What Are The 2024 401k Ira Hsa Contribution Limits

Irs Makes Historical Increase To 2024 Hsa Contribution Limits First Highlights of changes for 2024. the contribution limit for employees who participate in 401(k), 403(b), and most 457 plans, as well as the federal government's thrift savings plan is increased to $23,000, up from $22,500. the limit on annual contributions to an ira increased to $7,000, up from $6,500. The hsa contribution limits for 2025 are $4,300 for self only coverage and $8,550 for family coverage. those 55 and older can contribute an additional $1,000 as a catch up contribution. hsa eligibility. to contribute to an hsa, you must be enrolled in an hsa eligible health plan. for 2024, this means: it has an annual deductible of at least.

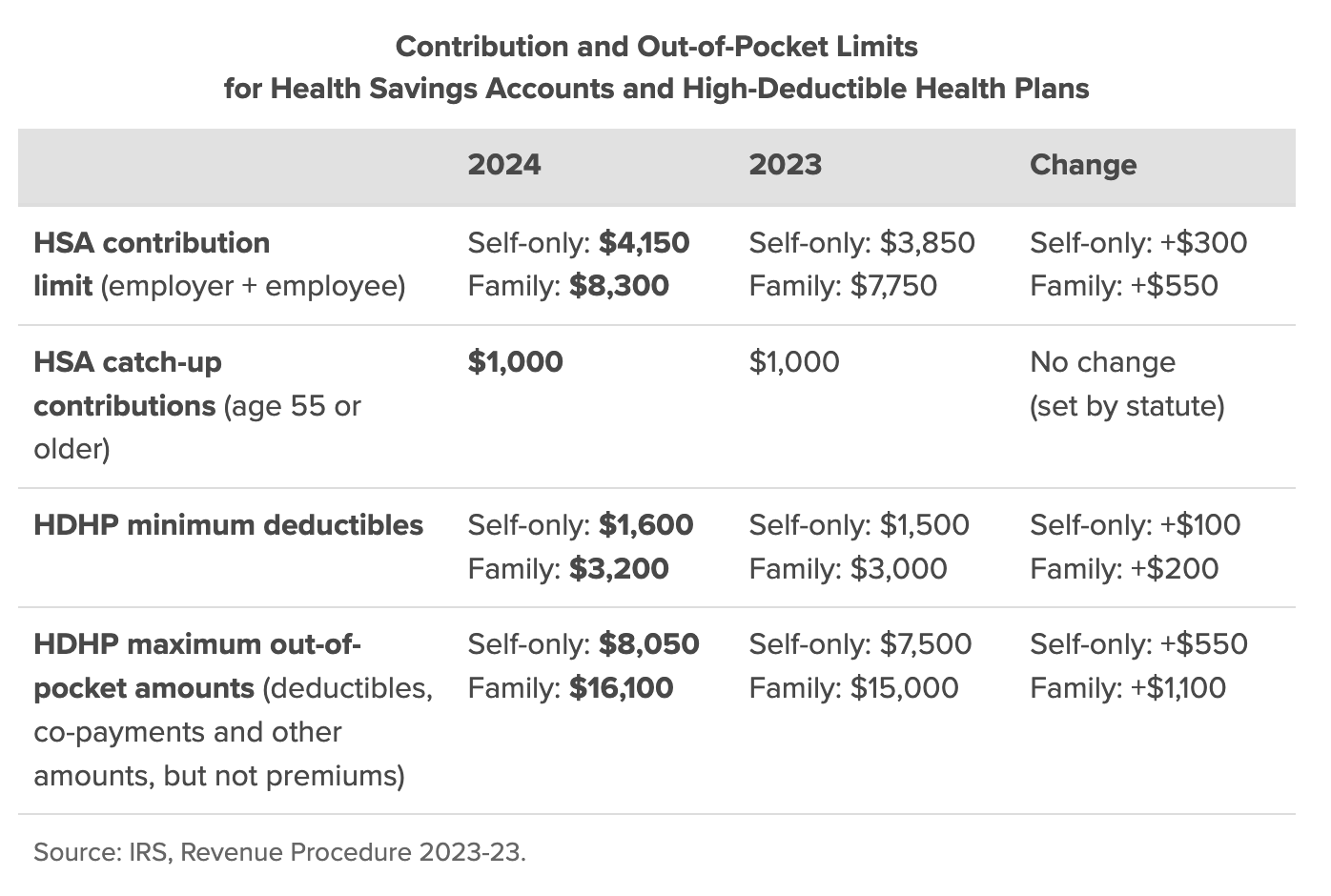

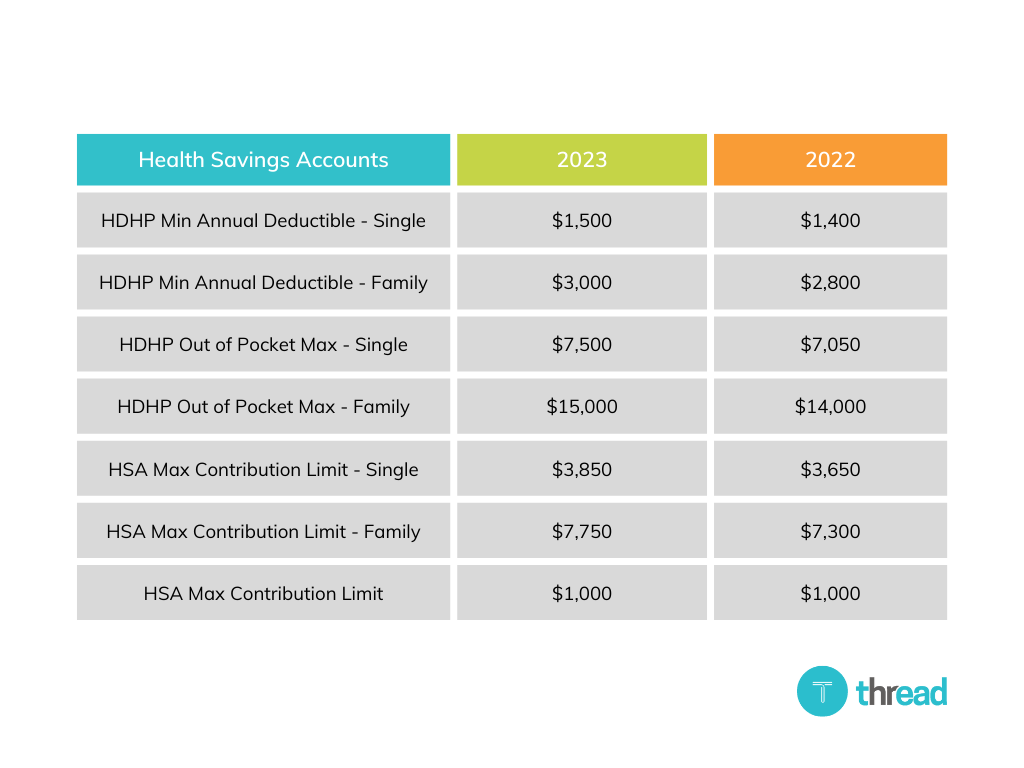

2024 Hsa Contribution Limits Claremont Insurance Services The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023. the 2024 hsa contribution limit for families is $8,300, a 7. Contribution limits for 401 (k), 403 (b), and most 457 plans, as well as the federal government's thrift savings plan will also increase by $500 for 2024. eligible taxpayers can contribute $23,000. The 401(k) contribution limit for 2025 is $23,500, up from $23,000 in 2024. however, individual retirement account (ira) contributions will continue to be $7,000 in 2025, the same as in 2024. Best roth iras best gold iras best investments for a roth ira best bitcoin iras protecting your 401(k) you can contribute $4,150 to an eligible self only hsa in 2024. your contribution limit.

Here S The Latest 401k Ira And Other Contribution Limits For 2024 The 401(k) contribution limit for 2025 is $23,500, up from $23,000 in 2024. however, individual retirement account (ira) contributions will continue to be $7,000 in 2025, the same as in 2024. Best roth iras best gold iras best investments for a roth ira best bitcoin iras protecting your 401(k) you can contribute $4,150 to an eligible self only hsa in 2024. your contribution limit. The maximum contribution for self only coverage is $4,150. the maximum contribution for family coverage is $8,300. those age 55 and older can make an additional $1,000 catch up contribution. add. The irs sets the maximum that you and your employer can contribute to your 401 (k) each year. in 2023, the most you can contribute to a roth 401 (k) and contribute in pretax contributions to a traditional 401 (k) is $22,500. in 2024, this rises to $23,000. those 50 and older can contribute an additional $7,500 in 2023 and 2024.

2024 Hsa Family Contribution Limits Natka Vitoria The maximum contribution for self only coverage is $4,150. the maximum contribution for family coverage is $8,300. those age 55 and older can make an additional $1,000 catch up contribution. add. The irs sets the maximum that you and your employer can contribute to your 401 (k) each year. in 2023, the most you can contribute to a roth 401 (k) and contribute in pretax contributions to a traditional 401 (k) is $22,500. in 2024, this rises to $23,000. those 50 and older can contribute an additional $7,500 in 2023 and 2024.

2024 Contribution Limits For Hsa Rae Leigha

Comments are closed.