What Is A 1031 Exchange

1031 Exchange Rules New Construction Marindamermelstein A 1031 exchange is a tax deferred swap of one investment property for another that meets certain irs criteria. learn how to use 1031 exchanges to defer capital gains, avoid depreciation recapture, and build wealth with real estate. A 1031 exchange is a tax deferment strategy for selling and buying investment properties. learn how it works, what are the requirements and benefits, and how to do it step by step.

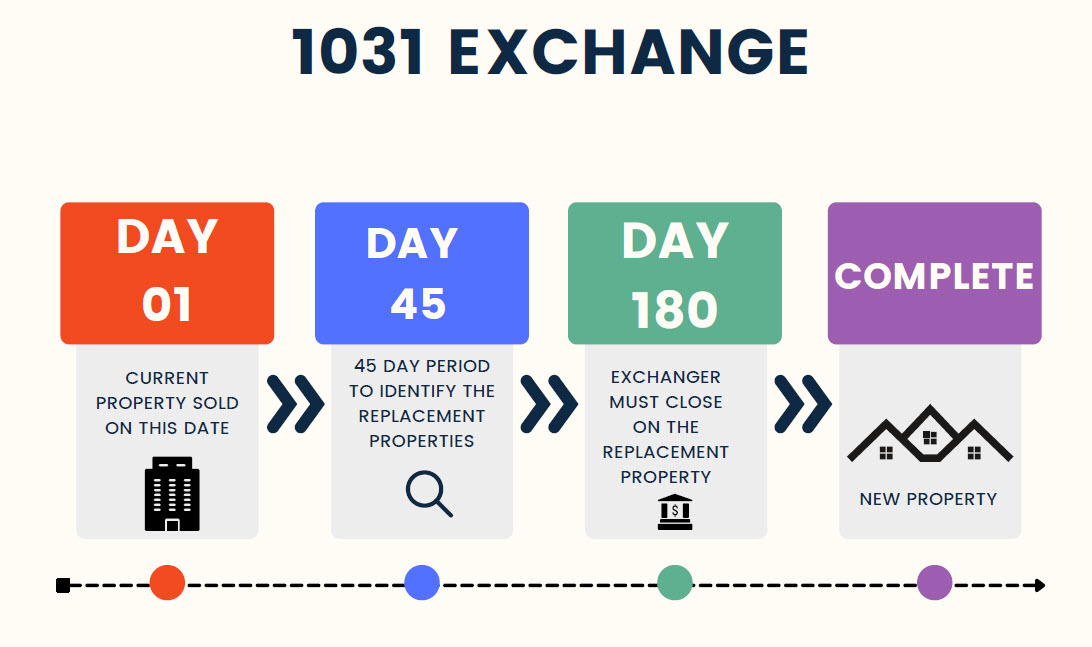

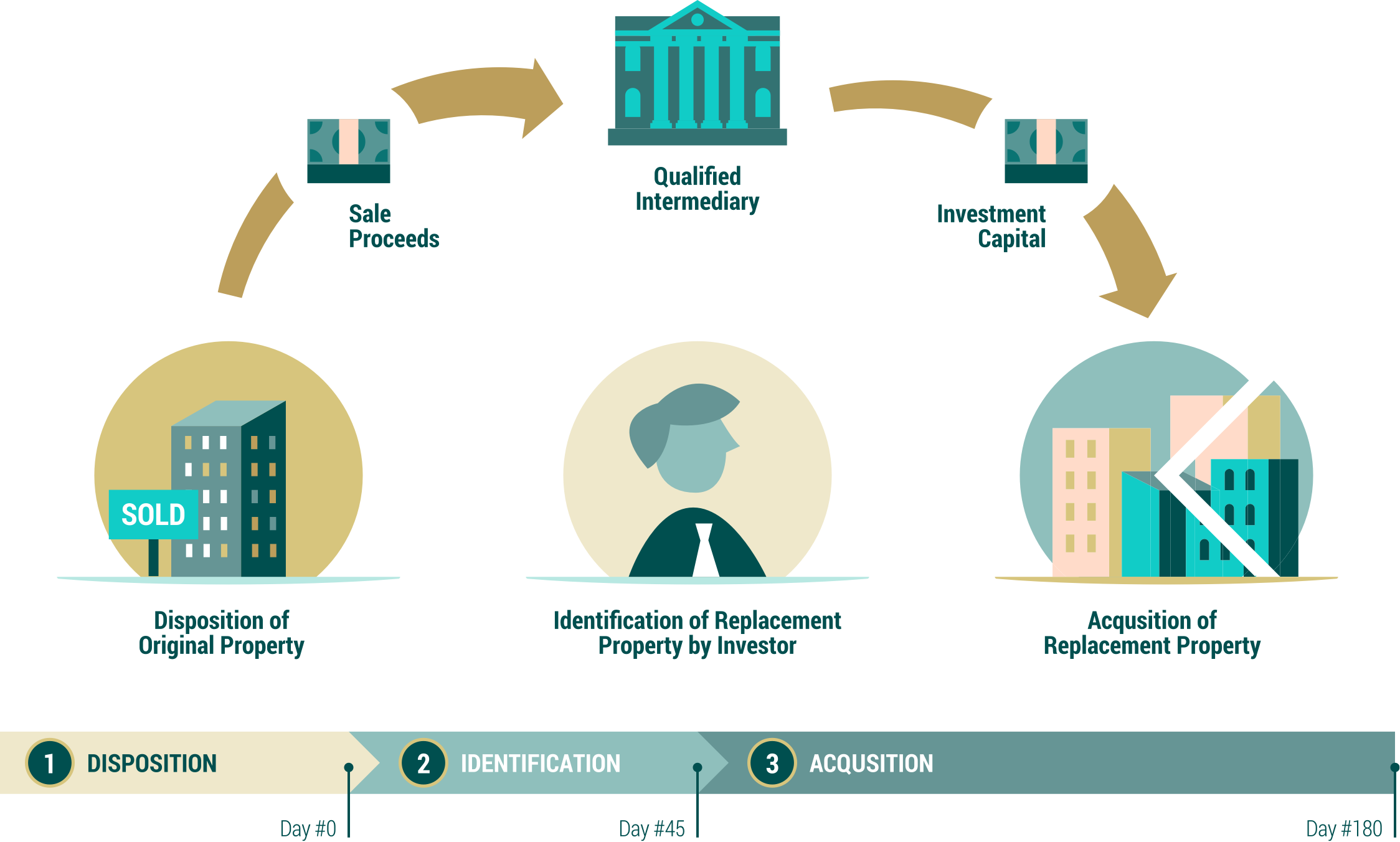

Section 1031 Exchange The Ultimate Guide To Like Kind Exchange A 1031 exchange is a way to postpone capital gains tax on the sale of a business or investment property by using the proceeds to buy a similar property. learn how it works, what qualifies as a like kind exchange, and what are the rules and deadlines to follow. Learn how to defer capital gains taxes by exchanging one property for another of like kind within 45 and 180 days. find out the types, requirements and benefits of 1031 exchanges and how to use a qualified intermediary. A 1031 exchange is a tax deferred way to swap an investment property for another property of equal or higher value. learn how it works, when to use it, and what types of properties are eligible for this real estate investing tool. What is a 1031 exchange? normally, when you sell investment property, you're required to pay capital gains tax on the profit. but with a 1031 tax deferred exchange (also known as a “like kind exchange”), you can delay payment of the tax on the sale of real property (your “original” property) if you use the proceeds from the sale to buy another property (“replacement” property) of.

Understanding 1031 Exchange Rules In North Carolina Cottage Real Estate A 1031 exchange is a tax deferred way to swap an investment property for another property of equal or higher value. learn how it works, when to use it, and what types of properties are eligible for this real estate investing tool. What is a 1031 exchange? normally, when you sell investment property, you're required to pay capital gains tax on the profit. but with a 1031 tax deferred exchange (also known as a “like kind exchange”), you can delay payment of the tax on the sale of real property (your “original” property) if you use the proceeds from the sale to buy another property (“replacement” property) of. Learn how to defer capital gains tax on investment property sales with a 1031 exchange. find out the types, rules, exceptions, and implications of this tax strategy. A 1031 exchange is a tax deferred way to sell and buy real estate of like kind. learn how it works, what types of properties qualify and what are the pros and cons of this strategy.

Excel 1031 Exchange Llc Learn how to defer capital gains tax on investment property sales with a 1031 exchange. find out the types, rules, exceptions, and implications of this tax strategy. A 1031 exchange is a tax deferred way to sell and buy real estate of like kind. learn how it works, what types of properties qualify and what are the pros and cons of this strategy.

Comments are closed.