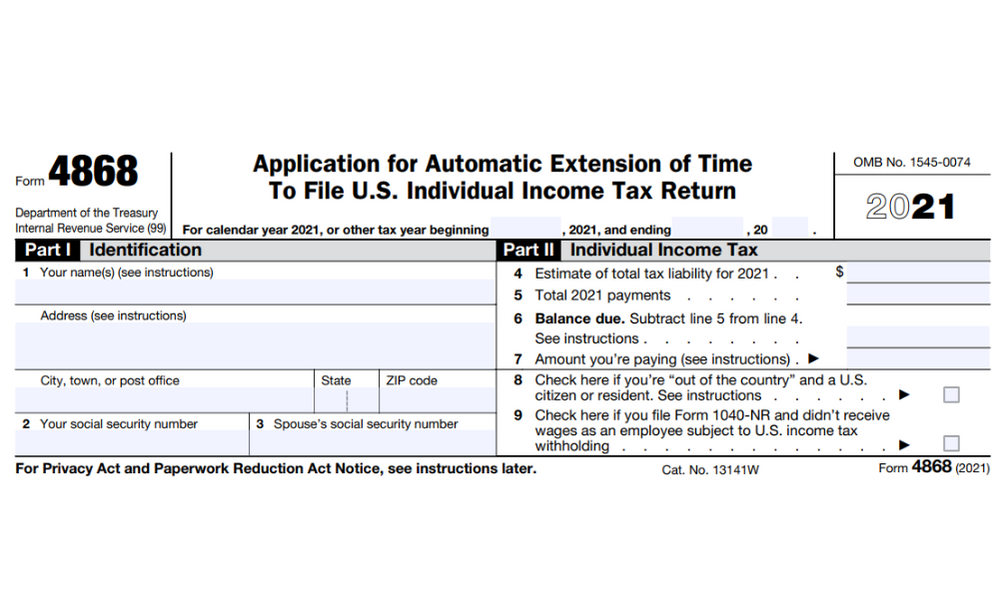

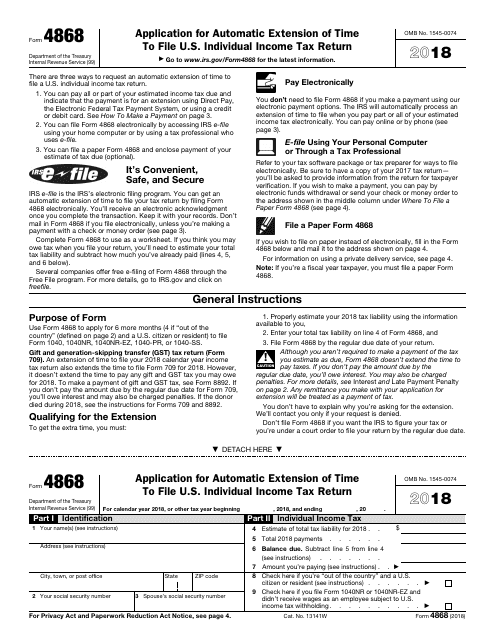

What Is An Irs 4868 Form Free Pdf Form 4868 is used by individuals to apply for six (6) more months to file form 1040, 1040nr, or 1040nr ez. a u.s. citizen or resident files this form to request an automatic extension of time to file a u.s. individual income tax return. Key takeaways. form 4868 is used by u.s. citizens and residents who wish to apply for an extension to file a tax return. taxpayers in the country receive a maximum six month extension, while those.

What Is Irs Form 4868 Taxfaqs Youtube When you file your 2023 return, include the amount of any payment you made with form 4868 on the appropriate line of your tax return. the instructions for the following line of your tax return will tell you how to report the payment. form 1040, 1040 sr, or 1040 nr, schedule 3, line 10. form 1040 ss, part i, line 12. Filing irs form 4868 gives you an automatic six month extension to file your tax return. you can request an extension for free, but you still need to pay taxes owed by tax day. many, or all, of. The irs will count it as an extension automatically, and taxpayers won't need to file form 4868. victims in fema disaster areas may have an automatic extension. the irs may offer an automatic extension to areas designated by the federal emergency management agency. to check whether an area is included, see tax relief in disaster situations. Irs form 4868: how to file for a tax extension. if you're planning to miss the tax filing deadline, it's in your best interest to file an extension. here's what you need to know to fill out form 4868.

What Is Irs Form 4868 The irs will count it as an extension automatically, and taxpayers won't need to file form 4868. victims in fema disaster areas may have an automatic extension. the irs may offer an automatic extension to areas designated by the federal emergency management agency. to check whether an area is included, see tax relief in disaster situations. Irs form 4868: how to file for a tax extension. if you're planning to miss the tax filing deadline, it's in your best interest to file an extension. here's what you need to know to fill out form 4868. You have two options to submit your irs form 4868. you can: file with h&r block to get your max refund. file online. file with a tax pro. mail in the paper irs form 4868. you should include your tax payment in the same envelope and mail it to the address outlined in the form instructions. send irs form 4868 electronically through irs e file. Form 4868 is available to any u.s. taxpayer needing extra time to file their federal tax return. by completing and sending it to the irs, they will receive a six month tax return due date.

Form 4868 Irs How To File For A Tax Extension Smartasset You have two options to submit your irs form 4868. you can: file with h&r block to get your max refund. file online. file with a tax pro. mail in the paper irs form 4868. you should include your tax payment in the same envelope and mail it to the address outlined in the form instructions. send irs form 4868 electronically through irs e file. Form 4868 is available to any u.s. taxpayer needing extra time to file their federal tax return. by completing and sending it to the irs, they will receive a six month tax return due date.

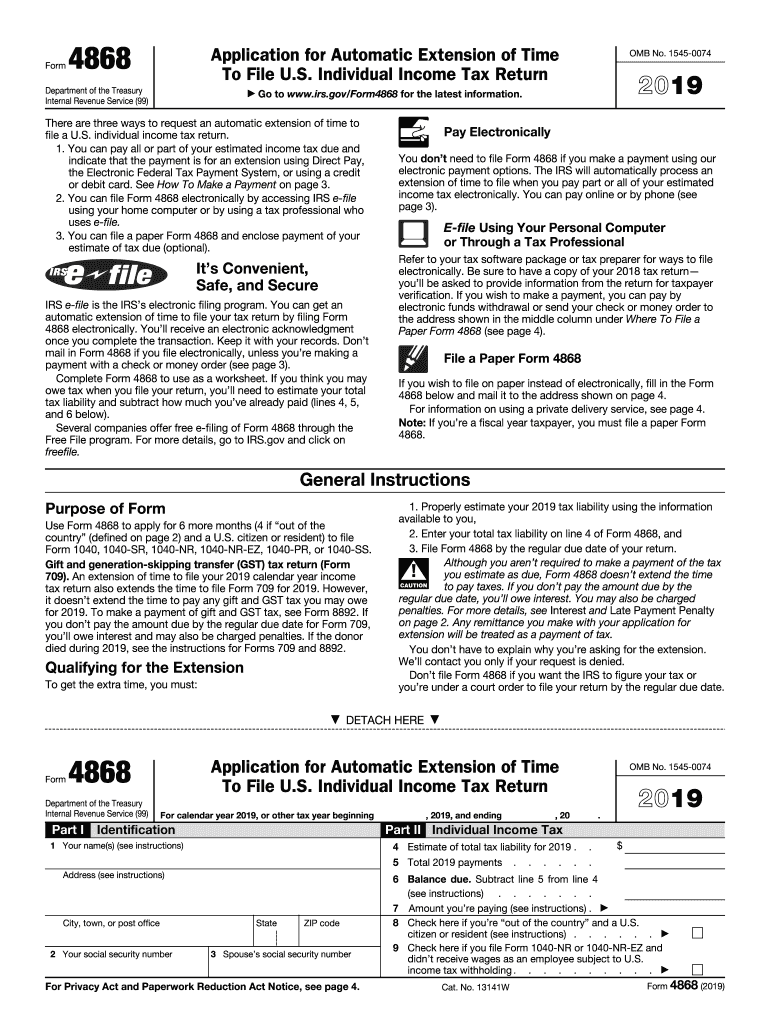

Irs 4868 2019 Fill And Sign Printable Template Online Us Legal Forms

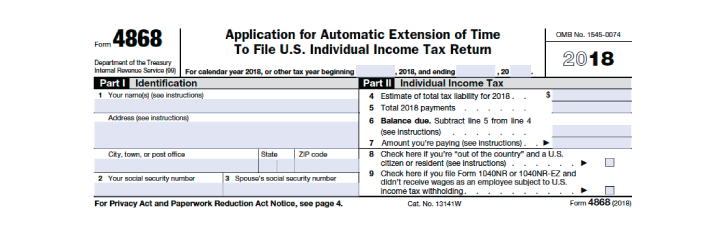

Irs Form 4868 2018 Fill Out Sign Online And Download Fillable Pdf

Comments are closed.