What Is Chexsystems Are You Blacklisted Unchex

What Is Chexsystems Are You Blacklisted Unchex The chexsystems score system is based on defining a risk level. scores range from 100 to 899. the higher your score, the better, since this means that you have a low risk profile. this score is not sugar level, so you shouldn’t pay too much attention to it if everything goes ok. Call 800 513 7125 and speak to a representative. this is the best choice if you don’t have supporting documents. also, it makes sense to call if you want to make a dispute involving identity theft or fraud. online. go to the chexsystems dispute center and submit your information.

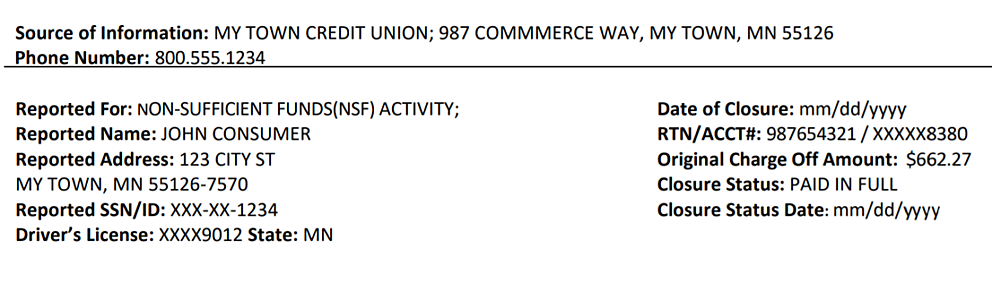

What Is Chexsystems Are You Blacklisted Unchex Chexsystems is the largest consumer reporting agency in the united states used by banks, credit unions, and other financial institutions to track customers when they apply for a bank account. it was created back in 1971 and has become a go to service for about 80% of financial institutions across the country. Chexsystems is a specialty consumer reporting agency that tracks consumers’ deposit and debit history, similar to a credit bureau. overdraft fees are a major contributor to negative reports on. If you’ve been blacklisted by chexsystems for a negative banking history, there are second chance or safe bank account options available. –bankrate’s rené bennett contributed to this article. Chexsystems is a reporting agency that banks use to track people who have had issues with their bank account. chexsystems retains consumer records for up to five years. second chance checking.

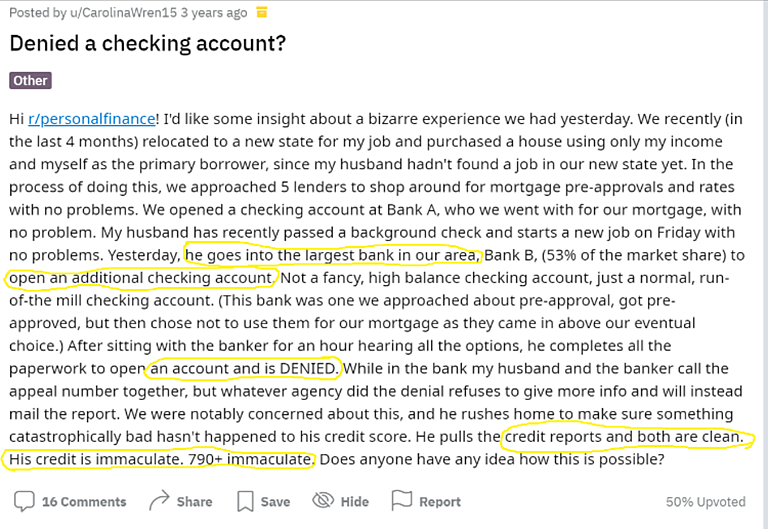

What Is Chexsystems Are You Blacklisted Unchex If you’ve been blacklisted by chexsystems for a negative banking history, there are second chance or safe bank account options available. –bankrate’s rené bennett contributed to this article. Chexsystems is a reporting agency that banks use to track people who have had issues with their bank account. chexsystems retains consumer records for up to five years. second chance checking. Chexsystems assigns each person a consumer score based on how risky they are to open a bank account. the chexsystems score ranges from 100 to 899, with a higher score indicating lower risk. you. You probably know that a poor credit score can lead to being denied credit, but you might not be aware of another consumer report that can prevent you from even opening a checking account. it’s called a chexsystems consumer report, and getting blacklisted by this reporting agency can create a big obstacle to getting your finances back on track.

Comments are closed.