What Is Cap Rate And How To Calculate It

Understanding And Calculating Cap Rate For Rental Properties Cap rate example. calculating the cap rate is relatively simple if you have the property’s net operating income (noi). remember to calculate noi, subtract all expenses related to the property, excluding mortgage interest, depreciation, and amortization, from the property’s income. to explain this, let’s use a simple example. For instance, say the net operating income of a property is $50,000, and it is expected to rise by 2% annually. if the investor’s expected rate of return is 10% per annum, then the net cap rate.

The Beginner S Guide To The Cap Rate Calculation In Real Estate Mashvisor To calculate the market value of your property, you simply have to divide the net income by the cap rate: $33,600 9.7% = $33,600 0.097 = $346,392. this result is the value of your property. of course, consider this as a rule of thumb – there might be other reasons for increasing or lowering the selling price. The formula for the cap rate or capitalization rate is straightforward. one may calculate by dividing the net operating income by the asset’s current market value and percentage. investors use it to evaluate real estate investment based on one year’s return and to help decide whether a property is a good deal. The formula for cap rate is: cap rate = net operating income (noi) ∕ current market value × 100. let’s walk through an example to better illustrate how to use this formula. 1. calculate the property’s net operating income. first, you’ll need to learn how to calculate the net operating income (noi). the noi is essentially the sum of a. To calculate cap rate, you take the net operating income (noi) of the property and divide that number by its value. to get the final percentage, multiply by one hundred. the net operating income is a measure of how much income a property is able to generate. it’s a pre tax figure that accounts for maintenance and other operational costs.

Cap Rate Formula Rate Step By Step Cap Rate Calculation The formula for cap rate is: cap rate = net operating income (noi) ∕ current market value × 100. let’s walk through an example to better illustrate how to use this formula. 1. calculate the property’s net operating income. first, you’ll need to learn how to calculate the net operating income (noi). the noi is essentially the sum of a. To calculate cap rate, you take the net operating income (noi) of the property and divide that number by its value. to get the final percentage, multiply by one hundred. the net operating income is a measure of how much income a property is able to generate. it’s a pre tax figure that accounts for maintenance and other operational costs. Cap rate summary. the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. the formula for the capitalization rate is calculated as net operating income divided by the current market value of the asset. the capitalization rate can be used to determine the riskiness of an investment. It is the percentage return of the function between annual cash flows and asset market value. it is expressed as: capitalization rate = net operating income current market value. for example, a property with a $1 million current market value and $100,000 in annual net operating income would have a 10% cap rate.

How To Figure Cap Rate 6 Steps With Pictures Wikihow Cap rate summary. the capitalization rate is a profitability metric used to determine the return on investment of a real estate property. the formula for the capitalization rate is calculated as net operating income divided by the current market value of the asset. the capitalization rate can be used to determine the riskiness of an investment. It is the percentage return of the function between annual cash flows and asset market value. it is expressed as: capitalization rate = net operating income current market value. for example, a property with a $1 million current market value and $100,000 in annual net operating income would have a 10% cap rate.

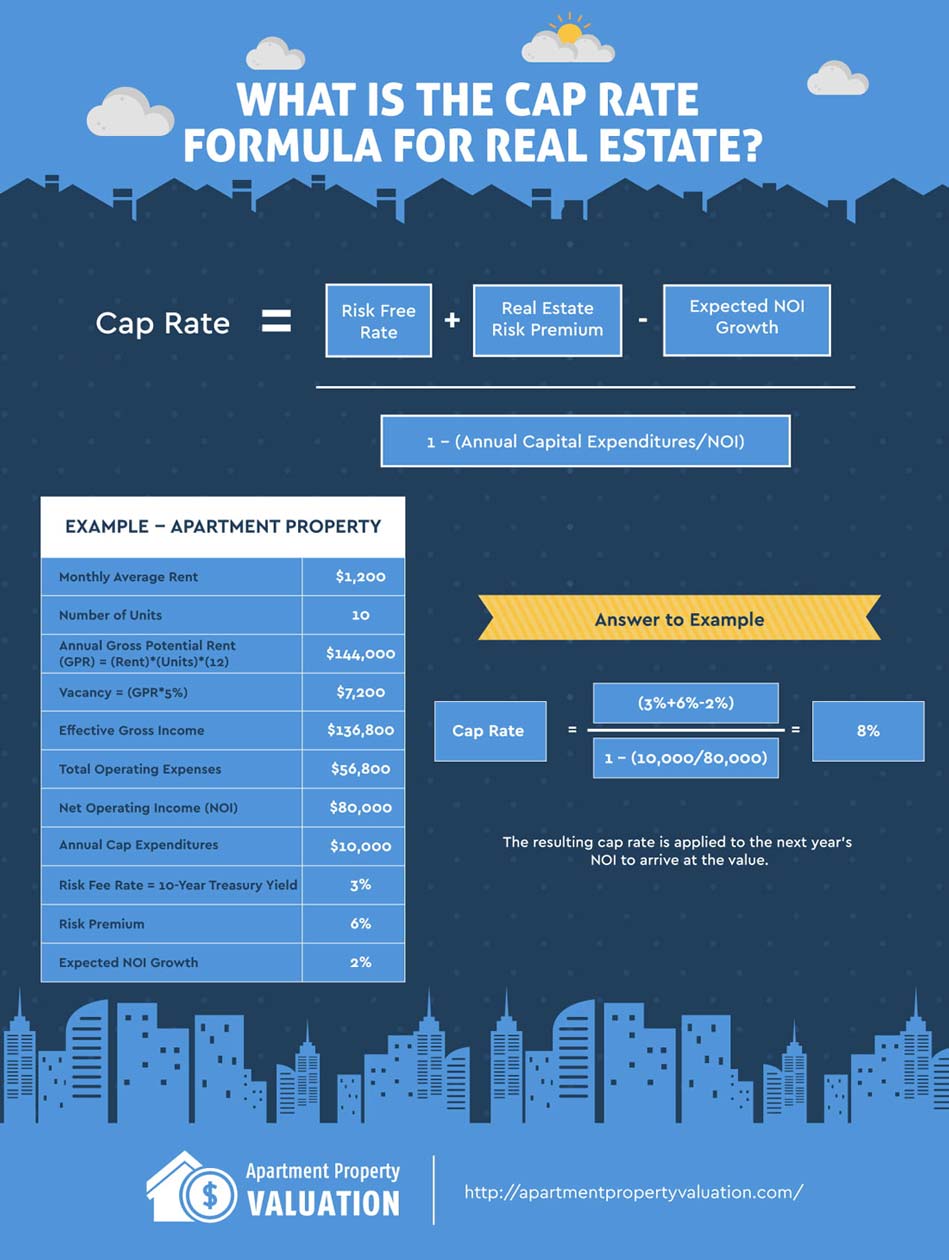

What Is Cap Rate And How To Calculate It Infographic What Is Cap

What Is A Cap Rate Apartment Property Valuation

Comments are closed.