What Is Earned Income And Why Its Important

What Is Earned Income And Why It S Important Youtube Gross income is all income an individual earns during the year both as a worker and as an investor. gross income is derived from income sources beyond those related to employment. earned income. Important aspects of your tax return depend on whether income is considered "earned" or "unearned." this video tells you how to spot the difference and why i.

Earned Income Advantages And Disadvantages Of Earned Income Earned income is any compensation that you receive from a job or self employment. it can include wages, tips, salaries, commissions, or bonuses. it is different from unearned income, which comes. Earned income is what you receive from actively working. it includes wages, salaries, and self employment income. unearned income is from anything other than work, unemployment, retirement, investments, etc. unearned includes investment type income such as taxable interest, ordinary dividends, and capital gains distributions. Earned income is the total taxable compensation (e.g., wages or salaries) an employee earns, or the net earnings a self employed individual earns, for work. both employees and self employed individuals receive earned income and pay taxes on that income. regular wages aren’t the only type of compensation that contributes to earned income. Why earned income is important . you must generally have earned income to make traditional ira or roth ira contributions. the exception is a spousal ira. you can contribute to this type of ira on behalf of a non working spouse if you have sufficient earned income to cover contributions to both.

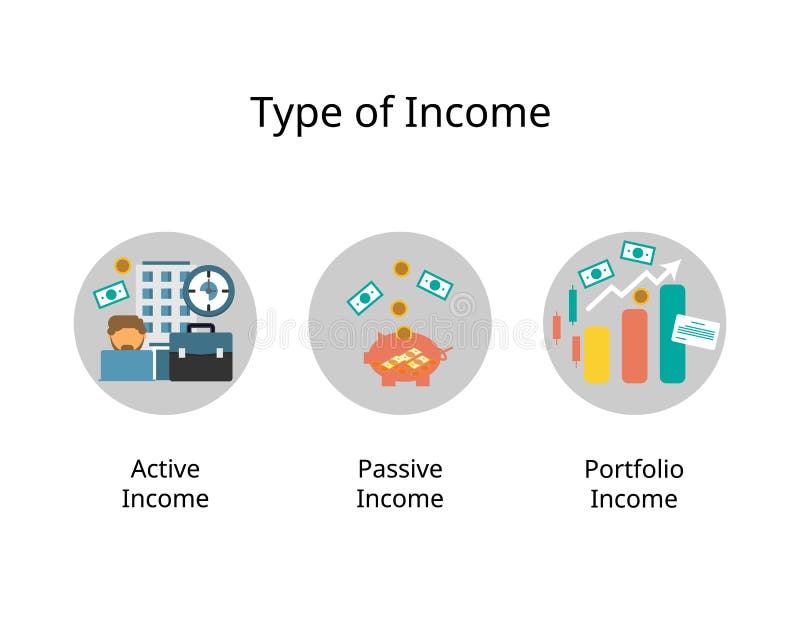

Three Of The Main Types Of Income Are Earned Income Passive Income And Earned income is the total taxable compensation (e.g., wages or salaries) an employee earns, or the net earnings a self employed individual earns, for work. both employees and self employed individuals receive earned income and pay taxes on that income. regular wages aren’t the only type of compensation that contributes to earned income. Why earned income is important . you must generally have earned income to make traditional ira or roth ira contributions. the exception is a spousal ira. you can contribute to this type of ira on behalf of a non working spouse if you have sufficient earned income to cover contributions to both. Earned income is also significant because it affects your eligibility for the earned income tax credit (eitc or eic). the eitc is an irs program that helps to alleviate tax liability for low and moderate income individuals. the eitc is also a refundable tax credit, which means that people with a higher tax credit than tax liability receive a. Earned income is money you make from working, such as salaries, wages, tips and professional fees. in contrast, unearned income is the money you receive without working. this includes dividends.

Why It S Important To Earn What You Re Worth Career Tips To Go Earned income is also significant because it affects your eligibility for the earned income tax credit (eitc or eic). the eitc is an irs program that helps to alleviate tax liability for low and moderate income individuals. the eitc is also a refundable tax credit, which means that people with a higher tax credit than tax liability receive a. Earned income is money you make from working, such as salaries, wages, tips and professional fees. in contrast, unearned income is the money you receive without working. this includes dividends.

Earned Income Advantages And Disadvantages Of Earned Income

Earned Income Definition What It Is And All You Must To Know

Comments are closed.