What Are Real Time Payments

Understanding Real Time Payments The Complete Guide A real time payments rail is the digital infrastructure that facilitates real time payments. ideally, real time payment networks provide 24x7x365 access, which means they are always online to process transfers. this includes weekends and holidays. in the united states, the most prominent example of a real time payments network is the clearing. Real time payments are instant payments that are processed immediately and continuously, 24 7. unlike traditional payment systems, which can take hours or even days to complete transactions, rtp systems immediately transfer funds from one bank account to another. this can occur within seconds of the transaction initiating, at which point the.

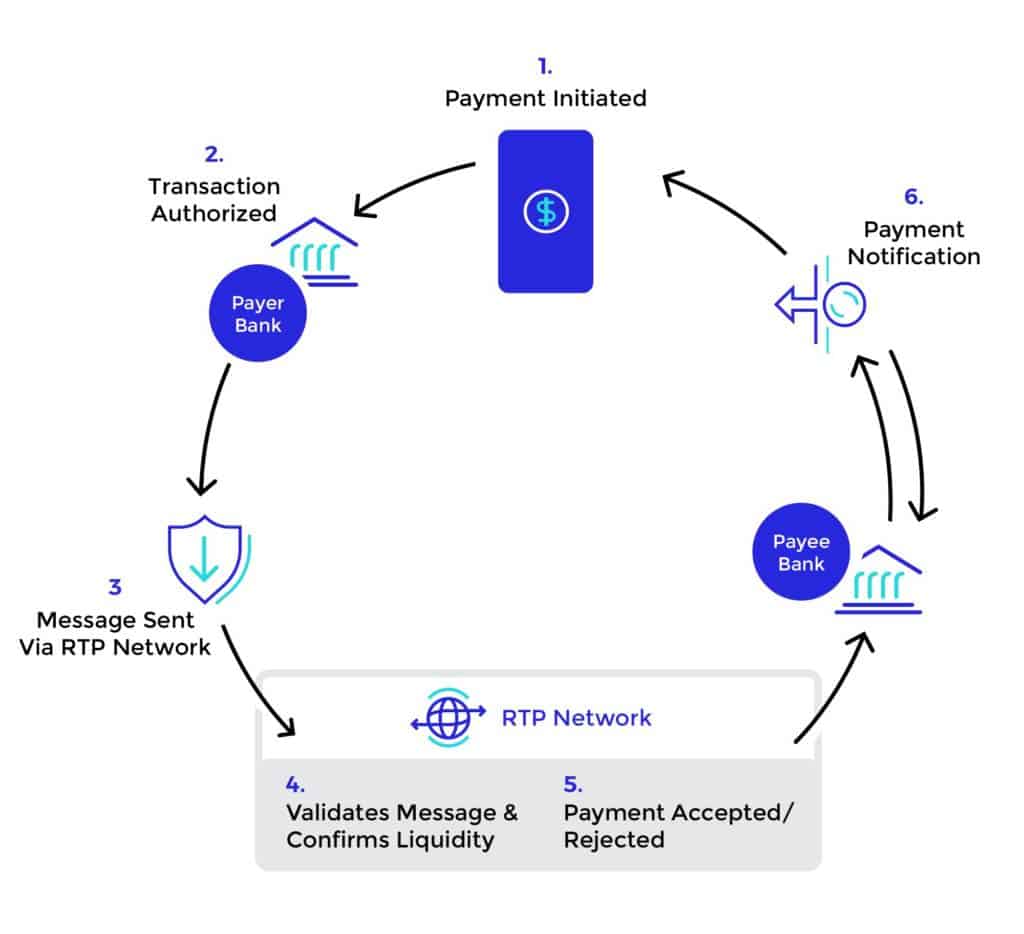

The Breakdown Of Real Time Payments Past Present Future Diceus Real time payments are payments made between bank accounts that are initiated, cleared and settled within seconds, at any time of the day or week, holidays and weekends included. this improves transparency and confidence in payments, helping consumers, banks and businesses manage their money. Rtp® from the clearing house is a real time payments platform that all federally insured u.s. depository institutions are eligible to use for payments innovation. with mobile technology and digital commerce driving the need for safer and faster payments in the u.s., financial institutions of all sizes are taking advantage of the rtp network. The term “real time payment” (rtp) is used to describe any account to account fund transfer that allows for the immediate availability of funds to the beneficiary of the transaction. real time payments offer a confirmation of funds via a real time balance; once a payment is authorized, the payer’s account reflects the deduction of funds. Real time payments are here, and banks, consumers and commercial customers all can benefit from transactions settling instantly. the clearing house real time payment network (rtp) started processing in 2017, and the federal reserve’s fednow service is expected to go live in 2023. rtp uses a shared pre funded joint account to settle.

The Rise Of Real Time Payments Understanding The Technology And The term “real time payment” (rtp) is used to describe any account to account fund transfer that allows for the immediate availability of funds to the beneficiary of the transaction. real time payments offer a confirmation of funds via a real time balance; once a payment is authorized, the payer’s account reflects the deduction of funds. Real time payments are here, and banks, consumers and commercial customers all can benefit from transactions settling instantly. the clearing house real time payment network (rtp) started processing in 2017, and the federal reserve’s fednow service is expected to go live in 2023. rtp uses a shared pre funded joint account to settle. Real time payments are those made between banks or other financial institutions that are initiated, cleared, and settled almost immediately at any time of the day or night, seven days a week, 365 days a year. this contrasts with checks, which often take several days to clear through the banking process, or cash which, although immediate, is not. Here are four ways real time payments (rtp) will disrupt the future of payments and how businesses should get prepared. 1. endless possibilities for new payments experiences. the 24 7 365 payments environment means you can send and receive payments any time of day and any day of the week.

Real Time Payments Gain A Competitive Edge Fifth Third Bank Real time payments are those made between banks or other financial institutions that are initiated, cleared, and settled almost immediately at any time of the day or night, seven days a week, 365 days a year. this contrasts with checks, which often take several days to clear through the banking process, or cash which, although immediate, is not. Here are four ways real time payments (rtp) will disrupt the future of payments and how businesses should get prepared. 1. endless possibilities for new payments experiences. the 24 7 365 payments environment means you can send and receive payments any time of day and any day of the week.

Comments are closed.