What Is A Consumer Finance Account Loans Credit Lines Responsible

What Is A Consumer Finance Account Loans Credit Lines Responsible So i was reviewing my equfax's score factors, and it says "you have a consumer finance account on your credit report.". when i click on the ? for more information, i get the following: the presence of a consumer finance company loan on a credit report generally represents a higher risk to lenders compared to having no consumer finance company. A line of credit is a preset borrowing limit that can be used at any time, paid back, and borrowed again. a loan is based on the borrower's specific need, such as the purchase of a car or a home.

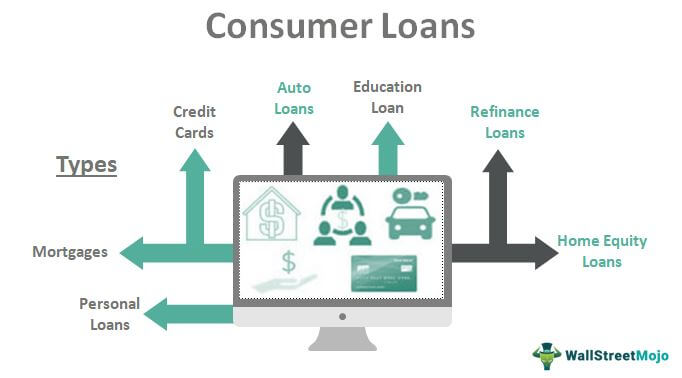

Consumer Loan What Is It Examples Types Interest Eligibility A responsible line of credit requires the bank to examine an applicant's ability to pay ethically and impartially so as to prevent over indebtedness. it helps the bank anticipate a default that may harm the borrower's financial health, the bank and society. banks promise to provide consumers with clear, straightforward details about these products. Understanding consumer finance accounts. consumer finance accounts, also known as consumer finance loans, are a lifeline for individuals with less than stellar credit ratings. these accounts provide a solution for those facing credit challenges by bridging the gap when traditional lending channels are out of reach. Getty. a line of credit is a type of loan that provides borrowers money they can draw from as needed. once a borrower draws against a line of credit, they are responsible for making regular. Alongside consumer finance accounts, consider having other types of credit, such as credit cards or installment loans, to demonstrate your ability to manage different types of credit responsibly. avoid opening too many accounts: while having a mix of credit is important, avoid opening too many consumer finance accounts within a short period.

What Is A Line Of Credit And How Does It Work Creditrepair Getty. a line of credit is a type of loan that provides borrowers money they can draw from as needed. once a borrower draws against a line of credit, they are responsible for making regular. Alongside consumer finance accounts, consider having other types of credit, such as credit cards or installment loans, to demonstrate your ability to manage different types of credit responsibly. avoid opening too many accounts: while having a mix of credit is important, avoid opening too many consumer finance accounts within a short period. With a revolving line of credit, a person can borrow money and then make payments on an ongoing basis as long as they don’t exceed the account’s credit limit. as they use the line of credit, the amount of available credit goes down. as they pay it back, the available credit goes back up. nonrevolving lines of credit are similar to revolving. A consumer finance account is a financial product that allows individuals to manage their personal finances and make transactions. it provides a convenient way to access and use money, whether for everyday expenses or long term financial goals. understanding the basics of consumer finance accounts, their key features, and the different types available can help individuals […].

Comments are closed.