What Does Mergers Acquisitions Mean

M A Meaning Mergers Acquisitions Definition Types Examples A merger occurs when two separate entities combine forces to create a new, joint organization. meanwhile, an acquisition refers to the takeover of one entity by another. mergers and acquisitions. A merger is the combination of two firms, which subsequently form a new legal entity under the banner of one corporate name. mergers and acquisitions require the valuation of a company or its.

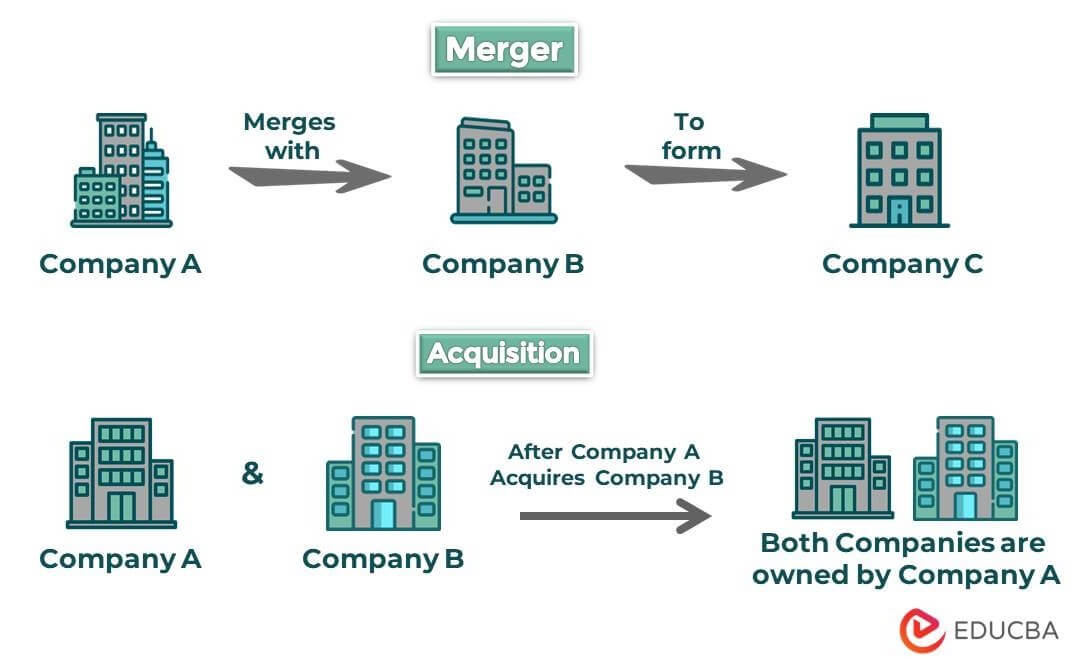

Mergers And Acquisitions M A Definition Examples Types Salary Mergers and acquisitions (m&a) is the consolidation of companies or assets through various financial transactions. in a merger, two or more companies merge their operations and become one entity. on the other hand, in an acquisition, one company acquires another company, and the acquired company becomes a subsidiary of the acquiring company. 2. overpayment. overpayment is a common pitfall of mergers and acquisitions. there can be a lot of pressure from several sides when preparing for such significant transactions. in addition to the seller, you may be urged by intermediaries involved in the agreement, along with teams within your own company. A merger is a combination of two or more businesses; an acquisition takes place when one business buys another. m&a transactions involve high risk and the potential for high reward. most m&a transactions result in disappointment. the accounting and legal structures of mergers and acquisitions are complicated. m&a is a major change in corporate. Corporate finance. mergers and acquisitions (m&a) are business transactions in which the ownership of companies, business organizations, or their operating units are transferred to or consolidated with another company or business organization. this could happen through direct absorption, a merger, a tender offer or a hostile takeover. [1].

M A Meaning Mergers Acquisitions Definition Types Examples 2023 A merger is a combination of two or more businesses; an acquisition takes place when one business buys another. m&a transactions involve high risk and the potential for high reward. most m&a transactions result in disappointment. the accounting and legal structures of mergers and acquisitions are complicated. m&a is a major change in corporate. Corporate finance. mergers and acquisitions (m&a) are business transactions in which the ownership of companies, business organizations, or their operating units are transferred to or consolidated with another company or business organization. this could happen through direct absorption, a merger, a tender offer or a hostile takeover. [1]. Mergers and acquisitions (m&a) is a $3 trillion activity that changes the long term trajectory of careers, companies, and industries. outside of an ipo and even that is arguable an m&a transaction is the largest corporate action that any company can take in its lifetime. outside of startups, there is not a billion dollar company in. Mergers are a way for companies to expand their reach, expand into new segments, or gain market share. a merger is the voluntary fusion of two companies on broadly equal terms into one new legal.

M A Meaning Mergers Acquisitions Definition Types Examples 2023 Mergers and acquisitions (m&a) is a $3 trillion activity that changes the long term trajectory of careers, companies, and industries. outside of an ipo and even that is arguable an m&a transaction is the largest corporate action that any company can take in its lifetime. outside of startups, there is not a billion dollar company in. Mergers are a way for companies to expand their reach, expand into new segments, or gain market share. a merger is the voluntary fusion of two companies on broadly equal terms into one new legal.

What Does Mergers Acquisitions Mean Youtube

Comments are closed.