What Does Consumer Credit Mean

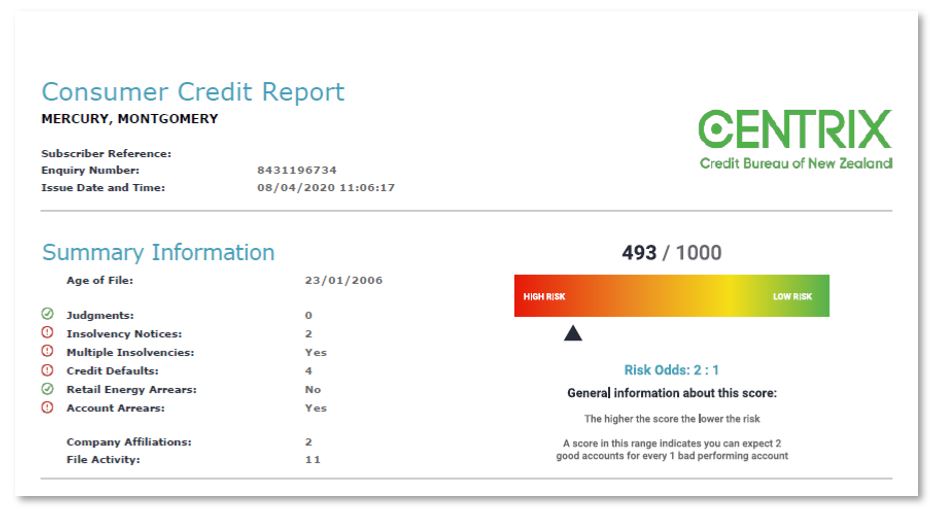

Consumer Credit Reports Explained Centrix Consumer credit is credit issued to individuals that is not collateralized. installment credit is provided in a lump sum and then repaid in regular installments over a set period of time. The bottom line. consumer credit provides access to more spending power, which enables you to do things like take out a home loan or make purchases with a credit card. responsible use of consumer credit can open doors to new opportunities, but borrowing also has the potential to result in unmanageable levels of debt.

Consumer Credit Meaning Counseling Service Union Act Consumer credit is money consumers borrow and repay over time. banks, financial institutions, and businesses extend credit based on a consumer's borrowing history and ability to repay. consumer credit can be secured or unsecured. consumers can access credit products by applying with a lender or creditor. Consumer credit, often referred to as consumer debt, is a financial tool that individuals use to make immediate purchases of goods and services. unlike secured loans, consumer credit is not collateralized, making it a flexible option for smaller amounts. while various types of personal loans can fall under consumer credit, it’s commonly. What does "consumer credit" mean in legal documents? consumer credit is a term that refers to the ability of individuals to borrow money or access funds for personal use. this borrowing can take many forms, but the most common way people use consumer credit is through credit cards. Consumer credit, put simply, is the ability to pay for items with credit instead of cash, which usually means borrowing money and paying it back over a period of time. credit cards, student loans and mortgages are all examples of consumer credit in action. taking on credit such as a credit card or loan can offer opportunities you may not have.

What Does Consumer Credit Mean Youtube What does "consumer credit" mean in legal documents? consumer credit is a term that refers to the ability of individuals to borrow money or access funds for personal use. this borrowing can take many forms, but the most common way people use consumer credit is through credit cards. Consumer credit, put simply, is the ability to pay for items with credit instead of cash, which usually means borrowing money and paying it back over a period of time. credit cards, student loans and mortgages are all examples of consumer credit in action. taking on credit such as a credit card or loan can offer opportunities you may not have. Consumer credit refers to the ability of a consumer to access a loan. the most common form of credit used by consumers is a credit card account issued by a financial institution. merchants may also provide direct financing for products which they sell. banks may directly finance purchases through loans and mortgages. Consumer credit is debt taken on by a consumer, typically to be repaid with interest in the future. as an economic indicator, consumer credit is used to gauge the indebtedness of americans.

Ppt Chapter 5 Introduction To Consumer Credit Powerpoint Presentation Consumer credit refers to the ability of a consumer to access a loan. the most common form of credit used by consumers is a credit card account issued by a financial institution. merchants may also provide direct financing for products which they sell. banks may directly finance purchases through loans and mortgages. Consumer credit is debt taken on by a consumer, typically to be repaid with interest in the future. as an economic indicator, consumer credit is used to gauge the indebtedness of americans.

Comments are closed.