What Is Donut Hole In Medicare Insurance

Medicare Donut Hole How It Works And How To Get Out In the donut hole, a person pays for 25% of their medication costs out of pocket and receives discounts from drug manufacturers to cover the remaining costs. the insurance company will add up what. However, at some point, you may face a coverage gap called the “donut hole,” which is a temporary limit on what your part d plan will pay for your drugs for a specified period of time. read on.

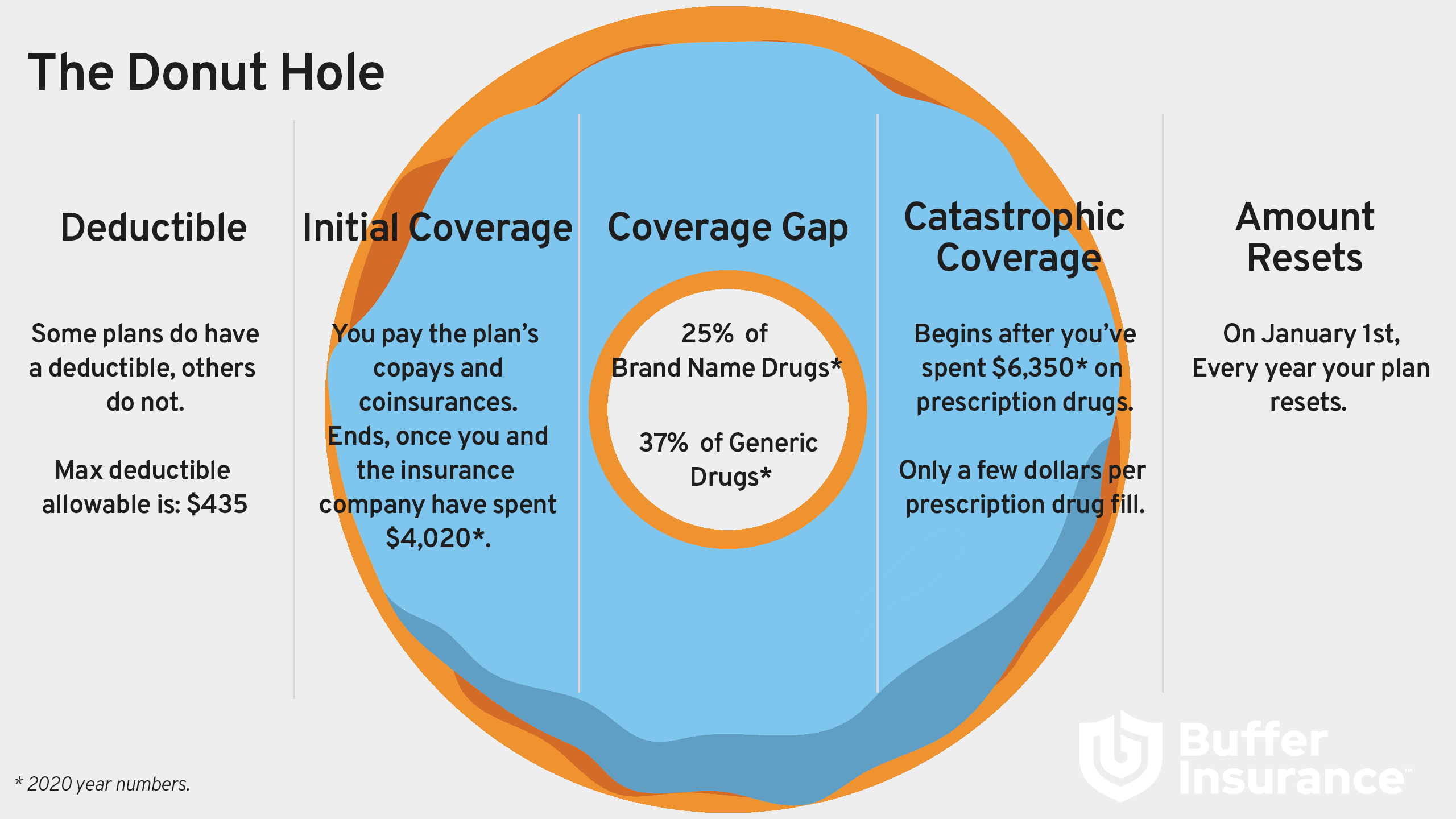

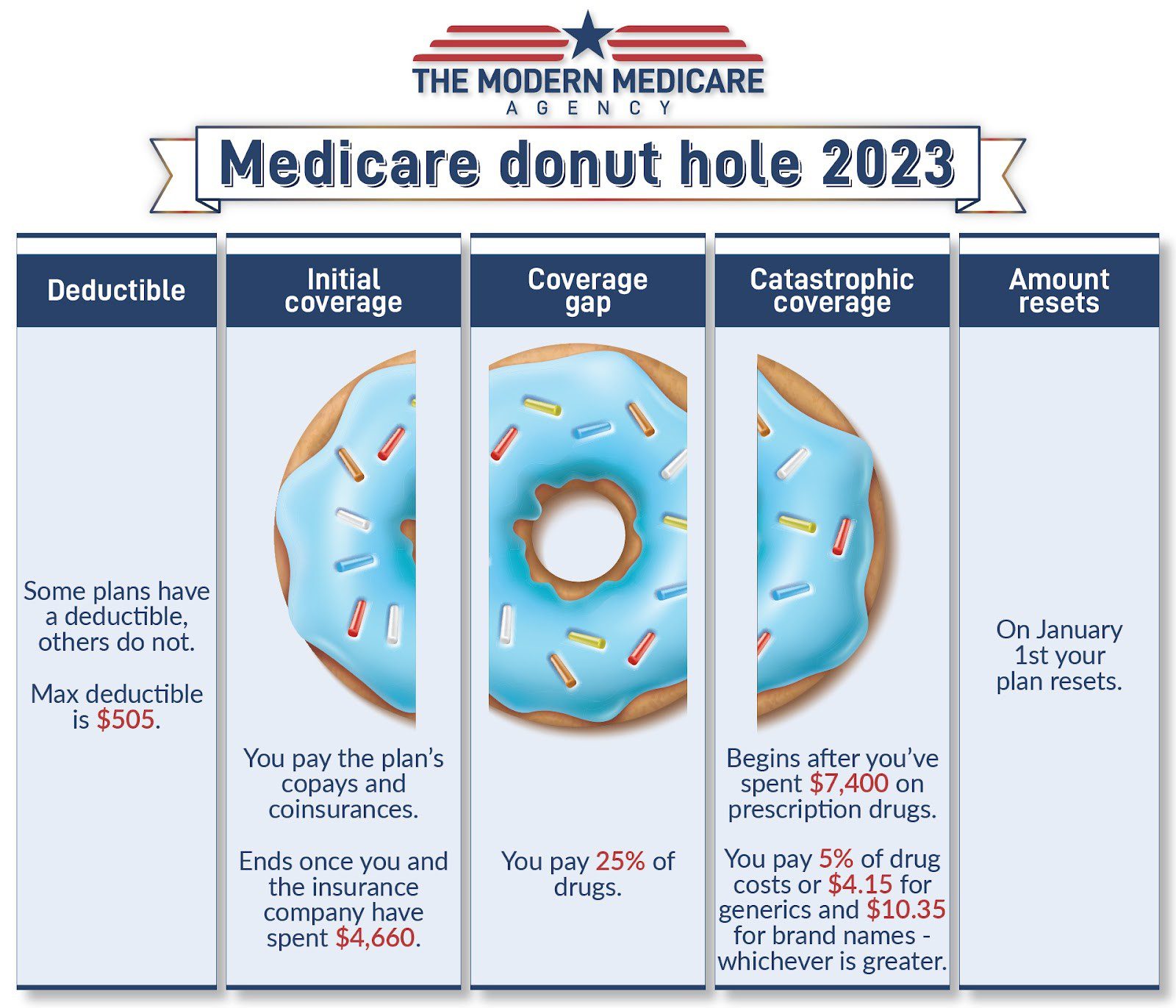

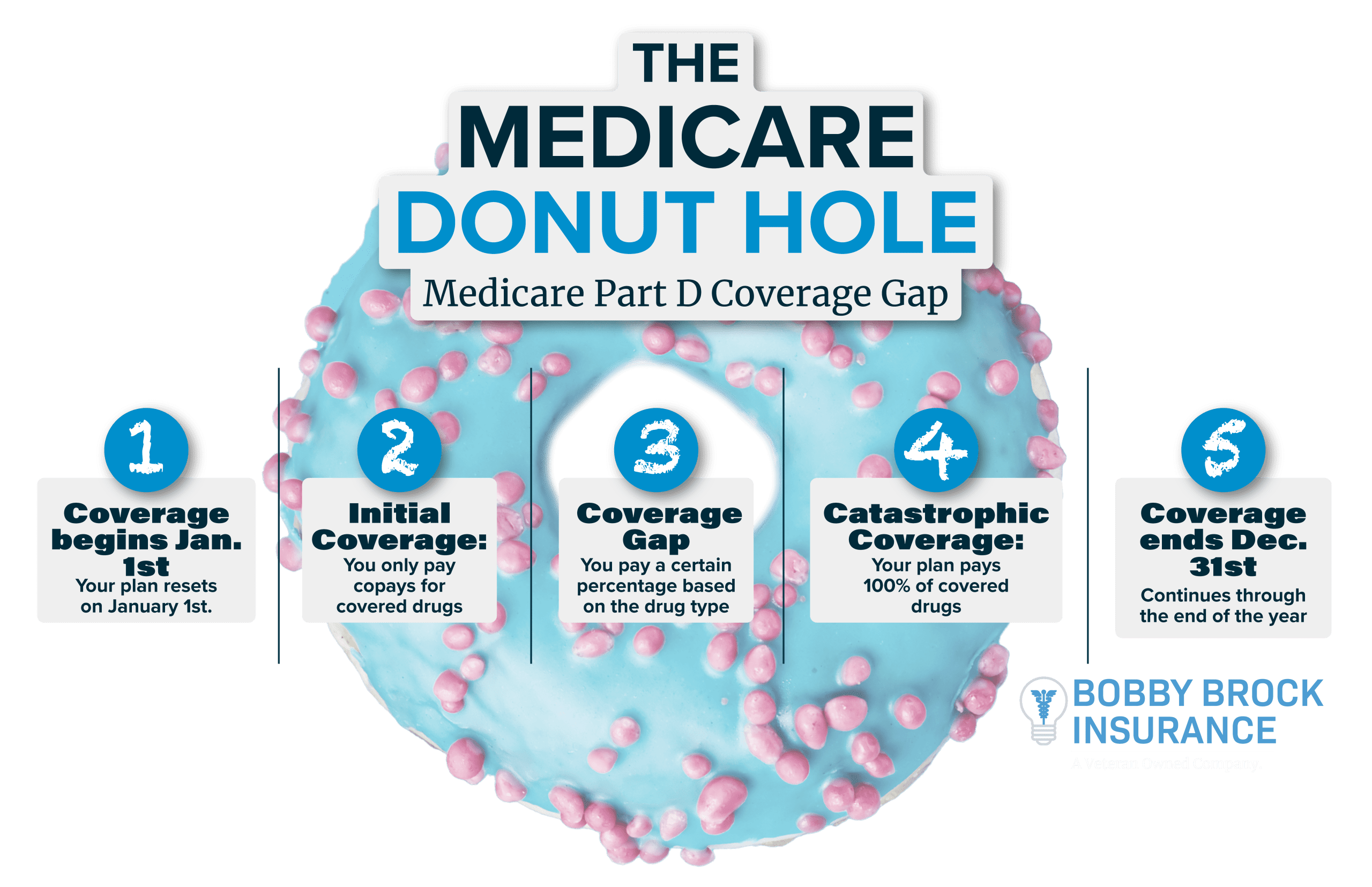

The Donut Hole Medicare Part D Buffer Benefits Through 2024, most medicare drug plans have a coverage gap (also called the "donut hole"). this means there's a temporary limit on what the drug plan will cover for drugs. because of the prescription drug law, the coverage gap ends on december 31, 2024. The medicare part d donut hole, or coverage gap, is one of four stages you may encounter during the year while a member of a part d prescription drug plan. specifically, the donut hole is the point in the year when your prescription benefits change because the total cost paid by you and the plan have reached the initial coverage limit. The donut hole, or coverage gap, has long been one of the most controversial parts of the medicare part d prescription drug benefit. it affects how much you will pay for your drugs over the course of the year. the good news is that the affordable care act (aca) closed the donut hole as of 2020, after several years of slowly shrinking it. What was the medicare donut hole? the medicare part d program was designed with a gap in coverage: before the aca, beneficiaries’ drug expenses (after the deductible) were covered up to a certain dollar amount (on standard plan designs, the beneficiary pays 25% of the cost during this phase), then not covered at all up to another amount, and then more robust coverage would kick in (the.

What Is A Donut Hole In Medicare The Modern Medicare Agency The donut hole, or coverage gap, has long been one of the most controversial parts of the medicare part d prescription drug benefit. it affects how much you will pay for your drugs over the course of the year. the good news is that the affordable care act (aca) closed the donut hole as of 2020, after several years of slowly shrinking it. What was the medicare donut hole? the medicare part d program was designed with a gap in coverage: before the aca, beneficiaries’ drug expenses (after the deductible) were covered up to a certain dollar amount (on standard plan designs, the beneficiary pays 25% of the cost during this phase), then not covered at all up to another amount, and then more robust coverage would kick in (the. The donut hole is the third of four phases or stages of medicare part d coverage. it comes after the deductible and initial coverage phases, but before catastrophic coverage. in the donut hole. The medicare donut hole is a coverage gap in plan d prescription coverage. you enter it after you’ve passed an initial coverage limit. in 2024, you’ll have to pay 25% oop from the time you.

The History Of The Medicare Donut Hole Bobby Brock Insurance The donut hole is the third of four phases or stages of medicare part d coverage. it comes after the deductible and initial coverage phases, but before catastrophic coverage. in the donut hole. The medicare donut hole is a coverage gap in plan d prescription coverage. you enter it after you’ve passed an initial coverage limit. in 2024, you’ll have to pay 25% oop from the time you.

Comments are closed.