What Are The Benefits Of Enrolling In An Hdhp And Hsa Ameriflex

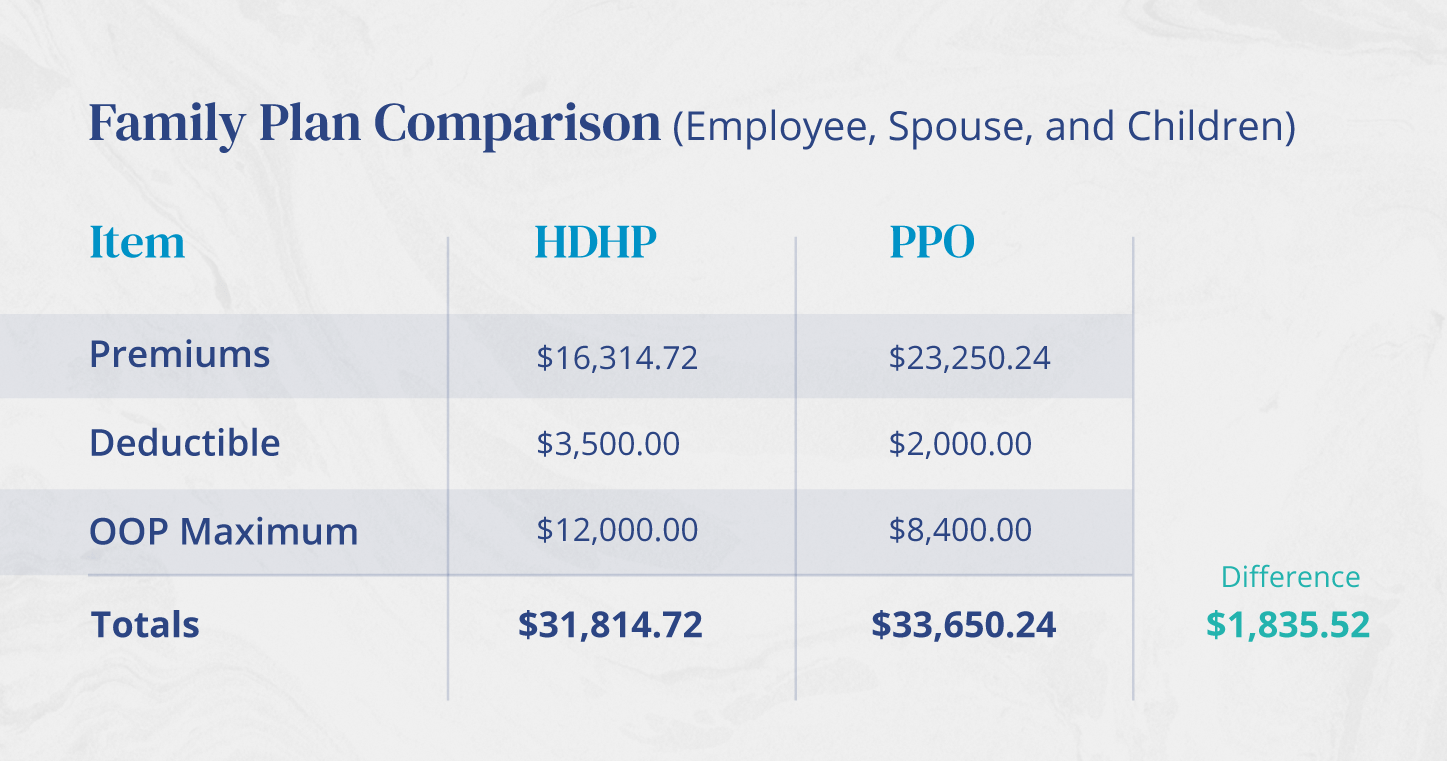

What Are The Benefits Of Enrolling In An Hdhp And Hsa Ameriflex Lower premiums can be one of the most significant benefits of a high deductible health plan (hdhp). by offsetting the higher deductible, lower premiums can often save participants money in the long run. another big benefit is the ability to partner an hdhp with the triple tax advantage of an hsa. this combo can work together to be a powerful. When you enroll in an hdhp and hsa, you have an opportunity to potentially pay less in monthly insurance premiums and lower your taxable income by setting aside pretax money from your paycheck. according to valuepenguin, individuals can potentially save $955 in taxes per year, and families could potentially save $1,909 in taxes.

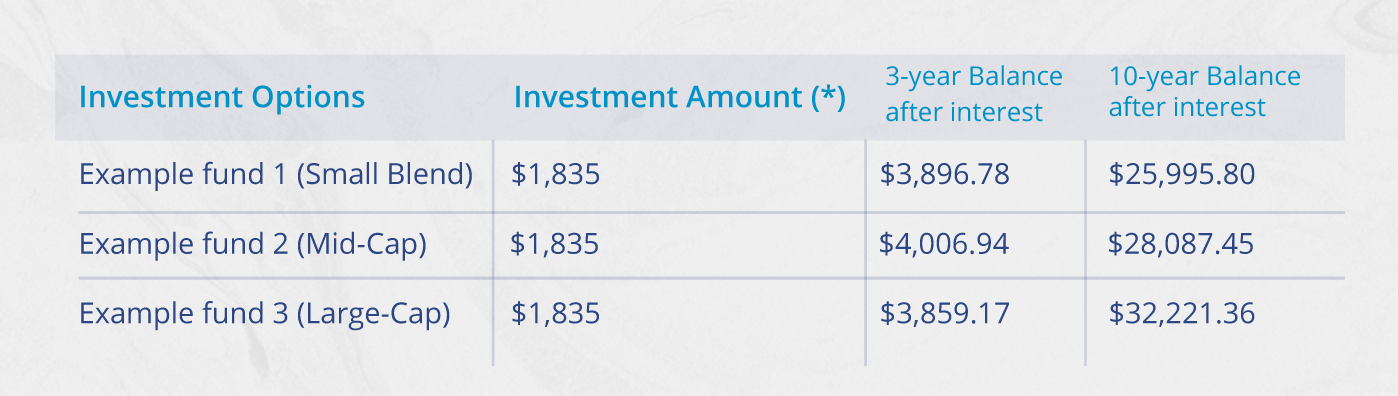

What Are The Benefits Of Enrolling In An Hdhp And Hsa Ameriflex It can be used to pay for current medical expenses or invested and saved for later. in short, a health savings account is a personal account for saving and investing. employees can contribute pre taxed earnings to their hsa to pay for current or future medical expenses such as copays, deductibles, over the counter medications, and prescriptions. A health savings account is a personal account for saving and investing. employees can contribute pre taxed earnings to their hsa to pay for current or future medical expenses such as copays, deductibles, over the counter medications, and prescriptions. there is no use it or lose it rule for an hsa, and the balance carries over from year to. What are hsa eligible plans? one way to manage your health care expenses isto enroll in a. health savings account (hsa) eligible plan (also called a high deductible health plan (hdhp)) and open an hsa, a type of savings account that lets you set aside money on a pre tax basis to pay for qualified medical expenses (like some dental, drug, and. If you do decide to enroll in an hdhp, one of the benefits is that you can establish and make contributions to an hsa. you can deduct your hsa contributions when you file your tax return, without having to itemize your deductions (the deduction is taken on schedule 1 of form 1040 4 ).

What Are The Benefits Of Enrolling In An Hdhp And Hsa Ameriflex What are hsa eligible plans? one way to manage your health care expenses isto enroll in a. health savings account (hsa) eligible plan (also called a high deductible health plan (hdhp)) and open an hsa, a type of savings account that lets you set aside money on a pre tax basis to pay for qualified medical expenses (like some dental, drug, and. If you do decide to enroll in an hdhp, one of the benefits is that you can establish and make contributions to an hsa. you can deduct your hsa contributions when you file your tax return, without having to itemize your deductions (the deduction is taken on schedule 1 of form 1040 4 ). Employees who enroll in an hdhp associated with an hsa for 2024 will automatically have a portion of their insurance premiums contributed to the hsa. employees pay a portion of the premiums– on average 25 to 28 percent of the total premium, and the employee’s agency pays the remaining premium contribution – the other 72 to 75 percent. Key takeaways. the health savings account (hsa) helps people with high deductible health insurance plans cover out of pocket medical costs. contributions to hsas aren’t subject to federal income.

Why You Should Consider Adding An Hdhp Hsa To Your Benefits Package Employees who enroll in an hdhp associated with an hsa for 2024 will automatically have a portion of their insurance premiums contributed to the hsa. employees pay a portion of the premiums– on average 25 to 28 percent of the total premium, and the employee’s agency pays the remaining premium contribution – the other 72 to 75 percent. Key takeaways. the health savings account (hsa) helps people with high deductible health insurance plans cover out of pocket medical costs. contributions to hsas aren’t subject to federal income.

Comments are closed.