What Is Gst What Are The Types Of Gst Basics Of Gst Lecture 1 By Ca Rachana Ranade

What Is Gst Chapter 1 Gst Basics Dear ca, here's a new way to manage your accounting practice #quickbooks ️ intuit.me inqarr. #03 introduction to gst | what is gst? basics of gst lecture, gstn | ca raj k agrawal gst playlist playlist?list=plyy2cccwylapom.

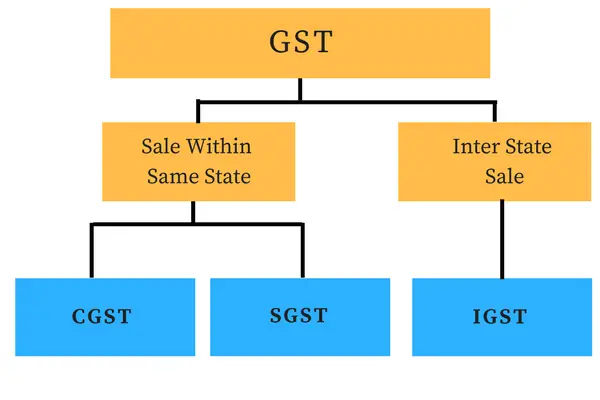

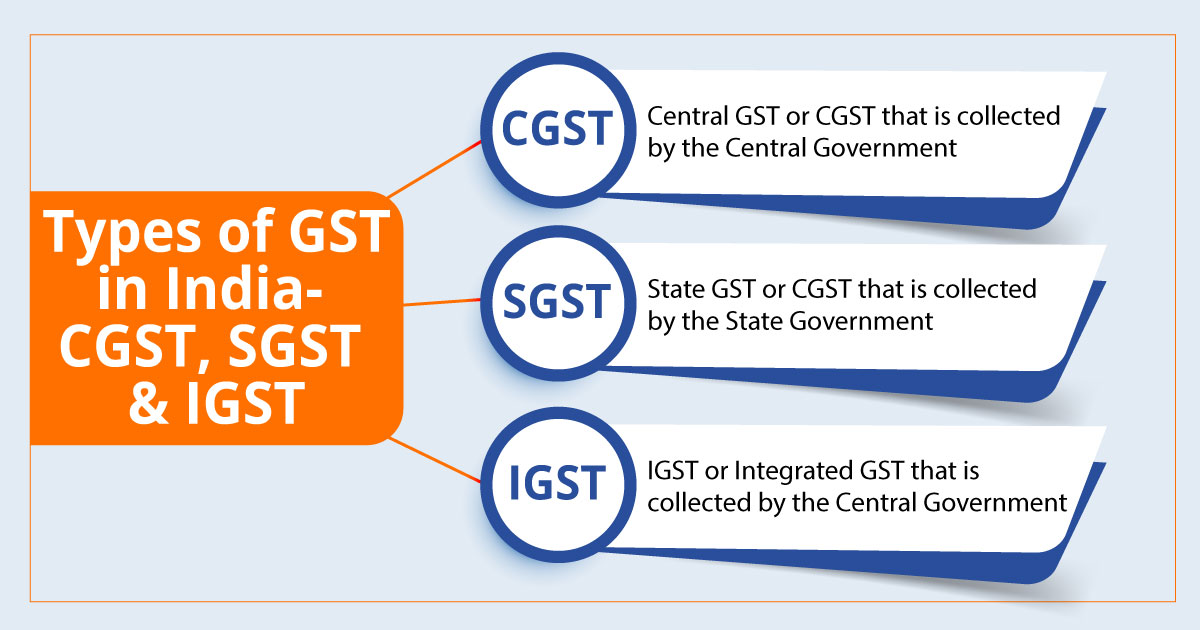

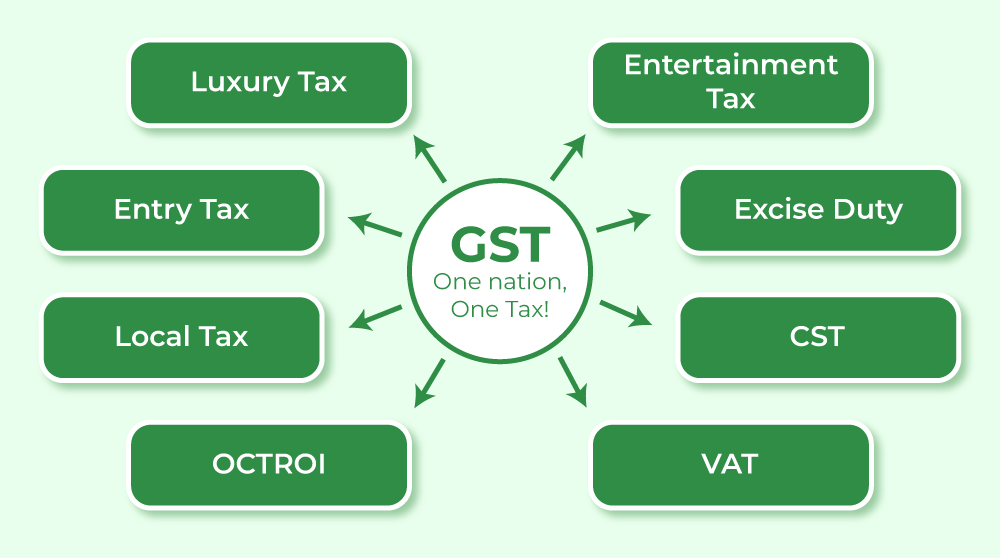

Basics Of Gst With Examples What are the types of gst? basics of gst lecture 1 by ca rachana ranade. basics of gst lecture 1 by ca rachana ranade. login. username * password * forgot password?. Vat in goods and services tax (gst) means the tax is imposed only on the value added at each stage of the supply chain. this ensures that the tax is not charged on the same value more than once and that the final customer bears the tax obligation. 3. input tax credit (itc) mechanism. Types, features, benefits, input tax credit, gst council. the goods and services tax or gst is a single, indirect tax that integrates all indirect taxes within the indian economy. the gst act was passed on 29th march 2017 in the parliament of india and came into effect on 1st july 2017. the idea behind it was to replace multiple layers of. Example. intra state (i.e. sale within the same state) cgst sgst. a dealer in delhi makes a sale to another dealer in delhi. gst rate is 18%, so cgst of 9% and sgst of 9% will be applicable. inter state (i.e sale outside state) igst. a dealer in mumbai makes a sale to a dealer in delhi. gst rate is 5%, so 5% igst will be applicable.

Gst Types Eligibility Latest Updates How To Calculate And More Types, features, benefits, input tax credit, gst council. the goods and services tax or gst is a single, indirect tax that integrates all indirect taxes within the indian economy. the gst act was passed on 29th march 2017 in the parliament of india and came into effect on 1st july 2017. the idea behind it was to replace multiple layers of. Example. intra state (i.e. sale within the same state) cgst sgst. a dealer in delhi makes a sale to another dealer in delhi. gst rate is 18%, so cgst of 9% and sgst of 9% will be applicable. inter state (i.e sale outside state) igst. a dealer in mumbai makes a sale to a dealer in delhi. gst rate is 5%, so 5% igst will be applicable. #2 introduction to gst | genesis of gst in india, types of gst, power to tax gst by ca raj k agrawal gst playlist playlist?list=pl. Key features and objectives of gst. 4.1. key features of gst: single tax: gst replaces multiple indirect taxes with a single comprehensive tax, simplifying the tax structure. value added tax: a value added tax levied at each stage of the supply chain, allowing for the credit of taxes paid on inputs.

Goods And Services Tax Gst Geeksforgeeks #2 introduction to gst | genesis of gst in india, types of gst, power to tax gst by ca raj k agrawal gst playlist playlist?list=pl. Key features and objectives of gst. 4.1. key features of gst: single tax: gst replaces multiple indirect taxes with a single comprehensive tax, simplifying the tax structure. value added tax: a value added tax levied at each stage of the supply chain, allowing for the credit of taxes paid on inputs.

Comments are closed.