What Is Holding Open Banking Back All About Payments

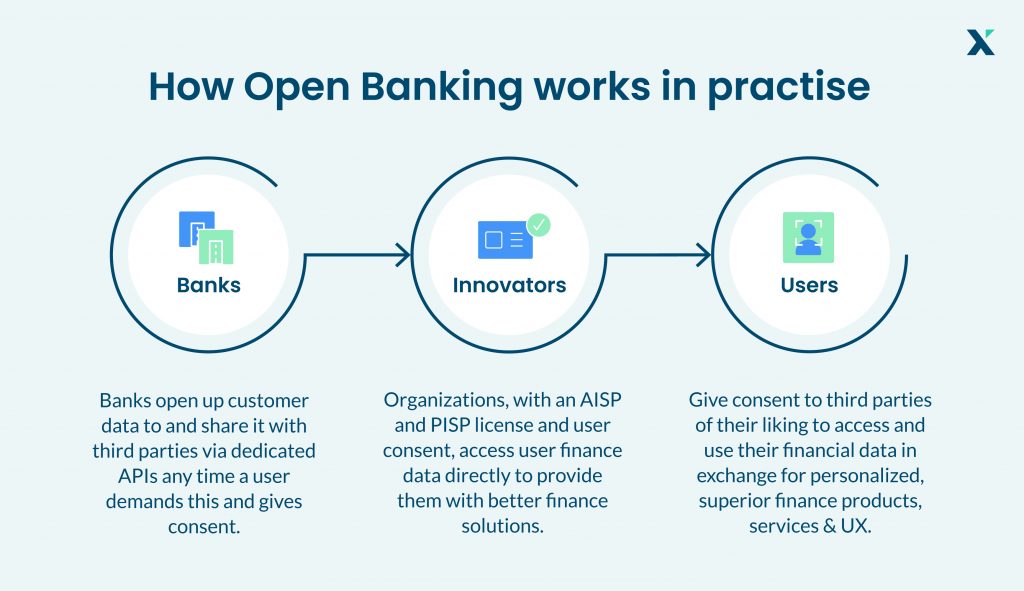

What Is Holding Open Banking Back All About Payments Youtube Here are some of the ways open banking is currently used: payment initiation services. retailers can initiate payments directly from a customer’s bank account, bypassing the need for a traditional payment gateway. this method could lead to faster settlements and reduced transaction fees. account aggregation. Open banking is helping fuel a revolution in financial services. it can provide people with more convenient ways to view and manage their money and simpler ways to access credit. open banking can also power different kinds of payment services, such as payments in video games or business accounting apps. the practice is already helping to widen.

Everything You Need To Know About Open Banking In the future, variable recurring payments apis may remove the need to fall back on these direct debits but for now it’s a pretty neat fit. for j.p. morgan, open banking is just one option, particularly from a payments perspective. we already process large volumes of direct debits, and in tandem are heavily invested in providing real time. Open banking is a secure way for providers access to your financial information in the uk. it was a result of psd2, but they are not the same thing. psd2 requires banks to open up access to customer data (and remember: it’s only shared with your consent), but open banking specifies a standard format for the process. Open banking allows you to share certain financial information that only you and your bank can see, such as your balance and transaction history, with other financial providers or services of your choosing. the idea is to make it easier for other organisations to use your data to personalise products or make suggestions on areas you can save. Payments: open banking is a faster and easier way of making an online bank transfer. for example, if you use wise , instead of going to your online banking in a separate window or on a different device, you can log into a secure page hosted by your bank and authorise a payment, without manually setting up a transfer.

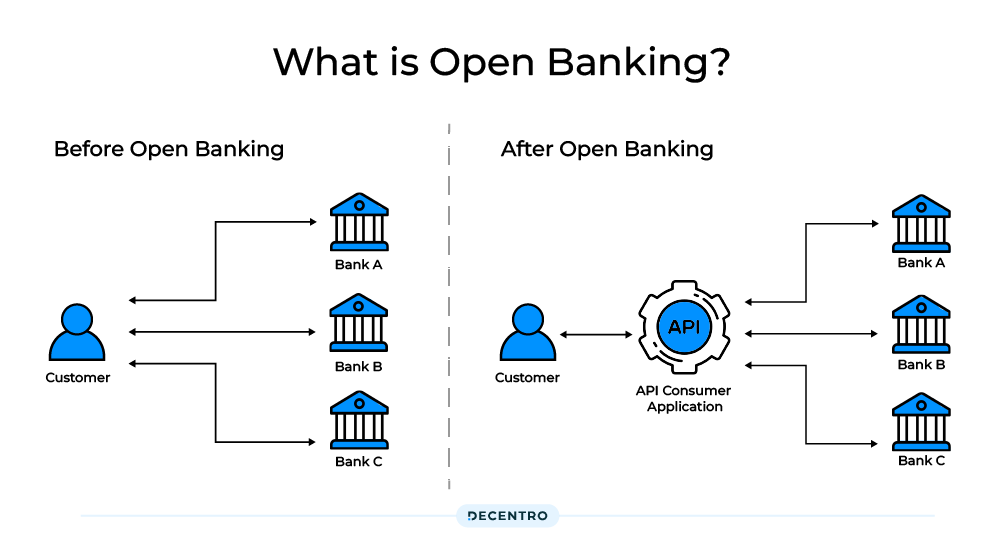

Open Banking What Is It And How Does It Work Decentro Open banking allows you to share certain financial information that only you and your bank can see, such as your balance and transaction history, with other financial providers or services of your choosing. the idea is to make it easier for other organisations to use your data to personalise products or make suggestions on areas you can save. Payments: open banking is a faster and easier way of making an online bank transfer. for example, if you use wise , instead of going to your online banking in a separate window or on a different device, you can log into a secure page hosted by your bank and authorise a payment, without manually setting up a transfer. In these markets, payment initiation service provider (pisp) open banking enables third parties to move money from a consumer’s account to a merchant’s account, usually via a real time rail. these a2a payments are typically for bill paying or e commerce but could migrate to the point of sale (pos) over time. A new type of payment called variable recurring payments (vrps), enabled by open banking, is providing a ‘smart’ alternative to traditional direct debits or keeping your card details on file with a merchant. in the case of vrps, you’ll still need to consent to the recurring payments being made from your account by the third party’s app.

Open Banking Examples Aisps Pisps Explained Mooncascade Blog In these markets, payment initiation service provider (pisp) open banking enables third parties to move money from a consumer’s account to a merchant’s account, usually via a real time rail. these a2a payments are typically for bill paying or e commerce but could migrate to the point of sale (pos) over time. A new type of payment called variable recurring payments (vrps), enabled by open banking, is providing a ‘smart’ alternative to traditional direct debits or keeping your card details on file with a merchant. in the case of vrps, you’ll still need to consent to the recurring payments being made from your account by the third party’s app.

Open Banking What Small Businesses Need To Know

Comments are closed.