What Is Cap Rate In Real Estate

The Beginner S Guide To The Cap Rate Calculation In Real Estate Mashvisor Learn how to calculate the cap rate, a measure of the rate of return on a real estate investment property. find out what factors affect the cap rate and how it compares different properties in the market. Learn what a cap rate is, how to calculate it and why it is important for real estate investors. a cap rate is a benchmark to estimate the return on investment for a property based on its net operating income and market value.

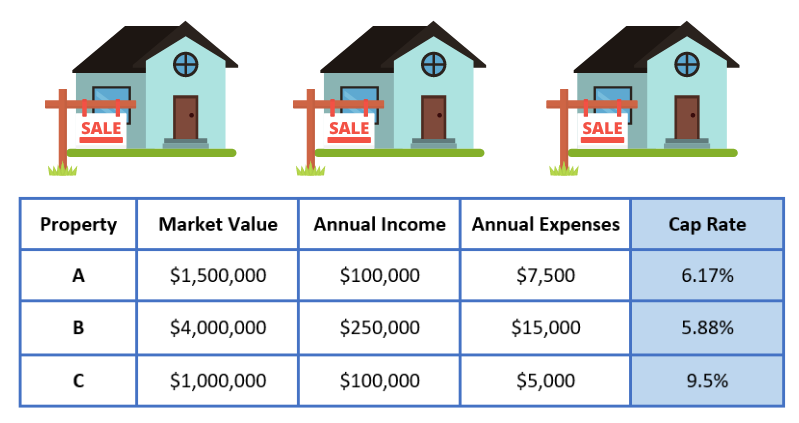

What Is Cap Rate In Real Estate Cap rate is the ratio of a property's net income to its purchase price. it helps you gauge the rental income potential and the risk of an investment. learn how to calculate cap rate and see examples of different cap rates. Cap rate is a metric to estimate the return on investment in commercial real estate, similar to pe ratio for stocks. it compares a property's net operating income to its value and varies by property type, quality, and market. Cap rates are a common metric for assessing the yield and risk of commercial properties. learn how cap rates are calculated, influenced by interest rates, rent growth, economic factors and more. Learn what a cap rate is in real estate, how to calculate it, and why it matters for investment decisions. a cap rate tells you the potential return and risk of a property based on its net operating income and purchase price.

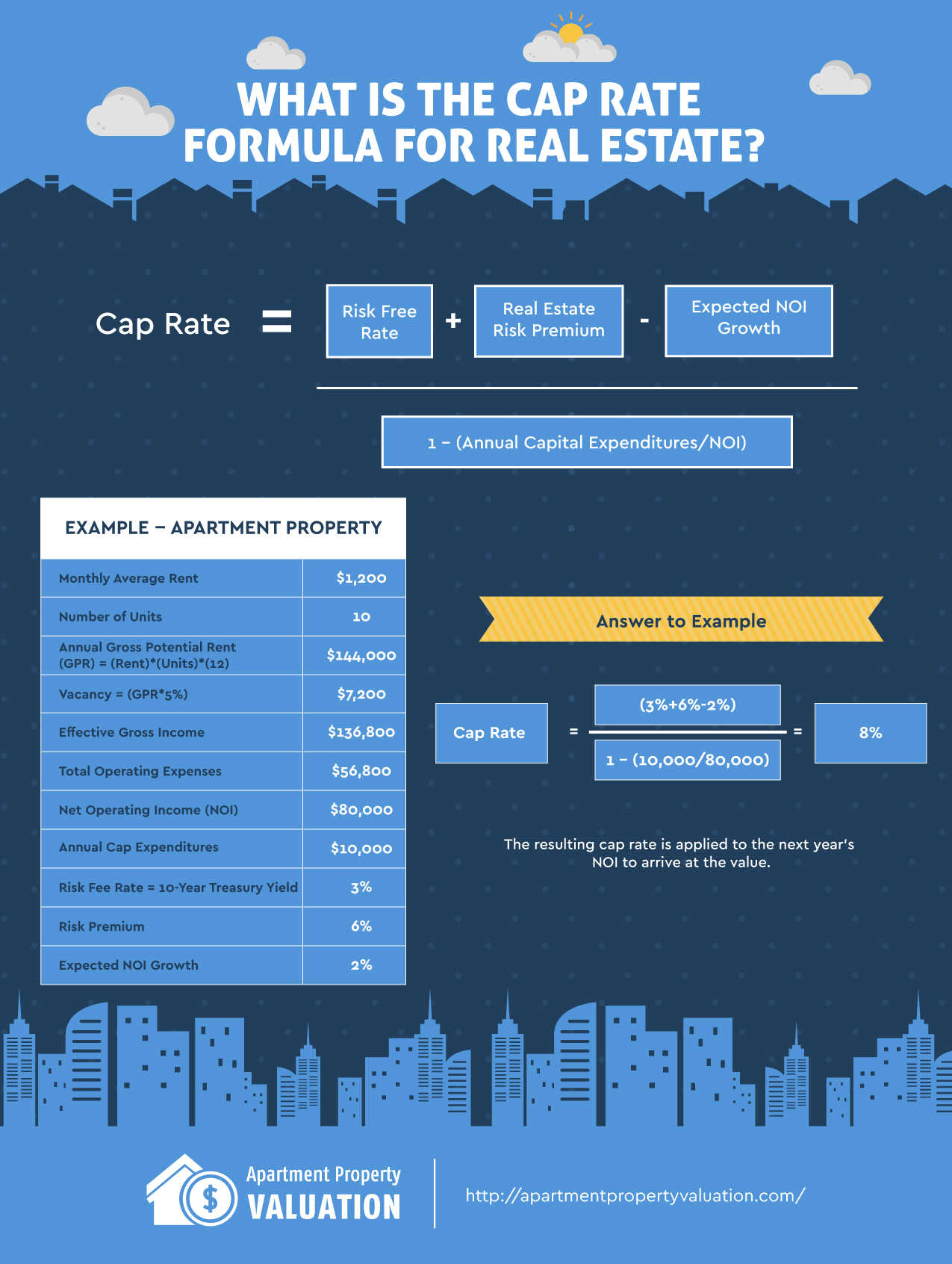

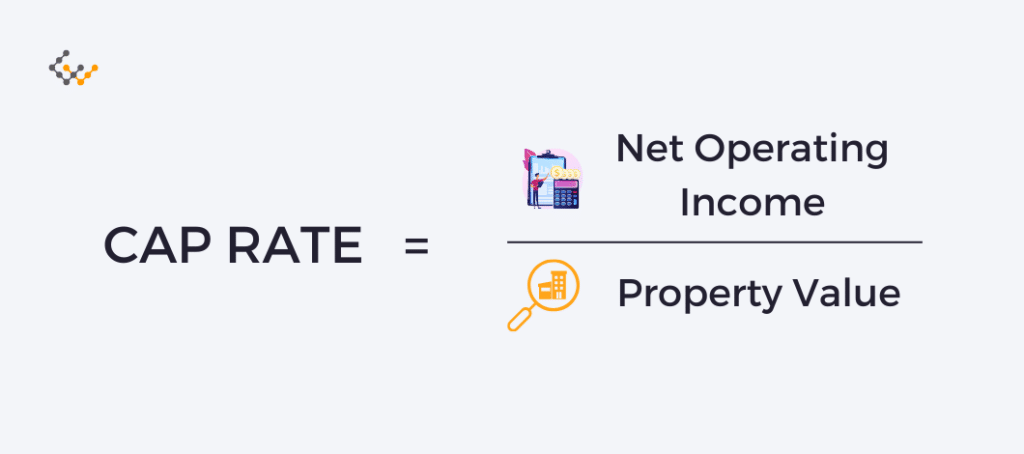

What Is Cap Rate And How To Calculate It Infographic What Is Cap Cap rates are a common metric for assessing the yield and risk of commercial properties. learn how cap rates are calculated, influenced by interest rates, rent growth, economic factors and more. Learn what a cap rate is in real estate, how to calculate it, and why it matters for investment decisions. a cap rate tells you the potential return and risk of a property based on its net operating income and purchase price. Cap rate summary. the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. the formula for the capitalization rate is calculated as net operating income divided by the current market value of the asset. the capitalization rate can be used to determine the riskiness of an investment. Learn how to calculate and interpret the cap rate, a measure of the expected rate of return on a real estate investment. the cap rate formula divides the net operating income (noi) by the market value of a property, and reflects the income potential and risk of the investment.

Cap Rate Formula For Real Estate Apartment Property Valuation Cap rate summary. the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. the formula for the capitalization rate is calculated as net operating income divided by the current market value of the asset. the capitalization rate can be used to determine the riskiness of an investment. Learn how to calculate and interpret the cap rate, a measure of the expected rate of return on a real estate investment. the cap rate formula divides the net operating income (noi) by the market value of a property, and reflects the income potential and risk of the investment.

What Are Cap Rates In Commercial Real Estate Commloan

Comments are closed.