What Are Mortgage Points Mortgage Points Explained

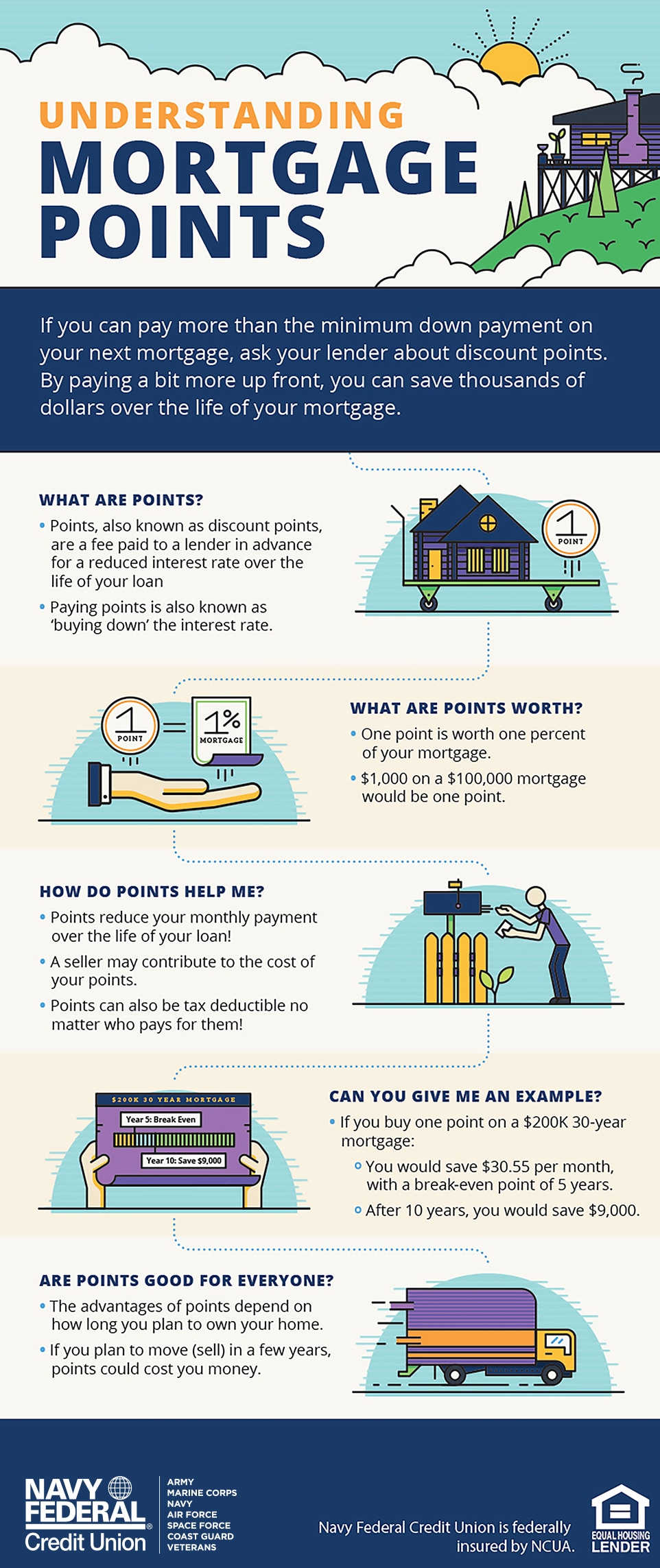

What Are Mortgage Points And How Do They Work Mortgage points, also known as discount points, are an option for buyers to pay an upfront fee at closing to buy down the interest rate on a loan. the term ''points'' is a common way of referring to a percentage of your loan amount. for example, one discount point will cost you 1% of your loan amount and will lower your interest rate by 0.25%. Typically speaking, if you have a $350,000 loan with a 7% interest rate and buy two points for $7,000, you’ll bring the loan’s interest rate down to 6.5% and save $117 a month on your mortgage payment. if you divide the upfront cost of the points by your monthly savings, you’ll find that your breakeven point is about 60 months ($7,000 ∕.

How Do Mortgage Points Work Navy Federal Credit Union Each point the borrower buys costs 1 percent of the mortgage amount. one point on a $400,000 mortgage would cost $4,000, for example. in effect, mortgage points are a type of prepaid interest. by. This one! after you buy the mortgage point, your lender reduces the interest rate of your mortgage by, say, a quarter of a percent. that takes your interest rate from 4.5% to 4.25%. this slightly lowers your monthly payment from $1,562 to $1,526—which is $36 less a month on a fixed rate conventional mortgage. There are two kinds of mortgage points: origination points and discount points. buyers pay origination points to the lender as a type of fee for processing the loan. discount points are a way for. Mortgage points, also known as discount points, are fees a homebuyer pays directly to the lender (usually a bank) in exchange for a reduced interest rate. this is also called “buying down the rate.”. essentially, you pay some interest up front in exchange for a lower interest rate over the life of your loan. each point you buy costs 1.

All About Mortgages What Are Points On A Mortgage Bigger Investing There are two kinds of mortgage points: origination points and discount points. buyers pay origination points to the lender as a type of fee for processing the loan. discount points are a way for. Mortgage points, also known as discount points, are fees a homebuyer pays directly to the lender (usually a bank) in exchange for a reduced interest rate. this is also called “buying down the rate.”. essentially, you pay some interest up front in exchange for a lower interest rate over the life of your loan. each point you buy costs 1. As a rule of thumb, paying one discount point lowers a quoted mortgage rate by 25 basis points (0.25%). different banks will offer different rate reductions in exchange for paying points. so shop. The payment drop may not give you bragging rights at the neighborhood block party, but the extra $600 to $1,300 each year could buy you an upgraded appliance or new furniture for a child’s room. $20,602.04 to $40,972.05 over 30 years. the savings really add up over time. if you’re in your forever home, discount points may be worth the cost.

Mortgage Points Calculator 2022 Complete Guide Casaplorer As a rule of thumb, paying one discount point lowers a quoted mortgage rate by 25 basis points (0.25%). different banks will offer different rate reductions in exchange for paying points. so shop. The payment drop may not give you bragging rights at the neighborhood block party, but the extra $600 to $1,300 each year could buy you an upgraded appliance or new furniture for a child’s room. $20,602.04 to $40,972.05 over 30 years. the savings really add up over time. if you’re in your forever home, discount points may be worth the cost.

Comments are closed.