What Is A Nonprofit Corporation 501c3 Status

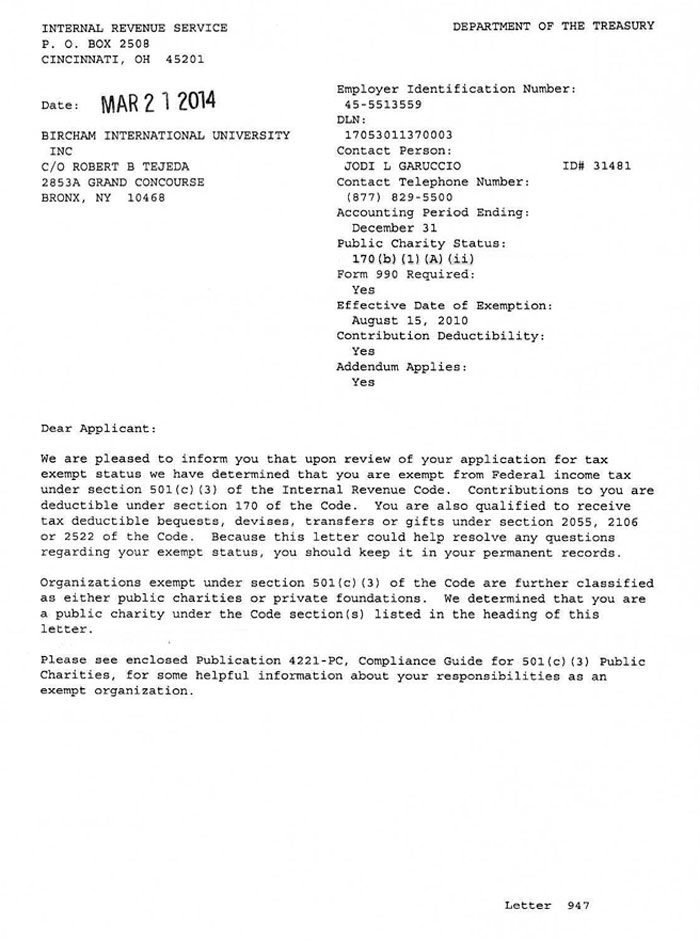

What Is A Nonprofit Corporation 501c3 Status Youtube The files are images of the actual letters or returns. to obtain one of these documents, you may: request it directly from the organization, complete and submit form 4506 a, request for public inspection or copy of exempt or political organization irs form, or. call te ge customer account services at 877 829 5500 to request the document. Section 501 (c) (3) is a portion of the u.s. internal revenue code (irc) and a specific tax category for nonprofit organizations. organizations that meet the requirements of section 501 (c) (3.

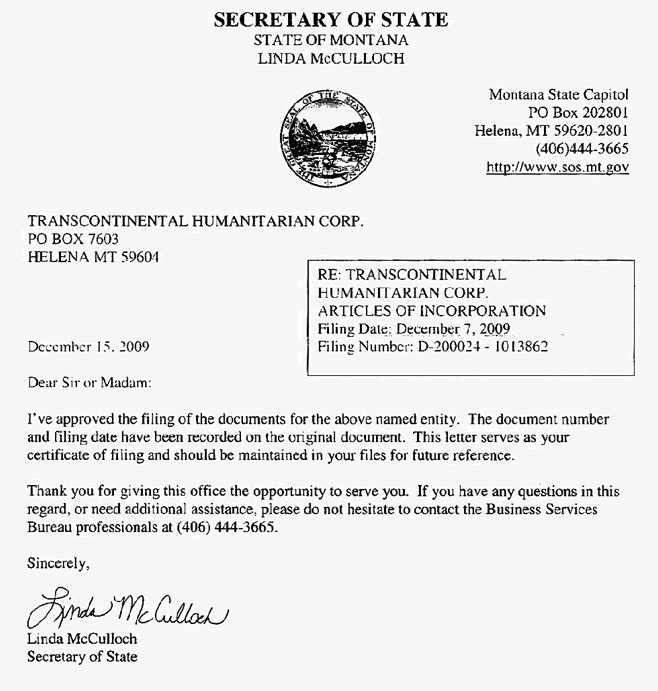

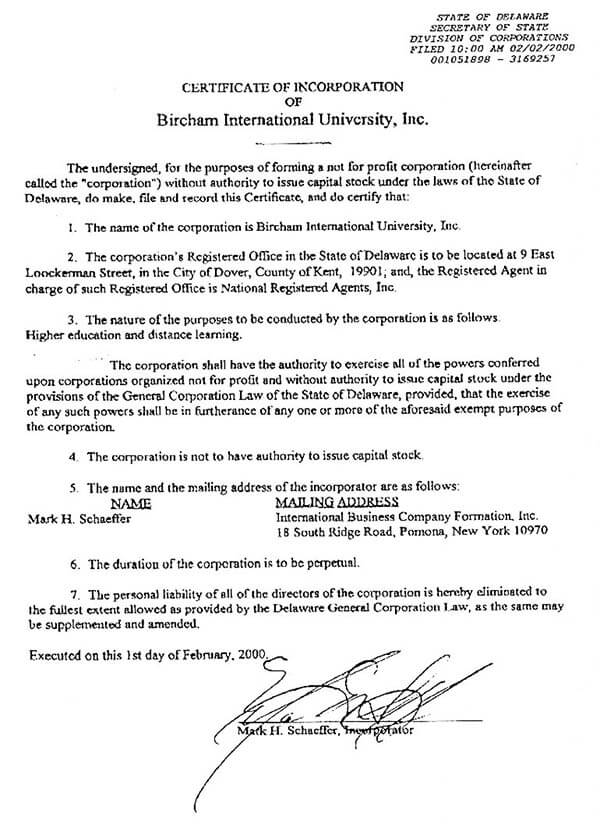

Usa Non Profit 501c3 Status To be tax exempt under section 501 (c) (3) of the internal revenue code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501 (c) (3), and none of its earnings may inure to any private shareholder or individual. in addition, it may not be an action organization, i.e., it may not attempt to. 501 (c) (3) is just one category of 501 (c) organizations, but it is the primary nonprofit status through which donations made to the organization are tax deductible. 501 (c) (3) status is regulated and administered by the us department of treasury through the internal revenue service. Non profit status may make an organization eligible for certain benefits, such as state sales, property, and income tax exemptions; however, this corporate status does not automatically grant exemption from federal income tax. to be tax exempt, most organizations must apply for recognition of exemption from the internal revenue service to. 501 (c) (3) organization. a 501 (c) (3) organization is a united states corporation, trust, unincorporated association or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26 of the united states code. it is one of the 29 types of 501 (c) nonprofit organizations [1] in the us.

How To Start Form A 501c3 Nonprofit Organization By Steps Non profit status may make an organization eligible for certain benefits, such as state sales, property, and income tax exemptions; however, this corporate status does not automatically grant exemption from federal income tax. to be tax exempt, most organizations must apply for recognition of exemption from the internal revenue service to. 501 (c) (3) organization. a 501 (c) (3) organization is a united states corporation, trust, unincorporated association or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26 of the united states code. it is one of the 29 types of 501 (c) nonprofit organizations [1] in the us. The most common include: 501 (c) (1): any corporation that is organized under an act of congress that is exempt from federal income tax. 501 (c) (2): corporations that hold a title of property for. A 501(c)(3) organization is a nonprofit that enjoys special, tax exempt status. these organizations are obligated to serve the public good. nonprofits can receive grants from the government and from private foundations due to their tax exempt status, and they receive several discounts as well, from postage to advertising rates.

Usa Non Profit 501c3 Status The most common include: 501 (c) (1): any corporation that is organized under an act of congress that is exempt from federal income tax. 501 (c) (2): corporations that hold a title of property for. A 501(c)(3) organization is a nonprofit that enjoys special, tax exempt status. these organizations are obligated to serve the public good. nonprofits can receive grants from the government and from private foundations due to their tax exempt status, and they receive several discounts as well, from postage to advertising rates.

Comments are closed.