What Is A Mortgage Rate Definition And Examples

What Is A Mortgage Rate Definition And Examples 6.750%. 7.561%. 5 6 arm. 6.625%. 7.227%. *arm rates are expressed as a fixed term (during which the interest rate won't change), followed by how often the rate can charge after that. a 10 6 arm. Since 1980, average mortgage rates for a 30 year fixed rate mortgage have hit a high of 18.3%, during a period of runaway inflation in 1981, and a low of 2.6% in 2020, in the early days of the.

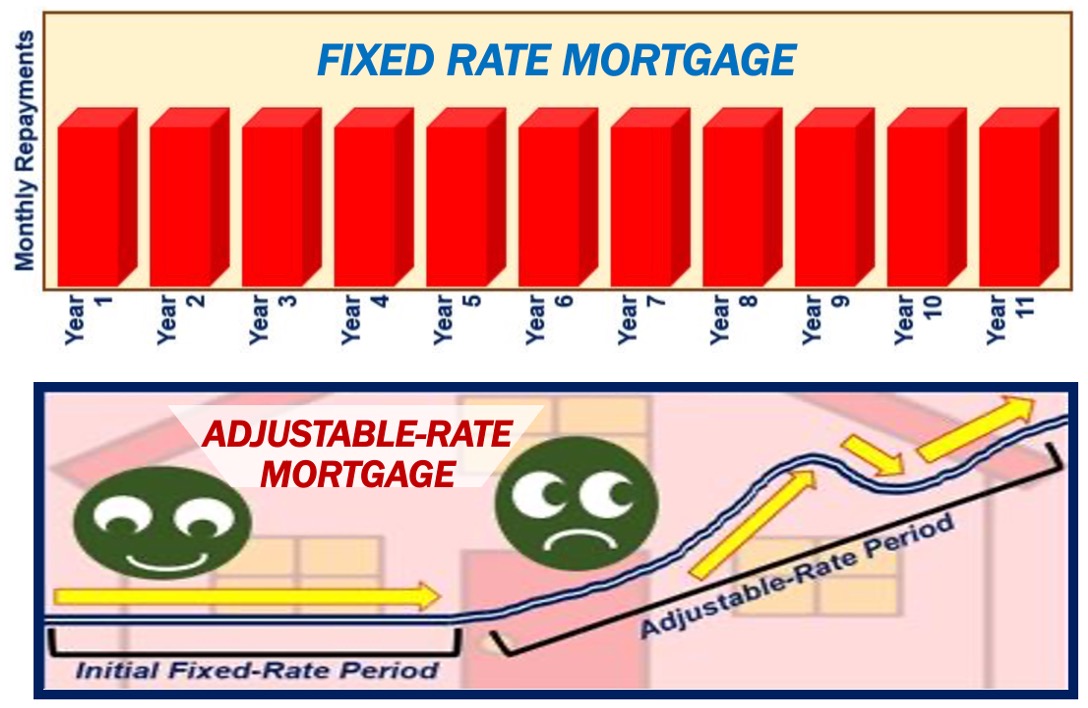

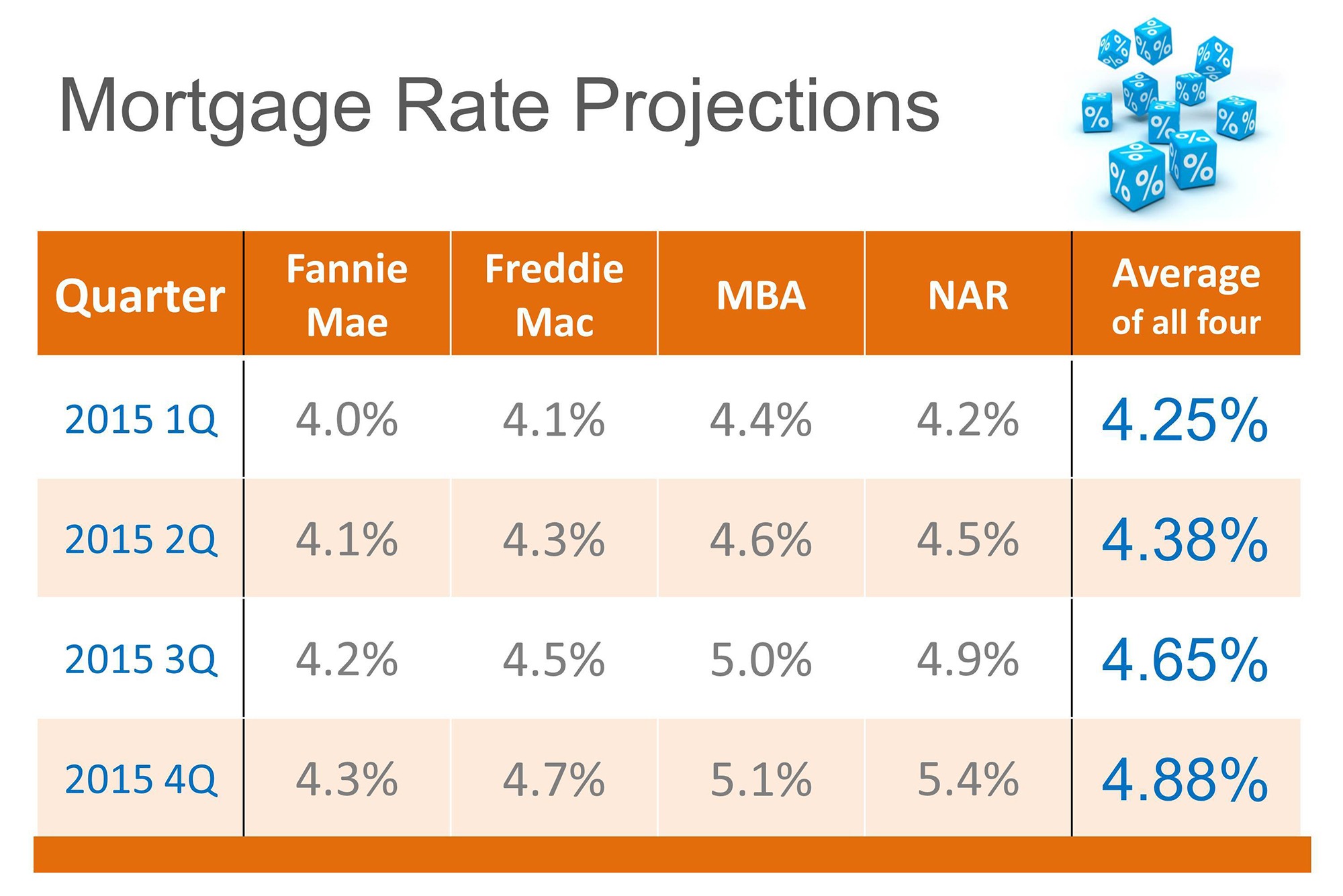

What Is A Mortgage Rate Definition And Examples Mortgage interest rate example say you’re buying a home for $400,000 with 20 percent down. with a 30 year mortgage for $320,000 at a fixed rate of 6.75 percent, your monthly payment would be $2,076. Definition and examples. in the term mortgage rate, the word ‘rate’ means ‘interest’. a mortgage rate is the interest that we pay on a home loan. a mortgage is a home loan, i.e., a loan to purchase a property. the size of the monthly installments on a home loan depends on how much is borrowed as well as the mortgage rate. Mortgages are loans that are used to buy homes and other types of real estate. the property itself serves as collateral for the loan. mortgages are available in a variety of types, including fixed. Mortgage rates can be either fixed or variable. the terms and conditions related to the mortgage rate are outlined in detail in the mortgage loan documents. a fixed rate mortgage charges the borrower the same interest rate over the entire life of the loan. the rate on an adjustable rate mortgage (arm), also known as a 'variable rate mortgage.

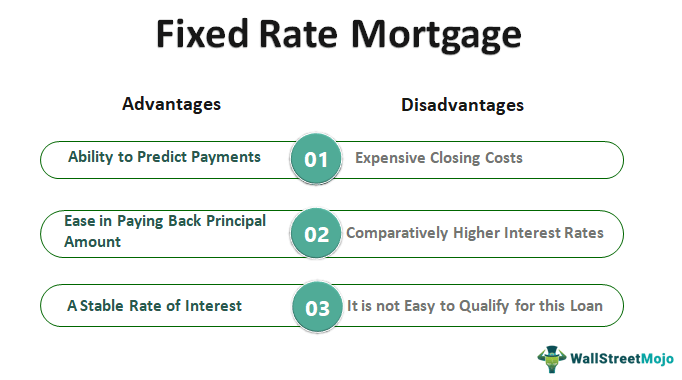

Fixed Rate Mortgage Definition Type Example Vs Variable Rate Mortgages are loans that are used to buy homes and other types of real estate. the property itself serves as collateral for the loan. mortgages are available in a variety of types, including fixed. Mortgage rates can be either fixed or variable. the terms and conditions related to the mortgage rate are outlined in detail in the mortgage loan documents. a fixed rate mortgage charges the borrower the same interest rate over the entire life of the loan. the rate on an adjustable rate mortgage (arm), also known as a 'variable rate mortgage. Making a larger down payment or having significant equity in your home can improve your ltv ratio and decrease your interest rate. 3. economic factors: economic factors, such as inflation, unemployment rates, and the overall state of the economy, can affect mortgage rates. when the economy is thriving, interest rates tend to rise, while they. Definition. a mortgage interest rate a percentage of your total loan balance. it's paid on a monthly basis, along with your principal payment, until your loan is paid off. it's a component in determining the annual cost to borrow money from a lender to purchase a home or other property.

Mortgage Rates A History Over The Years Infographics Making a larger down payment or having significant equity in your home can improve your ltv ratio and decrease your interest rate. 3. economic factors: economic factors, such as inflation, unemployment rates, and the overall state of the economy, can affect mortgage rates. when the economy is thriving, interest rates tend to rise, while they. Definition. a mortgage interest rate a percentage of your total loan balance. it's paid on a monthly basis, along with your principal payment, until your loan is paid off. it's a component in determining the annual cost to borrow money from a lender to purchase a home or other property.

Comments are closed.