What Is Consumer Credit Counseling

Consumer Credit Counseling What It Is How It Works Credit counseling organizations can help you with money and debt management, budgeting, and credit reports. learn how to choose a reputable and certified credit counselor and avoid scams. Credit counseling is designed to help you create a game plan for managing your finances. this involves having a credit counselor look over your finances and use their expertise to help you create.

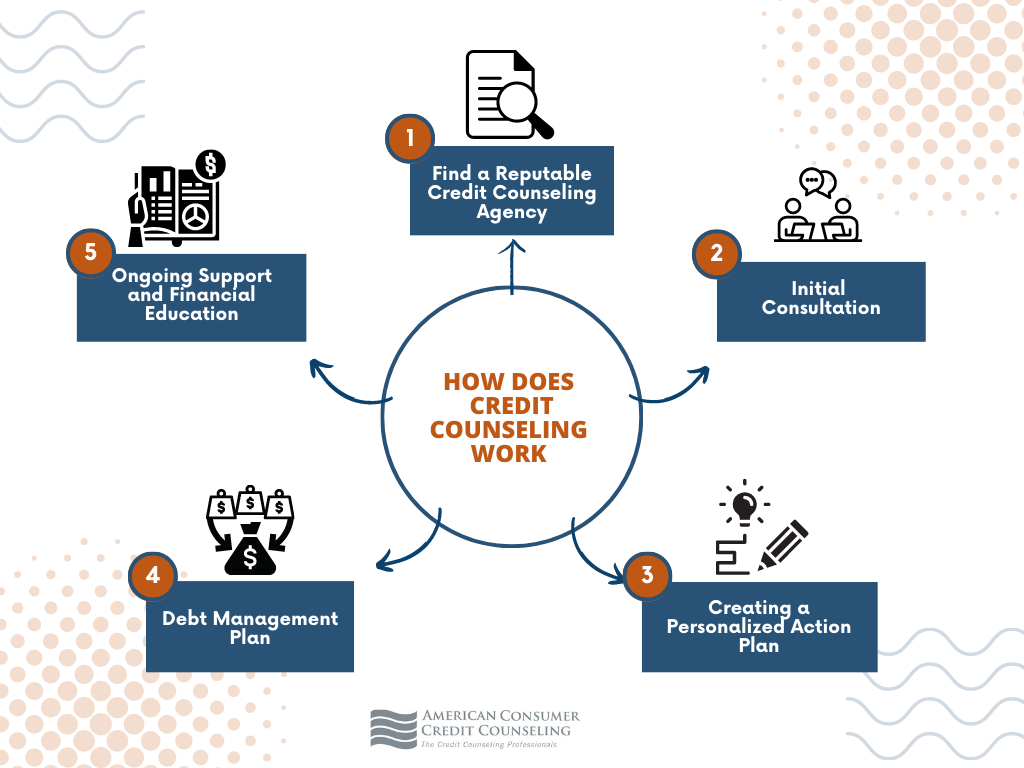

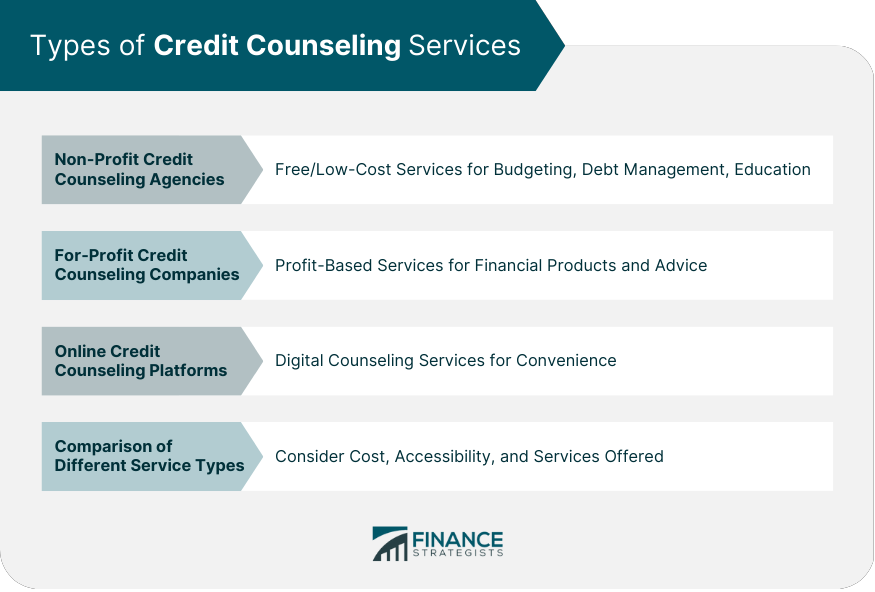

What Is Consumer Credit Counseling And Is It Right For You A certified consumer credit counselor can review your finances and credit, suggest solutions and connect you to unique resources. their counseling services are available in person or over the phone, and appointments typically last 30 minutes to an hour. during your session, an nfcc certified counselor can offer professional advice on the. Services available at credit counseling agencies. the five main services available from credit counseling agencies are: general budgeting: a free initial session, typically an hour long, explores. Credit counseling helps consumers with consumer credit, money management, debt management, and budgeting. one purpose of credit counseling is to help a debtor avoid bankruptcy if they are. Credit counseling is a way to help those overwhelmed by debt or unable to manage their expenses. in credit counseling, you’ll work with a credit counselor to review your finances and find out.

What Happens During Consumer Credit Counseling Credit counseling helps consumers with consumer credit, money management, debt management, and budgeting. one purpose of credit counseling is to help a debtor avoid bankruptcy if they are. Credit counseling is a way to help those overwhelmed by debt or unable to manage their expenses. in credit counseling, you’ll work with a credit counselor to review your finances and find out. Under a debt management plan or debt management program, the credit counseling agency works with you and your creditors on a financial plan. you deposit money with the credit counseling organization each month, and the organization uses your deposits to pay your creditors on schedule. but it’s important to note that a debt management plan isn. Credit counseling organizations offer a range of services, classes and programs around topics like bankruptcy, credit card debt, mortgages and reverse mortgages, foreclosure prevention, student.

Credit Counseling Meaning Types Process Agency Selection Under a debt management plan or debt management program, the credit counseling agency works with you and your creditors on a financial plan. you deposit money with the credit counseling organization each month, and the organization uses your deposits to pay your creditors on schedule. but it’s important to note that a debt management plan isn. Credit counseling organizations offer a range of services, classes and programs around topics like bankruptcy, credit card debt, mortgages and reverse mortgages, foreclosure prevention, student.

Consumer Credit Counseling Everything You Need To Know

Comments are closed.