What Is Credit Default Swap Cds Enterslice Pvt Ltd

What Is Credit Default Swap Cds Enterslice Pvt Ltd Credit default swaps (cds) are designed to cover a wide range of risks, including defaults, bankruptcies, and downgrades in credit ratings. three segments make up the credit swap market: single credit cds, multi credit cds, and cds index. aside from these advantages, cds offers access to bond liquidity, credit risk, foreign credit investment. A credit default swap (cds) is a type of derivative that transfers the credit exposure of fixed income products. in a credit default swap contract, the buyer pays an ongoing premium similar to the.

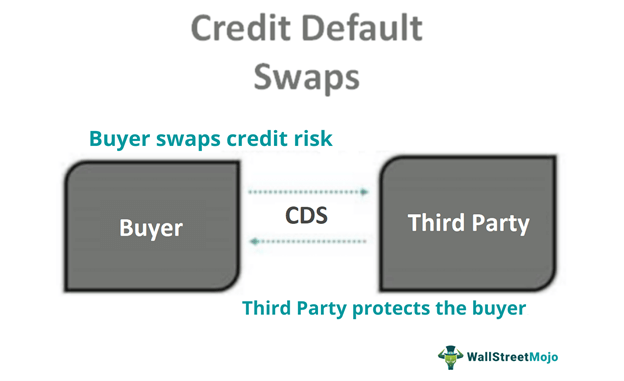

Credit Default Swap Definition And Meaning Market Business News Credit default swaps (cds) are widely used financial derivatives, or contracts, that give investors the ability to “swap” their credit risk with another investor. they’re a popular type of investment, especially for institutional investors. investors use cds for many types of credit investments, including mortgage backed securities, junk. Credit default swap. a credit default swap (cds) is a financial swap agreement that the seller of the cds will compensate the buyer in the event of a debt default (by the debtor) or other credit event. [1] that is, the seller of the cds insures the buyer against some reference asset defaulting. A credit default swap (cds) is a type of credit derivative that provides the buyer with protection against default and other risks. the buyer of a cds makes periodic payments to the seller until the credit maturity date. in the agreement, the seller commits that, if the debt issuer defaults, the seller will pay the buyer all premiums and. Credit default swaps (cds) are financial derivatives which transfer the risk of default to another party in exchange for fixed payments. cds can be thought of as a form of insurance for issuers of loans. a "credit default" is a default or inability to pay back a loan. the "swapping" takes place when an investor "swaps" their risk of net getting.

/TermDefinitions_Creditdefaultswap_finalv1-b682ce0e781d489db695637c6f884a82.png)

What Is A Credit Default Swap Cds And How Does It Work A credit default swap (cds) is a type of credit derivative that provides the buyer with protection against default and other risks. the buyer of a cds makes periodic payments to the seller until the credit maturity date. in the agreement, the seller commits that, if the debt issuer defaults, the seller will pay the buyer all premiums and. Credit default swaps (cds) are financial derivatives which transfer the risk of default to another party in exchange for fixed payments. cds can be thought of as a form of insurance for issuers of loans. a "credit default" is a default or inability to pay back a loan. the "swapping" takes place when an investor "swaps" their risk of net getting. In a credit default swap (cds), two counterparties exchange the risk of default associated with a loan (e.g. a bond or other fixed income security) for periodic income payments throughout the life of the loan. in the event that the borrowing party (the issuer) does default, the insuring counterparty agrees to pay the lender (bondholder) the par. A credit default swap (cds) is a contract that allows one party (an investor) to transfer some or all risk to a third party for a period of time. the investor who's buying the cds pays protection.

Credit Default Swap Cds Definition Example Pros Cons In a credit default swap (cds), two counterparties exchange the risk of default associated with a loan (e.g. a bond or other fixed income security) for periodic income payments throughout the life of the loan. in the event that the borrowing party (the issuer) does default, the insuring counterparty agrees to pay the lender (bondholder) the par. A credit default swap (cds) is a contract that allows one party (an investor) to transfer some or all risk to a third party for a period of time. the investor who's buying the cds pays protection.

What Is A Credit Default Swap Cds Meaning And How They Work Ig Uk

Comments are closed.