What Is A Line Of Credit

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Line Of Credit Loc Definition Types And Examples A line of credit (loc) is a preset borrowing limit that a borrower can draw on at any time until the limit is reached. learn about the types, advantages, and disadvantages of locs, such as personal, business, and home equity lines of credit. A line of credit is a flexible way to borrow money when you need it, up to a certain limit. learn how lines of credit work, the difference between secured and unsecured ones, and how they affect your credit scores.

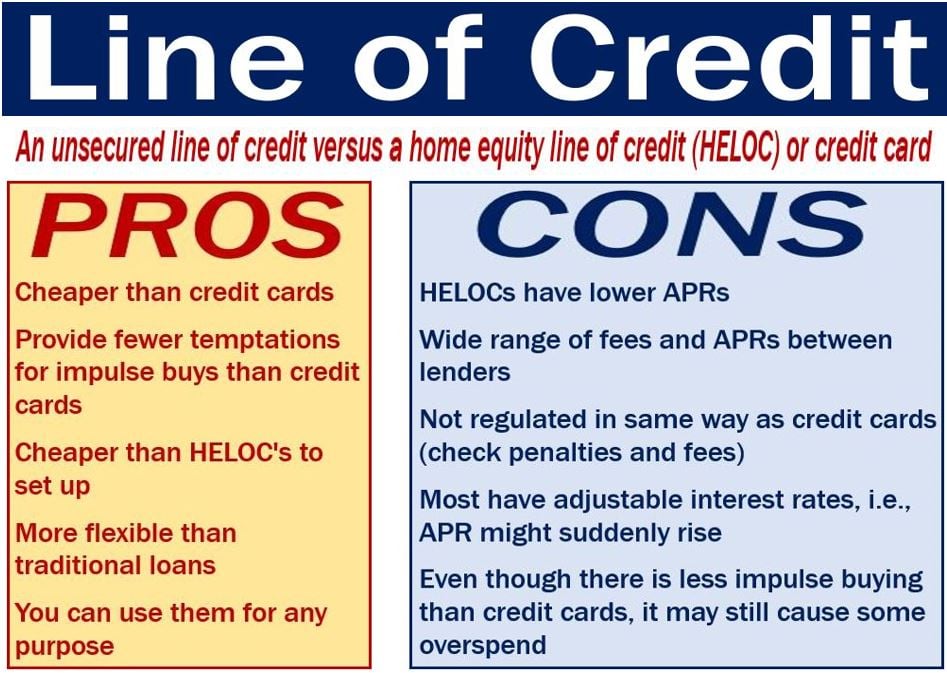

Line Of Credit Definition And Meaning Market Business News A line of credit is a flexible loan that allows you to borrow money up to a certain limit and repay it over time. learn how lines of credit work, when to use them, and what to watch out for. A line of credit is a flexible loan that lets you borrow money as needed and pay interest only on what you use. learn about the types, qualifications and benefits of lines of credit for personal or business purposes. A line of credit is a loan with a preset credit limit that you can use and repay repeatedly. learn about the different types of lines of credit, such as personal, home equity and business, and how they affect your credit scores. A personal line of credit is a loan that works like a credit card: you borrow only as much as you need and pay interest only on what you use. learn how it works, what types of lines of credit exist and the benefits and drawbacks of this flexible financing option.

What Is A Line Of Credit And How Does It Work Creditrepair A line of credit is a loan with a preset credit limit that you can use and repay repeatedly. learn about the different types of lines of credit, such as personal, home equity and business, and how they affect your credit scores. A personal line of credit is a loan that works like a credit card: you borrow only as much as you need and pay interest only on what you use. learn how it works, what types of lines of credit exist and the benefits and drawbacks of this flexible financing option. A line of credit is a flexible way to borrow money from a financial institution, with interest charged only on the amount withdrawn. learn about the different types of locs, such as heloc, cd backed, and credit cards, and how to apply for one. A personal line of credit (ploc) is a revolving loan that can be used and paid down repeatedly, up to a certain limit. learn how plocs work, what they are used for, and how they compare to other types of loans.

Business Line Of Credit Guide Businessloans A line of credit is a flexible way to borrow money from a financial institution, with interest charged only on the amount withdrawn. learn about the different types of locs, such as heloc, cd backed, and credit cards, and how to apply for one. A personal line of credit (ploc) is a revolving loan that can be used and paid down repeatedly, up to a certain limit. learn how plocs work, what they are used for, and how they compare to other types of loans.

Comments are closed.