What Is Aum Assets Under Management In Finance

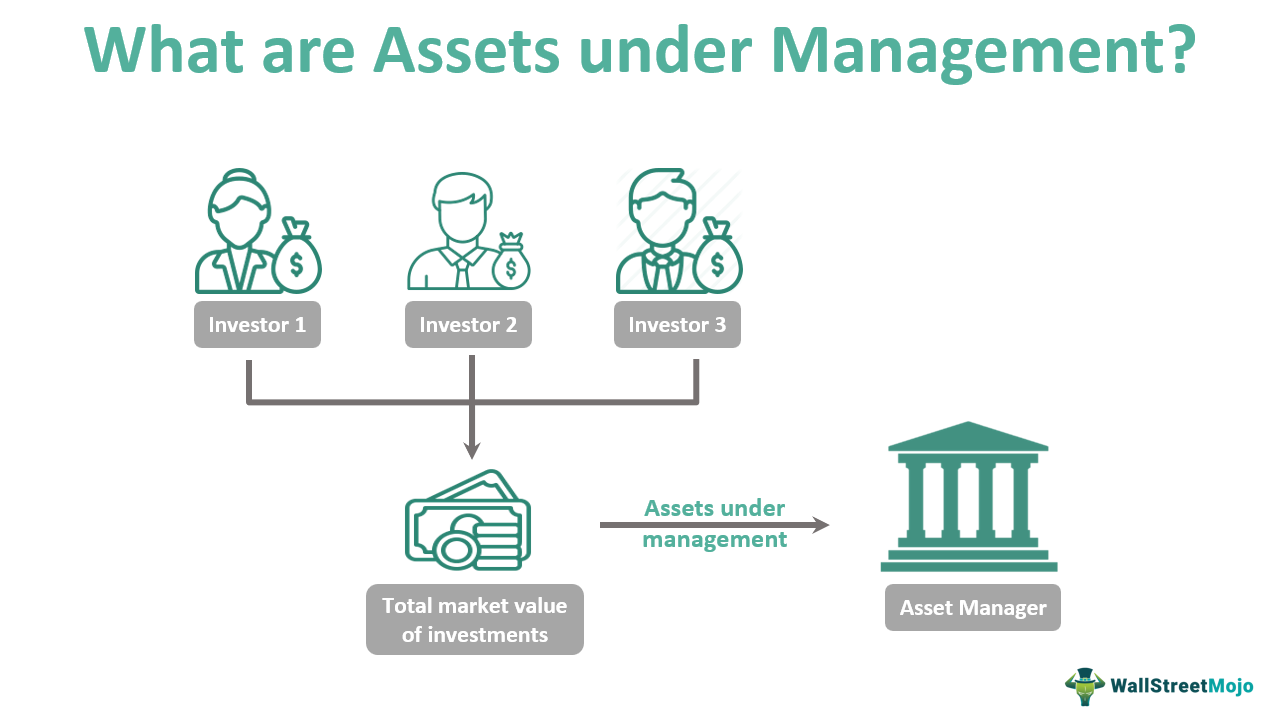

Assets Under Management Aum Meaning Calculation Example Assets under management (aum) is the total market value of the investments that a person (portfolio manager) or entity (investment company, financial institution) handles on behalf of investors. Assets under management measures the market value of the investments managed by a particular firm or fund. for example, a wealth management firm may have $2 billion in aum, which means they manage.

What Are Assets Under Management Aum The Motley Fool Aum is an acronym that stands for assets under management. assets under management (aum) is defined as the total amount of assets under the oversight of a particular asset management company, such as a mutual fund. some institutions only count discretionary funds, meaning funds that investors give for investment purposes, while other. Financial advisors, brokers, and mutual funds are often measured by their assets under management (aum). here's what that means, and why it matters. Assets under management (aum) are the financial assets a person or entity manages for their clients. aum is a key performance metric for many companies in the financial sector. The total value of the fund’s assets under management will be $6b. why assets under management are calculated. the total value of aum is a measure of the size of a financial institution and a key performance indicator of success, as a larger aum generally translates into larger revenue in the form of management fees.

Assets Under Management Aum Definition Finance Strategists Assets under management (aum) are the financial assets a person or entity manages for their clients. aum is a key performance metric for many companies in the financial sector. The total value of the fund’s assets under management will be $6b. why assets under management are calculated. the total value of aum is a measure of the size of a financial institution and a key performance indicator of success, as a larger aum generally translates into larger revenue in the form of management fees. Second, many asset management companies charge management fees that are equal to a fixed percentage of aum, making it especially important for investors to understand how the firm calculates aum. assets under management (aum) refers to the total market value of investments managed by a mutual fund, money management firm, hedge fund, portfolio…. Assets under management (aum), also referred to as funds under management, is the aggregate market value of all the investments managed by a financial institution. it is an important financial metric studied by investors before choosing their fund management institution. it also helps in the calculation of management fees.

Aum Assets Under Management Meaning Calculation Importance Second, many asset management companies charge management fees that are equal to a fixed percentage of aum, making it especially important for investors to understand how the firm calculates aum. assets under management (aum) refers to the total market value of investments managed by a mutual fund, money management firm, hedge fund, portfolio…. Assets under management (aum), also referred to as funds under management, is the aggregate market value of all the investments managed by a financial institution. it is an important financial metric studied by investors before choosing their fund management institution. it also helps in the calculation of management fees.

What Is Aum Assets Under Management Helpful Animation Video Your

Comments are closed.