What Are Your Financial Goals

Financial Goals Meaning Examples Types Financial disasters like losing your job or a medical crisis always lurk. you need enough money in an emergency fund to cover three months of your regular living expenses, like housing, food and transportation. 4. save for retirement. you want to live out your golden years in comfort, not poverty. Having financial goals can help shape your future by influencing the actions you take today. for example, say your goal is to pay off a colossal credit card bill. you might cut back on takeout.

How To Set Short Term Financial Goals With Smart Examples Self 13 popular financial goals. if you aren’t sure where to start with setting your financial goals, consider some of the key milestones that appear on many peoples’ lists. build an emergency fund. The three most important financial goals. let’s start with three goals that should be top priorities on everyone’s list. goal 1. set aside $500 to cover emergencies. the gold standard of. The biggest long term financial goal for most people is saving enough money to retire. the common rule of thumb is that you should save 10% to 15% of every paycheck in a tax advantaged retirement. 2. paying off debt: reducing or eliminating debt can help you improve your credit score and free up more money for other goals. 3. saving for a down payment on a home: owning a home is often a key financial milestone, and saving for a down payment is an important step towards achieving it. 4.

7 Smart Must Have Financial Goals To Take Control Of Your Finances The biggest long term financial goal for most people is saving enough money to retire. the common rule of thumb is that you should save 10% to 15% of every paycheck in a tax advantaged retirement. 2. paying off debt: reducing or eliminating debt can help you improve your credit score and free up more money for other goals. 3. saving for a down payment on a home: owning a home is often a key financial milestone, and saving for a down payment is an important step towards achieving it. 4. 6 steps for setting financial goals. 1. review your finances. to set financial goals, you need to figure out how much you can afford to save for each goal given your current spending levels. Here are some of the most important financial goals to put on your radar and how to attack them. 1. understand your essential expenses, your take home pay, and your interest rates. it sounds basic—just getting a grasp on the actual numbers involved in your financial situation.

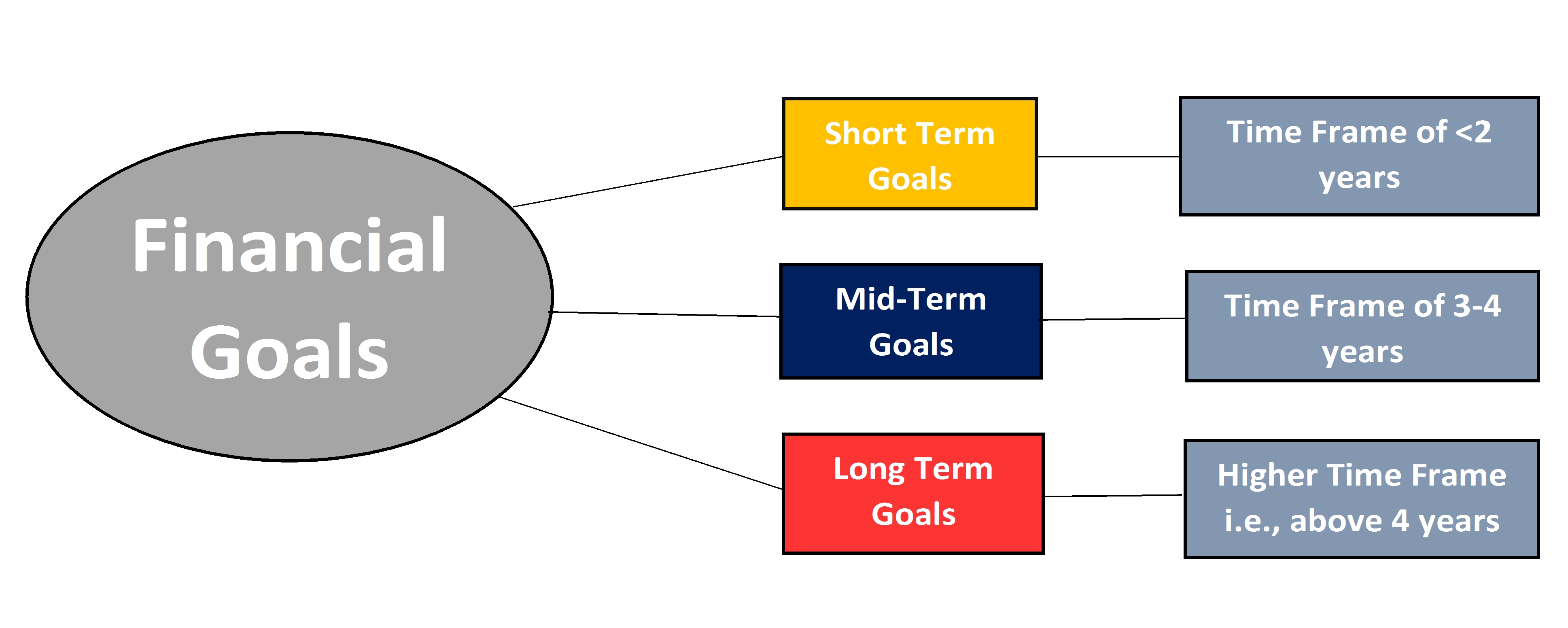

Financial Goals Short Term Long Term Financial Advice Financial 6 steps for setting financial goals. 1. review your finances. to set financial goals, you need to figure out how much you can afford to save for each goal given your current spending levels. Here are some of the most important financial goals to put on your radar and how to attack them. 1. understand your essential expenses, your take home pay, and your interest rates. it sounds basic—just getting a grasp on the actual numbers involved in your financial situation.

Comments are closed.