What Are The Costs Of Refinancing A Mortgage

Cost Of Refinancing What Is It Formula Examples Components Origination fees also typically cost around 0.5% – 1% of the total loan amount. other expenses that might be included in your refinance closing costs include a recording fee (if you’re updating ownership of the property), a credit report fee and an underwriting fee. you can expect to pay around 3% – 6% of your loan balance in closing costs. If you’re refinancing a $200,000 mortgage, say, you might be looking at anywhere between $4,000 and $10,000 in closing costs. here’s a breakdown of common closing costs: closing costs. fee.

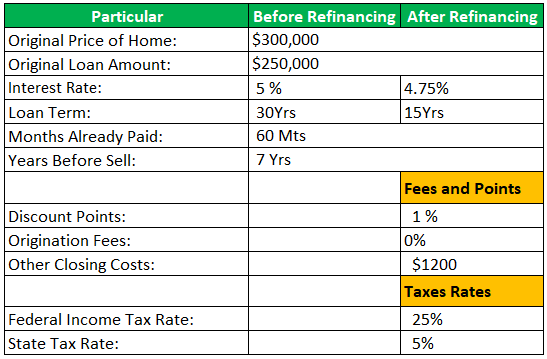

Looking Beyond The Monthly Payment And Calculating The True Cost Of The precise refinancing fees you pay depend on the loan type, lender and local fees. but here are estimates of the most common refinancing expenses: application fee: $0 to $500. attorney fees. Refinancing from a 30 year to a 15 year mortgage could help you lock in a lower rate and save on interest costs, as long as you can afford a much higher monthly payment. extending your loan term, on the other hand, would lower your monthly payment but cost you more in interest over the life of your loan. 5.00%. $3,163. $169,371. savings. $432. $77,785. since closing costs are between 3% and 6% of the loan amount, you could pay anywhere between $12,000 and $24,000 in closing costs for this mortgage. Generally, you can expect costs to refinance to be about 2% to 6% of the loan amount. freddie mac, which buys and guarantees mortgages, puts the typical cost of refinancing a mortgage at roughly.

Looking Beyond The Monthly Payment And Calculating The True Cost Of 5.00%. $3,163. $169,371. savings. $432. $77,785. since closing costs are between 3% and 6% of the loan amount, you could pay anywhere between $12,000 and $24,000 in closing costs for this mortgage. Generally, you can expect costs to refinance to be about 2% to 6% of the loan amount. freddie mac, which buys and guarantees mortgages, puts the typical cost of refinancing a mortgage at roughly. To refinance a mortgage, you’ll pay between 2 and 5 percent of the loan amount in closing costs, so if you’re refinancing to save money, you’ll need to calculate your break even point. Get started with rocket mortgage ® by checking out your refinance options and locking your rate today. you can also get started by phone at (833) 326 6018. mortgage refinancing works by trading your mortgage for a newer one, ideally with a lower balance and interest rate. learn why and how to refinance a mortgage.

Cost Of Refinancing What Is It Formula Examples Components To refinance a mortgage, you’ll pay between 2 and 5 percent of the loan amount in closing costs, so if you’re refinancing to save money, you’ll need to calculate your break even point. Get started with rocket mortgage ® by checking out your refinance options and locking your rate today. you can also get started by phone at (833) 326 6018. mortgage refinancing works by trading your mortgage for a newer one, ideally with a lower balance and interest rate. learn why and how to refinance a mortgage.

Comments are closed.