What Is A Pension Financial Terms

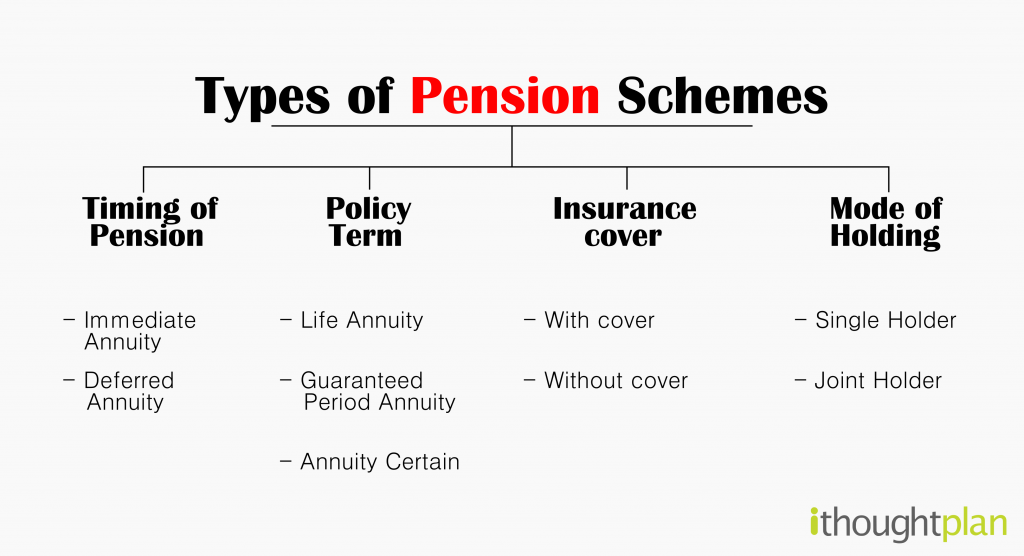

Types Of Pension Plans Ithought Plan S Blog On Pension Schemes A defined benefit pension plan guarantees a set monthly payment for life or a lump sum payment at retirement. a defined contribution plan, such as a 401 (k), is an investment account that is. Payments at retirement. pensions are often paid monthly for the rest of the retiree’s life or in a lump sum upon retirement. in most cases, pension income is calculated as a proportion of an employee’s earnings throughout his working years. this proportion is determined by the employer’s terms and the employee’s length of service.

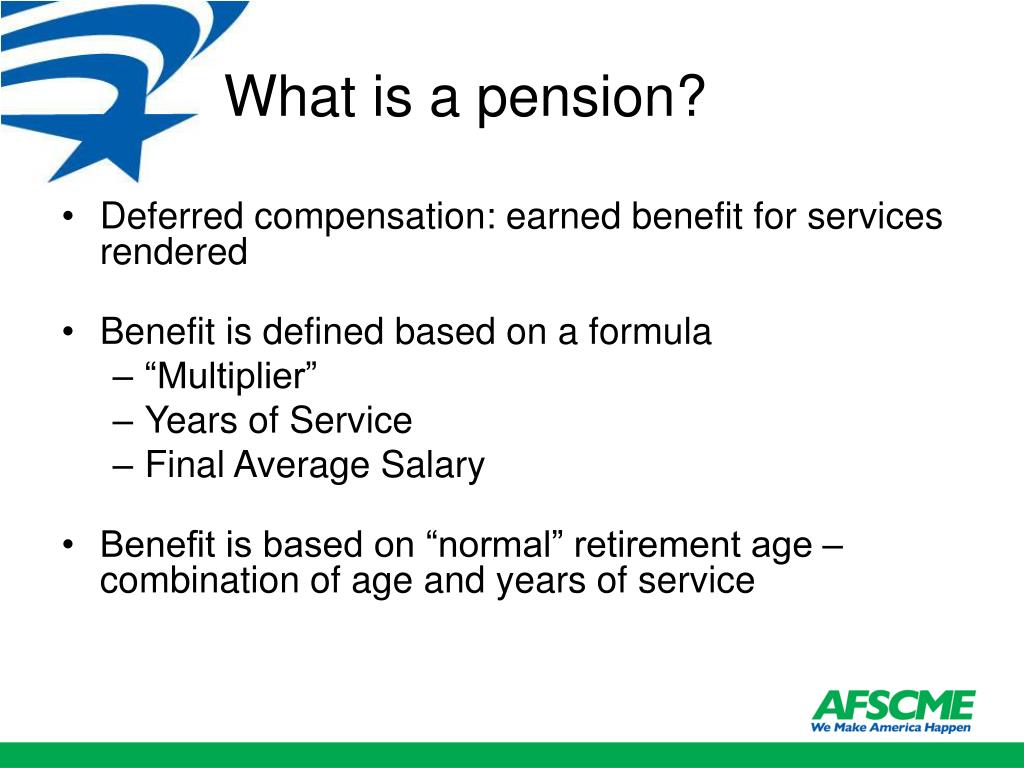

Ppt Pension Basics Powerpoint Presentation Free Download Id 978345 A traditional pension is what’s known as a defined benefit plan. as their name suggests, these plans provide retired employees with a specified, or “defined,” monthly benefit that is. Glossary definition. a pension plan is a benefit plan established by either an employer or a union (or another employee organization) to help employees save for retirement. the plan, depending on the type offered, may either guarantee workers a certain income during retirement or help them defer income for retirement. How do pensions work? the most common type of pension plan is a defined benefit plan. under that type, after an employee with a pension retires, they receive monthly benefits from the plan that. A pension is a retirement plan where the employer invests money for the benefit of workers and promises them a monthly payment in retirement. usually, the amount is based on salary and years of.

:max_bytes(150000):strip_icc()/pension-4f35e772406d433499d4954e3f595b36.jpeg)

What Is A Pension How do pensions work? the most common type of pension plan is a defined benefit plan. under that type, after an employee with a pension retires, they receive monthly benefits from the plan that. A pension is a retirement plan where the employer invests money for the benefit of workers and promises them a monthly payment in retirement. usually, the amount is based on salary and years of. There are two types of pension funds. the first, the defined benefit pension fund, is what most people think of when they say "pensions." the retiree receives the same guaranteed amount. the second, the defined contribution plan, is the familiar 401(k) plan. the payout depends on how well the fund does. A pension is a retirement plan that provides a monthly income in retirement. unlike a 401(k), the employer bears all of the risk and responsibility for funding the plan. a pension is typically based on your years of service, compensation, and age at retirement.

Difference Between Pension And Retirement Difference Between There are two types of pension funds. the first, the defined benefit pension fund, is what most people think of when they say "pensions." the retiree receives the same guaranteed amount. the second, the defined contribution plan, is the familiar 401(k) plan. the payout depends on how well the fund does. A pension is a retirement plan that provides a monthly income in retirement. unlike a 401(k), the employer bears all of the risk and responsibility for funding the plan. a pension is typically based on your years of service, compensation, and age at retirement.

Comments are closed.